From the December issue: David Ash founded the boutique commercial real estate firm Prince Realty Advisors in 2010, naming the company after a lease he arranged for True Religion on Prince Street early in his career. He describes himself as a “matchmaker” and has generated $2.6 billion in gross sales since founding the firm. Ash is best known for arranging Zara’s $248.2 million buy of a massive retail condominium at 503 Broadway in Soho in 2015, which set a record for the neighborhood. He also worked on Equity Residential’s $280 million purchase of the Beatrice at 105 West 29th Street and brokered a $200 million lease deal for a four-building office package in the Ring Portfolio as well as a $185 million deal with Vornado Realty Trust for 20 Broad Street.

Ash grew up in Flatbush, Brooklyn, and studied international business and marketing at New York University’s Stern School of Business. He worked on the side as a nightlife event organizer, a salesman at a wholesale jewelry company in Long Island City and at a paper products company at various points. He recalls experiencing a lack of direction after graduating, but a friend who had interned in real estate recommended that he give it a try. Ash landed a gig working on office and retail leasing for the Kaufman Organization and made the leap to investment sales three months before the market crashed in 2008. Though Ash started his own firm two years later, he didn’t do his first deal until 2012 — a $30 Million Retail Condo On Seventh Avenue.

6:00 a.m. My alarm goes off at my apartment on the Upper East Side. I make myself a very aggressive iced coffee with some espresso shots in it. I turn on New York 1 and grab my phone to go through emails. I go through my calendar. Check The Real Deal.

7:00 a.m. I do a tefillin, which is a Jewish way of praying. It is a great way to set aside a block of your morning for something that isn’t business-related.

7:30 a.m. I take the train to work every single day no matter what. Traffic is my biggest source of stress. I read the New York Post. Most people like to say they read the New York Times. I don’t know how they do it, honestly.

8:15 a.m. I am walking to the office or at a breakfast meeting, usually with private equity investors like David Mitchell or Gary Phillips from Allianz at places like the Regency. If I am in the office, I get my second Starbucks of the day — five shots over ice. It’s fuel. As I walk out of the train station I listen to the same song every single morning: “Lovely Day” by Bill Withers. It’s a stressful job, and at one point I wasn’t doing well financially. Now I am here, so I’ve got to be happy.

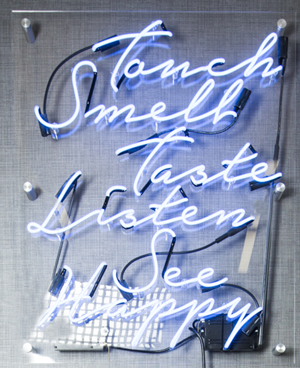

Ash’s neon sign

8:20 a.m. First thing I do when I get into my office at 450 Seventh Avenue is turn on my neon sign [that reads “touch, smell, taste, listen, see, happy”]. I am very big on visual and emotional cues to try and stay on point.

9:30 a.m. I meet with my team of eight, and we go through the current office pipeline. We talk about how we can think outside the box for their clients, like SL Green Realty, Blackstone Group, Extell Development and HFZ Capital.

10:30 a.m. I’ll be on the phone trying to further deals. Persistence is my main focus. It hurts when you miss something just because you didn’t follow up. “Follow up” is a mantra here.

12:30 p.m. Three out of five days in the week, I am out at lunch meetings with clients, typically at Koi, Milos or Abigail’s — A Kosher Spot On Broadway. If I am not out, I sit at the coffee table in my office and have a sushi roll or a piece of grilled chicken and answer any questions my team has.

2:00 p.m. I am back at my desk trying to set people up to discuss business. A lot of my day is trying to create a match for clients. There’s a $75 million hotel in contract, a substantial office deal play and an overseas government who has entrusted us in finding their consulate.

Casamigos

3:30 p.m. I have meetings or go on building tours. I just toured a 1 million-plus-square-foot warehouse complex in Brooklyn that is ripe for redevelopment for a client of ours. I love going to relics and untouched assets — even though they might get knocked down.

5:00 p.m. I come back to the office and prep for the next day. After 5:00 p.m. we are allowed to drink and wind down. I am a tequila guy. Casamigos I happen to like a lot. It is good and it is cheap.

6:30 p.m. I take the train back home. I only take cabs after 9:00 p.m. I usually try to go to some kind of exercise class. I am a Barry’s Bootcamp kinda guy. I like the aggressive running and weightlifting combination.

The NoMad Hotel

7:30 p.m. I try to push client dinners and drinks a little later. Our business is dog eat dog, but because our model is somewhat different than most brokerages, we have the ability to be friends with a lot of brokers who you would think are our competitors. I like being friends with everybody.

8:30 p.m. We are typically at the Library Bar at the NoMad Hotel. I am a big, big fan of Noho, so I go to Temple Bar Or Bond Street Sushi. I don’t like taking clients to see-and-be-seen spots. The idea is for us to get to know each other. If you spend half your time getting up and saying hi to other people, that defeats the purpose.

10:30 p.m. I get home and watch Fox News, CNN or local news. I am not biased toward one political perspective or another. I answer emails. I don’t have a ritual at night like I do in the morning.

12:00 a.m. I go to sleep.