After reaching a median rent of more than $3,000, you might think Brooklyn’s soaring housing market is showing no sign of an impending slowdown. While it’s true that developers are still pushing further out into the borough to stake their futures on people who make crochet Wes Anderson murals, developers aren’t approaching the multifamily residential market with the same gusto as they did last year.

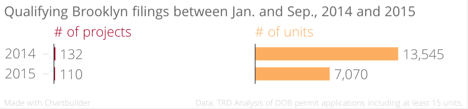

For multi-family buildings containing at least 15 units, the number of future units filed with the Department of Buildings in Brooklyn is down significantly from this time in 2014, according to a Real Deal analysis of applications data.

In that size category, approximately 7,070 residential units are included in permit applications filed this year through the month of September. At the same time last year, more than 13,000 residential units were already planned, a number buoyed by filings for mega projects like Two Trees’ Domino conversion in Williamsburg, TF Cornerstone’s 33 Bond Street and two giant Chetrit Group projects downtown (in partnership with JDS Development Group and Clipper Equity, respectively).

The discrepancy in the number of individual projects is much smaller, indicating that last year’s plans had much higher unit counts on average.

A map of 2014 and 2015 residential project filings illustrates where developers are giving contractors their marching orders. Prospect-Lefferts Gardens, Flatbush and Coney Island have seen some of the most noticeable upticks in 15-units-plus projects over the past year. Builders are slogging further out on Atlantic Avenue along the Bedford-Stuyvesant and Crown Heights border, the data shows. They’re also moving toward Broadway Junction, the gateway to East New York, the site of a serious city rezoning proposal.

View Jan – Sep Brooklyn DOB Filings, 2014 and 2015 in a full screen map

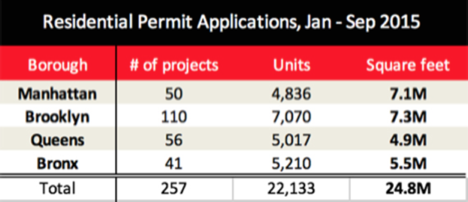

Despite the overall drop in year-over-year unit count, enough has been filed for Brooklyn in 2015 that, on the year to date, the borough has more residential units and square feet filed with the DOB than any other, when counting all projects with at least 15 units.

And it’s the why-is-it-so-expensive-to-live-in-an-indoor-tree-house-next-to-this-meat-packing-plant neighborhood of Bushwick that’s seen the most activity across the borough, The Real Deal analysis found.

There were just two qualifying filings in September for a total 123 units, but with 18 qualifying projects on the year-to-date, the L-train ‘hood has a total qualifying unit count of 1,328, or roughly 19 percent of the total borough sum. That number already matches 2014’s Bushwick total, with three months left in the year to further fuel an ongoing boom in supply that has possibly contributed to a 16 percent drop in year-over-year Bushwick rents, according to a report from MNS.

Moshe Braver filed Karl Fischer-designed plans in Bushwick and Williamsburg in September, together totaling over 100 units. Braver has filed at least 5 buildings in Brooklyn in just two months, combining for 338 units. Four of those are set for Bushwick.

The man with the biggest plan this year in Bushwick is still Simon Dushinsky, whose Rabsky Group plans to add more than 500 units to the conversion of the Rheingold Brewery near the Flushing Avenue and Myrtle Avenue-Broadway elevated metro stations.

Williamsburg is the second most active Brooklyn neighborhood so far in 2015, with 15 qualifying projects combining for 817 units. Coney Island, where Rubin Schron’s Cammeby’s International will build a 430-foot residential tower, has the third most units filed with 661.

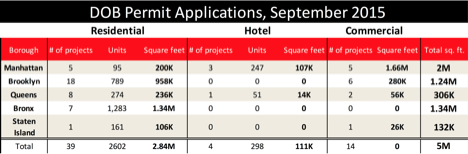

In September, the most individual project filings came from Brooklyn, where 18 projects were filed with at least 15 units. Of those, 10 were filed outside the northern neighborhoods known to realtors as “prime” Brooklyn. The largest of those was a Midwood development by elusive Queens-based developer Bo Jin Zhu, who plans to build a 162,000-square-foot mixed-use, apartment, synagogue and hotel building at 1721 East Eighth Street.

And can the Bronx get any hotter?

The Bronx had its third consecutive month of recording more than a 1,000 future apartment units in construction filings this September, according to a TRD analysis of Department of Buildings permit applications including at least 15 units or 15,000 square feet.

As TRD has previously reported, much of this growth in the northern borough is coming from large-scale affordable and supportive housing projects like La Central and Crossroads Plaza in the Melrose and Mott Haven neighborhoods. But as had been anticipated for months, plans came in Mott Haven this September for what will be an enormous market rate housing development from Chetrit Group and Somerset Partners at 101 Lincoln Avenue, with two future towers combining for nearly 1,200 apartments in over 1.1 million square feet of total building space.

In fact, on the year-to-date, more residential units and square feet are planned for the Bronx than for Manhattan or Queens, when counting multi-family projects containing at least 15 units. Apart from Chetrit’s mega-site on the Harlem River, L+M Development Partners and Hornig Capital Partners submitted plans last month for a 133-unit affordable housing residence at 4439 Third Avenue on land currently owned by the adjacent St. Barnabas Hospital. Other September Bronx projects include a likely below market rate apartment building at 3365 Third Avenue, a 30-unit plan from Bronx Pro Group, a firm that has developed over 1,000 units in the Bronx utilizing a mix of public and private financing.

Both the Bronx and Queens each have more units filed in the 15-unit or more building category than Manhattan during 2015.

Manhattan’s very large overall square footage for projects that include apartments indicates that those buildings are more likely to include mixed-use and amenity space, as well as larger residential units.

In September, notable filings in Manhattan included SL Green’s long awaited plans for the super-tall One Vanderbilt office tower, which will rise to over 1,400 feet atop Grand Central Terminal.

In Queens, a Long Island City hotel developer will squeeze 51 keys into 14,000 square feet at 38-22 28th Street, where he’ll have plenty of competition.

And finally, on Staten Island, the Brielle seniors’ residence in Willowbrook will add an additional 161 units to its existing 188-unit complex, making it one of the largest Staten Island filings of the year.