“The Spinnaker,” “The Veritas,” “The Gallica” — those are just a few shiny new names CBRE is pitching for Kips Bay Court, an 894-unit former Mitchell-Lama affordable housing complex now up for sale by owner Phipps Houses.

An offering memorandum obtained by The Real Deal details all the potential upsides of buying the complex, which is now fully market-rate after it exited the Mitchell-Lama program more than a decade ago. When TRD first reported the marketing of the complex in June, sources said it could fetch somewhere between $600 million and $700 million. Adam Weinstein, president of Phipps Houses, declined to comment at the time, as did CBRE’s Darcy Stacom. No asking price is included in the memo. Sources suggested that major investors who’ve made similar acquisitions in the recent past, such as Blackstone Group , A&E Real Estate Holdings, Brookfield Property Partners and Cammeby’s International Group, could be willing suitors.

The eight-tower community built in the 1970s on Manhattan’s East Side is a “rarity,” the memo says, not only due to its sheer size, but also because it falls into a sweet spot between newer developments hamstrung by 421a rent restrictions and older buildings that also often include low-and-moderate-income housing.

Though Section 8 tenants occupy close to 40 percent of Kips Bay Court’s units, those federally subsidized apartments bring in nearly market-rate rents — just 10 percent less. And unlike with rent regulation, when a Section 8 tenant leaves Kips Bay Court, the landlord is not required to replace them with another Section 8 renter.

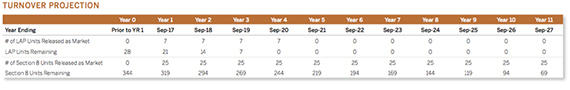

As such, the offering memo lays out a projection of how quickly Section 8 units can be phased out through natural turnover, allowing a new owner to fill those apartments with market-rate tenants.

Since 2004, the number of Section 8 apartments has decreased from 651 to 344. The memo projects that by 2027, a landlord could reasonably expect just 69 to remain — just 8 percent of the complex. A smaller group of tenants participate in what’s called a landlord assistance plan, or LAP, which was a negotiation on rents between tenants and Phipps Houses when the Mitchell-Lama benefits expired in 2002. Only 28 LAP apartments remain at Kips Bay Court, and according to the memo they could all be phased out through natural turnover within five years.

Alongside the exit of Section 8 tenants, the memo slates some ambitious income projections for the next decade. While the projected net operating income for 2017 is about $23.9 million, that number could balloon to $41.6 million by 2027, the memo shows.

CBRE declined to comment for this story. But in the memo, it suggests a number of strategies to hit those income projections. While the buildings have already undergone $39 million in capital investments since 2003, a new owner can do much more to “increase appeal and revenue,” the brokerage states.

One major suggested overhaul is branding. To properly transition what was an affordable housing complex to a luxury address fit to compete with other pricey destinations nearby, it has to sound like one.

CBRE proposes renaming the three existing tower groups (as of now North, Central and South) to things like “The Garden,” “The Sciences” and “The Nautical”, odes to a Dutch colonial magistrate by the name of Kip, who sailed to New Amsterdam and founded an estate known for its flowers, in a neighborhood now known for its budding life sciences industry, the memo says. Individual building name recommendations include The Rosa and The Gallica (references to the colonial flowers); The Veritas and The Agnitio (to celebrate the sciences); and The Spinnaker and The Mizzen (both nautical terms).

CBRE proposes renaming the three existing tower groups (as of now North, Central and South) to things like “The Garden,” “The Sciences” and “The Nautical”, odes to a Dutch colonial magistrate by the name of Kip, who sailed to New Amsterdam and founded an estate known for its flowers, in a neighborhood now known for its budding life sciences industry, the memo says. Individual building name recommendations include The Rosa and The Gallica (references to the colonial flowers); The Veritas and The Agnitio (to celebrate the sciences); and The Spinnaker and The Mizzen (both nautical terms).

The brokerage also suggests adding bedrooms to apartments to increase revenue, as well as outdoor amenities such as roof decks. The existing retail component, which already brings in close to $3 million in annual base rent, could also be expanded using development rights.

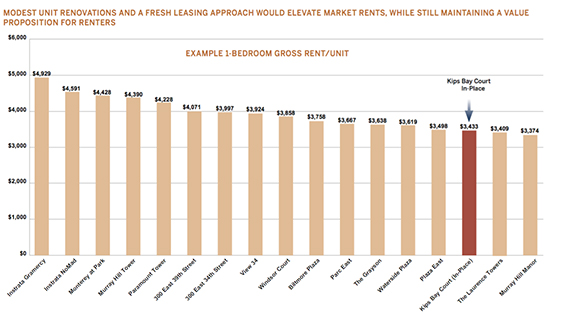

The hope is that the rebranding would put the complex in the same conversation as nearby luxury rentals like Elektra Acquisitions’ Instrata Gramercy, where gross 1-bedroom monthly rent is nearly $5,000 per unit (a figure that is currently $3,433 For Kips Bay Court, the memo shows).

The hope is that the rebranding would put the complex in the same conversation as nearby luxury rentals like Elektra Acquisitions’ Instrata Gramercy, where gross 1-bedroom monthly rent is nearly $5,000 per unit (a figure that is currently $3,433 For Kips Bay Court, the memo shows).

An example of how a new landlord can add bedrooms to existing units

The repositioning of Kips Bay Court is not an outlier—it’s going the way of other large complexes with expiring rent restrictions. Larry Gluck’s Stellar Management, for example, took the 1,328-unit Independence Plaza North to market after Mitchell-Lama regulations ran out in 2004. Two-bedroom units there now fetch more than $6,000 a month. However, some buildings can be brought back into regulatory agreements with the city. Last year, L+M Development Partners and Nelson Management announced they would enter an Article XI agreement for half the units at the Lands End I building in Two Bridges, originally built under Mitchell-Lama. A&E Real Estate entered a similar agreement in December when it bought the 1,229-unit Harlem complex known as the Riverton Houses.

But this is the reality of many affordable housing and rent-stabilized programs for privately-owned real estate in New York: They eventually expire, leaving the fate of the properties, as well as that of the city’s affordable housing stock, uncertain.