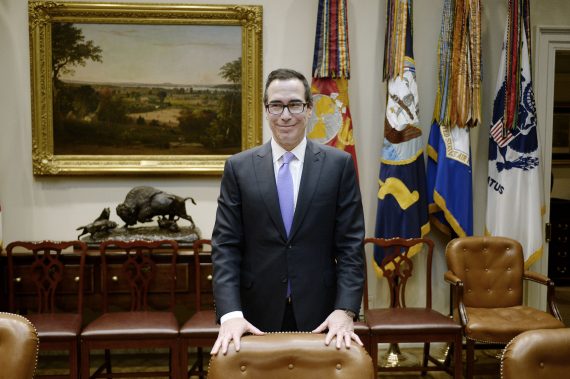

Steven Mnuchin may soon be forced to clarify his plans for housing finance reform, following this week’s Federal Appeal Court decision that investors in Fannie Mae and Freddie Mac aren’t entitled to billions in profits.

Mnuchin previously said that the $10 trillion mortgage market is a priority for the Trump administration. The decision from the Federal Appeal Court will push Mnuchin to show how soon he will make changes, Bloomberg reported. Some housing industry groups and analysts said reform won’t happen quickly, because Republican lawmakers are more interested in repealing the Affordable Care Act and overhauling the tax code.

“The court decision will force Mnuchin to show just how high a priority housing-finance reform is for the Trump administration,” Brandon Barford, a partner at Beacon Policy Advisors, a Washington-based policy research firm, and former staff member for the Senate Banking Committee, told Bloomberg. This week’s decision barred most legal claims from Fannie-Freddie investors — primarily hedge funds — who claimed the U.S. government illegally seized billions from the firms, and left shareholders little room to pursue claims for monetary damages.

In interviews with both CNBC and Fox Business Network Thursday, Mnuchin said taxes are the Treasury’s first priority. He added that he hopes to overhaul Fannie and Freddie in “this administration.”

Fannie Mae and Freddie Mac buy mortgage loans from lenders, stamp them with an implicit government guarantee, repackage them as securities and sell them off to investors. In 2015, Fannie Mae provided Blackstone Group and Ivanhoe Cambridge’s acquisition of Stuyvesant Town-Peter Cooper Village with a $2.7 billion loan originated by Wells Fargo.

The government took over Fannie and Freddie during the 2008 financial crisis, and injected $187.5 billion in bailout money. [Bloomberg] — Miriam Hall