What do you do when you’re a co-working-bar-hybrid startup and you need to raise cash, but getting a bank loan is hard and getting venture funding even harder? You create lease-backed securities for individual desks in your spaces and sell them to investors around the world via the internet.

That thought, at least, is what New York-based Bar Works is doing, earning it The Real Deal’s prize for the most creative real estate funding model of 2016.

Bar Works leases (and sometimes buys) retail spaces and turns them into co-working spaces, with the added twist that each of its locations is also a bar (because having just one keg in your office is so 2015). Customers pay $550 per month for a reserved desk. The company currently has three locations in New York City and one in San Francisco, with three more New York locations, one in Miami, one in Las Vegas and one in Dublin scheduled to open soon. It is reportedly also planning to turn Britain’s famous red telephone booths into mini street offices.

Leasing and fitting out co-working spaces is expensive. WeWork [TRDataCustom], the industry behemoth, has about raised about $1.7 billion from investors. Regus, another backer of co-working spaces, is a public company with a market cap of around $2.8 billion. It’s tough for startups like Bar Works to compete with that kind of financial heft. To make matters worse, sources say that venture funding for small firms is increasingly difficult to come by. That forces startups to be creative. Enter Bar Works’ so-called Partners program.

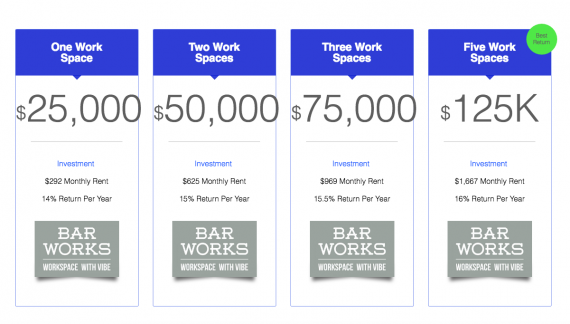

Investors can buy individual workstations in Bar Works spaces, which Bar Works agrees to lease from them for 10 years at rates that rise each year. At the the end of the term, investors have the chance to renew the lease or get back their initial investment. Bar Works also has an early buy-back option at a 25 percent premium. At its San Francisco location, according to a spokesperson the only property Bar Works owns, the lease has a 99-year term.

One of the agents marketing the investment, U.K.-based New World Property Investment, claims on its website that individual investments at the firm’s upcoming location at 242 Metropolitan Avenue in Williamsburg start at $25,000 and that the rent payments translate to net annual returns of 14 percent and up.

The model is certainly unusual. Finance types have been propagating lease securitizations (or selling the right to collect office rent payments for a one-off sum) for years, but the idea was always to do it with bundled long-term corporate office leases. The default risk on those would be fairly low.

But securitizing co-working leases appears far more risky. What if Bar Works can’t find enough short-term customers to pay its burden of rent to the landlord and “rent” to the investor?

Jonathan Black, co-founder of Bar Works, declined to talk about the funding model and it wasn’t clear what collateral the company offers. A Bar Works spokesperson told TRD that the company doesn’t own its spaces, with the exception of its San Francisco location, meaning there would be no real estate for the bond investor to foreclose on in the event of a default. Presumably the desk itself is collateral, but good luck turning that into money if the company that manages it is insolvent.

“You have people lending against an office unit inside a managed office space, which does not have the ability to be separated and condominiumized to give the lender clear access to the asset,” one real estate finance source told TRD after reviewing the offering.

The Partners program is basically a loan to a startup with little collateral. In other words: it’s quite risky. And that’s fine, because the flip side is potentially high returns.

It gets a bit more problematic when agents market it as a safe investment, as New World Property Investment’s website does. “If you are looking for a secure, proven and hands-free overseas property investment opportunity that offers unrivaled, double-digit income returns over the next decade, with guaranteed capital appreciation and an assured exit strategy this is the perfect property investment abroad for you,” it reads. EC1 Investments, another U.K.-based agency, also markets the offering as “proven” and “guaranteed returns.”

Asked what exactly is secure, proven, assured or guaranteed about the program, New World’s director Shan Mohammed wrote: “Proven and guaranteed from our perspective as we have been given every assurance required from the co-working space provider. We have had clients invest who have received their promised returns every month without fail.”

Bar Works declined to tell TRD how much money it has raised through the program. On New World Property Investment’s website, five out of six Bar Works investment offerings are marked as “sold out.”