Trending

One of NYC’s first co-working firms has shuttered its last location

Sunshine Suites, a precursor to WeWork, shut down its office at 419 Lafayette St.

One of the first tappers of the office keg is throwing in the towel after 15 years in the co-working business.

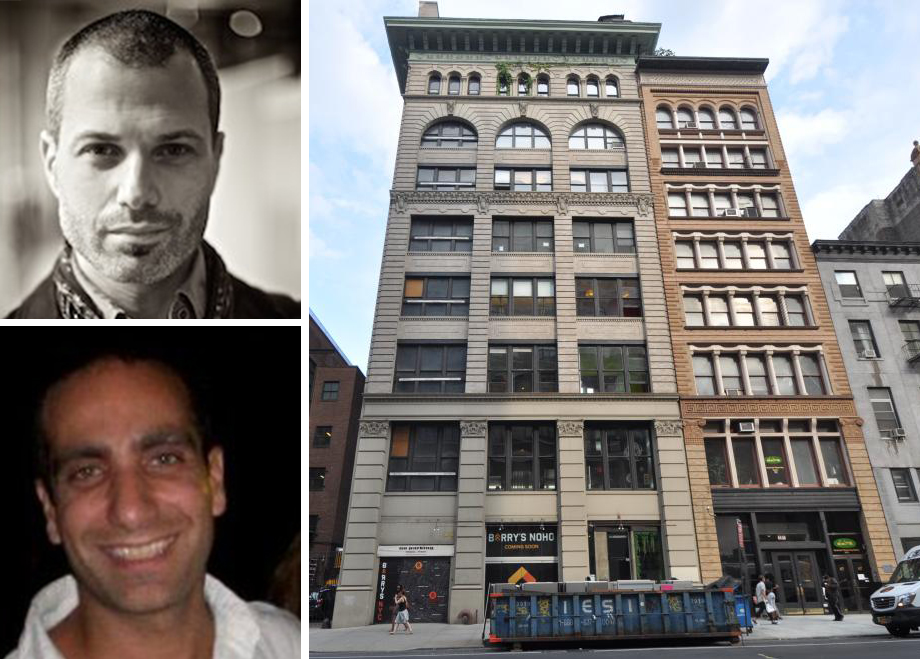

Sunshine Suites, founded by Cheni Yerushalmi and Joseph Raby in 2001, has closed its office at 419 Lafayette Street, where it formerly occupied more than 30,000 square feet. In recent months, it had reduced its footprint one floor at a time. Now, it has given up the location entirely.

The space was the final one in Sunshine’s portfolio. The company, one of New York City’s original co-working space concepts, previously operated locations at 12 Desbrosses Street in Tribeca, which it had 36,000 square feet, and at BankNote Building in the Bronx, where it had 11,000 square feet. Sunshine abandoned its Bronx lease in 2014 with eight years remaining on its term. The Tribeca location shuttered in 2013.

Sunshine Suites was among several co-working concepts that benefited from the rise of the freelance economy and free-flowing venture capital that poured into local startups following the recession. The company faltered amid increasing competition from co-working behemoths such as WeWork, formed by Miguel McKelvey and Adam Neumann, which expanded aggressively thanks to deep-pocketed backers and as of March was valued at $16 billion.

“It was hard to compete against them, and although we could fill the space to a point, we weren’t retaining tenants at the same rate as previously,” Yerushalmi told Crain’s in May of the Tribeca closure.

Niether Yerushalmi nor Raby immediately responded to requests for comment on whether the company had stopped doing business altogether or would be seeking new locations. The landlord at 419 Lafayette was also unavailable. Sunshine’s website was down on Monday.

Sunshine’s concept was a precursor to WeWork’s model. Yerushalmi even started a Facebook-style social networking site for the Sunshine tenants and had an open plan area of the office where entrepreneurs from fledgling companies worked side by side, much like the WeWork Labs concept.

But, with co-working spaces starting at $325 a month, it was much cheaper than WeWork, making its business model more volatile.

Even WeWork’s own bottom line has been called into question in recent months, after the company slashed profit projections by 78 percent due to delays in the opening of new locations, higher-than-expected build-out costs, and lower-than-expected landlord concessions.