Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

Video produced by Sabrina He

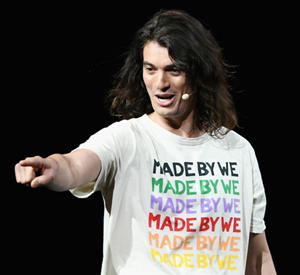

WeWork CEO Adam Neumann (Credit: Getty Images)

A trillionaire, prime minister of Israel and president of the world. Those are all the things WeWork founder and CEO Adam Neumann has said he wants to be, according to a new profile of a leader who is struggling to take his company public. [WSJ]

Compass’ top communications executive is out. Jason Post, who joined the brokerage nine months ago, will depart as the company mulls plans for an IPO. Post previously worked for Uber and the Bloomberg administration. [TRD]

Tom Barrack has buyers remorse. Three years after his firm Colony Capital merged with NorthStar Realty Finance Corp, the renowned CEO and Trump pal is seeking to offload almost $20 billion in real estate assets, as he plans for an entry to digital infrastructure. [WSJ]

Slate Property Group’s David Schwartz and 45 Rivington Street (Credit: Google Maps)

A mystery buyer acquired the controversial Rivington House. Slate Property Group and two other owners sold the 150,000-square-foot former nursing home — which became a flashpoint of controversy for Mayor Bill de Blasio in recent years — for $159.6 million. [TRD]

U.S. homebuilding reached a record high. Last month, housing starts surged 12.3 percent to a seasonally adjusted annual rate of 1.364 million units, the highest number since June 2007 — a sign that lower mortgage rates are boosting the crippled housing market. [Reuters]

Unizo Holdings is marketing a 650,000-square-foot tower. The Tokyo-based real estate investment firm has tapped CBRE to market the 27-story tower at 685 Third Avenue. The move comes as the firm holds talks to be acquired. [Crain’s]

New York brokers can now up the ante on promoting themselves. StreetEasy, the Zillow-owned listings portal, has launched a targeted advertising tool that allows brokers to market themselves as experts on specific listings. In return, StreetEasy will receive a referral fee on any sales commission. [Inman]

WeWork makes some employee cuts. After delaying its IPO, the office space company laid off 10 employees in a New York-based unit that handles on-demand rentals. The news came after TRD reported that a real estate executive is leaving the company. [Bloomberg]

Pol: Scale back plans for Industry City. That’s the message Brooklyn Councilman Carlos Menchaca had for the developers of the $1 billion overhauled industrial campus on the Sunset Park waterfront during a heated town hall. Menchaca, who has de facto veto power over a proposed rezoning, called for more community-oriented features, less retail and the abandonment of plans for two hotels. [NYDN, Crains]

It’s no Trump Tower, but it’s been Trump-occupied. The president’s childhood home in Queens is on the auction block after it failed to sell earlier this year for $2.9 million. It was purchased in 2017 for $2.14 million. The auction will conclude November 14. [NYT]

Despite new rent law, landlords are demanding more fees. Prospective tenants are being pressured to provide “good faith” deposits in addition to security deposits, even though the new rent law bars landlords from requesting more than one month’s rent. [The City]

Corcoran CEO Pam Liebman

Corcoran is still trying to plug its data breach. The New York-brokerage says information on agent splits, commissions and income disclosed in an email from an executive were the result of hackers and was doctored. CEO Pam Lieberman contacted other brokerage heads to warn them against using the allegedly stolen data to poach agents. [TRD]

A Brooklyn lawmaker is pushing back against illegal building conversions. Councilman Antonio Reynoso plans to introduce a bill next week that will increase penalties for landlords who allow buildings to be converted into uses that do not fit their zoning. It targets warehouses that have been converted to loft homes, and single-family homes to multi-family. [Crain’s]

WeWork’s junk bonds plummeted 7.3 cents on the dollar Tuesday. The trading signaled to the office-space giant that it would have to look elsewhere to raise more debt, as investors remain wary of its delayed IPO. Its $669 million in bonds are due 2025. [Bloomberg]

Rodrigo Niño (Credit: Prodigy Network and iStock)

Prodigy’s CEO is stepping down. The embattled real estate crowdfunding platform is facing three lawsuits from an investor and employees who allege the firm is insolvent and claim that they remain unpaid as investment properties underperform. [TRD]

Extell’s use of the mechanical-floor loophole is still being scrutinized. Even though the developer won two challenges to its 775-foot tall tower on the Upper West Side by a vote of the city’s Board of Standards and Appeals, the board opened a separate review of its use of mechanical floors to increase the building’s height. [Crain’s]

Soho could become an affordable housing hub. Two opposing advocacy groups have come together to propose a rezoning of the ritzy neighborhood that would spur high-profile development while accommodating low-income tenants. [The City]

A view from the top of the world. Extell’s Central Park Tower, which at 1,550 feet is the tallest residential building in the world, topped out Tuesday — 15 years after the developer began assembling the site. [TRD]

A view from the top of the world. Extell’s Central Park Tower, which at 1,550 feet is the tallest residential building in the world, topped out Tuesday — 15 years after the developer began assembling the site. [TRD]

FROM THE CITY’S RECORDS:

Financing: The Canadian Imperial Bank of Commerce provided a $95 million refinancing loan to Investcorp International Realty for two buildings in Murray Hill at 229 West 36th Street and 256 West 38th Street. [ACRIS]

Compiled by David Jeans