Share office space or go to Mars?: WeWork is now part of an elite club of privately-held U.S. companies valued at over $20 billion. Its latest valuation, courtesy of a $4.4 billion investment from Softbank, puts Adam Neumann’s capitalistic kibbutz just behind Elon Musk’s SpaceX. WeWork’s new cash comes from the world’s biggest tech investor, Softbank’s Vision Fund, a $93 billion behemoth backed by Saudi royal family money. The infusion allows WeWork to ramp up its Asian expansion and buy out some existing investors. It also gives Softbank two board seats.

I remember how I felt when I first heard of the $7.2 billion valuation that Anbang Insurance Group was going to work with at Kushner Company’s 666 Fifth Avenue. Incredulous doesn’t begin to describe it – the numbers had no bearing in anything I had learned covering this beat, and I could not – absent a nefarious quid-pro-quo political motive – see any reason for that deal to happen.

I’ve had that same incredulity about WeWork for its past three funding rounds. WeWork is unquestionably an impressive company, just not $160,000 a desk impressive and certainly with nowhere near the disruptive potential of the other companies – Airbnb, Uber, SpaceX, Palantir – in the $20 billion club.

On 666, turns out I was right. But WeWork somehow keeps winning the venture-capital sweepstakes and charges ahead. This latest round gives it an unparalleled ability to take on or gobble up rivals, spend its way out of any trouble, and avoid the added scrutiny of the public markets: in other words, fuck-you money.

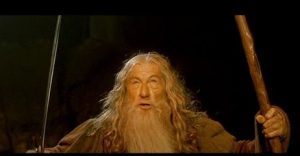

You shall not pass: Enforcement in the real estate markets is generally so sloppy, and the consequences of getting caught so trivial, that players tend to adopt the Uber method: make an omelette first, apologize for breaking the eggs later. And when a rule comes along, an army of lawyers and assorted apparatchiks get to work systematically dismantling it. Perhaps the most notable recent instance is the Treasury Department’s LLC disclosure rule, which aims to curb money laundering in real estate. When the law was first enforced through a series of geographic targeting orders (GTOs), buyers had a bevy of options to get around it. But now, the Treasury is moving to close the biggest loophole, putting wire-transfer transactions on its watchlist. It may also broaden the order’s scope to include commercial real estate transactions. Yet regulation vs. the private sector remains a serious mismatch: a McGregor vs. Mayweather, if you will.

You shall not pass: Enforcement in the real estate markets is generally so sloppy, and the consequences of getting caught so trivial, that players tend to adopt the Uber method: make an omelette first, apologize for breaking the eggs later. And when a rule comes along, an army of lawyers and assorted apparatchiks get to work systematically dismantling it. Perhaps the most notable recent instance is the Treasury Department’s LLC disclosure rule, which aims to curb money laundering in real estate. When the law was first enforced through a series of geographic targeting orders (GTOs), buyers had a bevy of options to get around it. But now, the Treasury is moving to close the biggest loophole, putting wire-transfer transactions on its watchlist. It may also broaden the order’s scope to include commercial real estate transactions. Yet regulation vs. the private sector remains a serious mismatch: a McGregor vs. Mayweather, if you will.

“Some smart practitioner now will probably come up with some new loophole,” Aaron Shmulewitz, a real estate attorney, told my colleague E.B. Solomont. “It’s like whack-a-mole.”

A quiet burial: Gov. Andrew Cuomo is pretty zealous about announcing new –and old — initiatives with a bang. But when he killed a key affordable housing program, he did it in stealth mode. Beginning last month, the New York State Homes and Community Renewal stopped funding so-called “80/20 projects” through tax-exempt bonds, a move that could make it trickier for the city to meet its affordable-housing goals. Read more here.

The curse of the detained CEO: What is up with Chinese moguls who spend big on U.S. real estate being detained? First, it was Fosun International’s (28 Liberty) chairman Guo Guangchang. Next came Anbang’s (Waldorf Astoria, 717 Fifth Avenue) then-chairman Wu Xiaohui. And now, there’s talk of Dalian Wanda Group’s (One Beverly Hills) chairman Wang Jianlin being prevented from leaving China, though Wanda has called these reports “groundless.” It’s got to be disconcerting for U.S. players to see the buyers and capital partners they were toasting in Manhattan ballrooms just a few months ago in such a jam.

(Paydirt is a weekly column that riffs on the biggest NYC real estate news of the moment, providing analysis and historical context on the deals and players that make this town tick. Read more from Paydirt here.)