Private real estate funds have more money to spend than ever before, but that’s not necessarily good news for the real estate market.

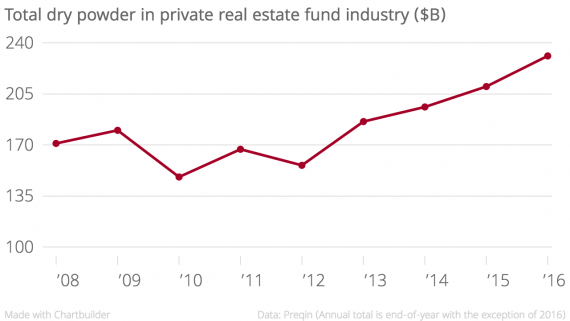

As of March, private real estate investment funds worldwide had $231 billion in aggregate dry powder – or capital commitments from fund investors ready to be spent – according to research firm Preqin. That’s the highest figure in history and a 10 percent increase since December (see chart below).

In one sense this is great for the real estate market. Most private real estate funds have fixed investment periods, meaning they are contractually required to spend their investors’ money by a fixed date (typically within five years). The more dry powder funds have, the more money is headed to the property market soon. And surveys show the U.S. market is still by far the most popular investment destination. Private funds will offer a much-needed boost as observers begin to worry about a market slowdown.

But there’s a more sober side note. Dry powder has grown in part because fund managers are having an increasingly difficult time finding profitable investments – not just because they are raising huge sums from investors. “Whilst there has been strong investment activity for these firms it is difficult to find opportunities at the moment,” said Andrew Moylan, senior research analyst at Preqin. “It’s is a very competitive market.”

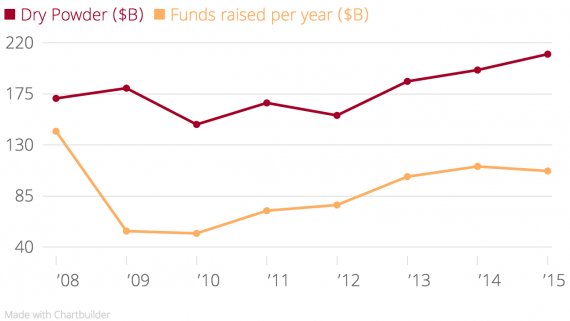

If the past eight years are any indication, private funds spend their investors’ money more quickly in boom times and take longer to find assets in downturns. That’s why fund managers sat on large piles of dry powder in 2009 and 2010 even though they were raising little new money from investors (see chart atop the article).

Over the past year, fundraising totals fell while dry powder continued to grow; fund managers are taking longer on average to spend their investors’ money. The growing gap between dry powder and new funds raised hardly signals a crisis or even a downturn, but it could be another sign of a market slowdown.

“I’d say that there’s been a slowdown in transaction activity generally in the market,” said one senior executive at a real estate fund manager, pointing to recent uncertainty over global stock and oil markets and tighter lending. The executive added that he now sees more opportunities in value-add assets as other investors, spooked by global market turmoil, retreat from risk.

Others are less bullish. In a year-end Preqin survey, 56 percent of fund managers polled said they see finding attractive investment opportunities as their biggest challenge – far head of raising funds (27 percent). More than two-thirds of respondents — 67 percent — said finding investments is more difficult than a year earlier.

Haves and Have-Nots

As dry powder grows across the industry, it also becomes concentrated in fewer hands. “We’ve had three strong years of fundraising, but the number of funds closing each year is actually falling,” said Moylan.

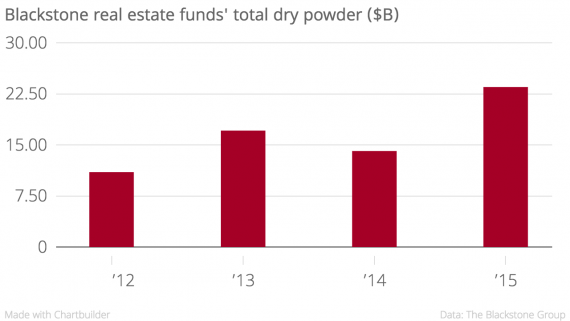

Between the end of 2014 and the end of 2015, dry powder across the private real estate fund industry grew by $14 billion. Blackstone Group, the world’s largest private real estate fund manager, accounted for $9.4 billion of that increase. Blackstone raised a staggering $26 billion from investors for its real estate funds in 2015, which pushed up its dry powder from $14.1 billion to $23.5 billion over the course of the year (see chart below).

Apollo Global Management, another leading fund manager, saw its real estate dry powder shrink slightly in 2015 to $984 million (from $997 million in 2014), according to a filing with the Securities and Exchange Commission. Apollo declined to comment for this article, as did Blackstone and the Carlyle Group.

The accumulation of dry powder in large funds can be good news for smaller and mid-sized fund managers, argued Bob Faith, CEO of Greystar, a Charleston-based fund manager that is currently raising a $1 billion real estate fund. “You know, I’d say we haven’t really noticed a dramatic increase in competition except as to where it relates to large deals,” he said. “A lot of people are aggressively pursuing large transactions. We have been selling into that.”

In December, Greystar sold a 32-building multifamily portfolio for $2 billion. The buyer: Blackstone.