One third of the Corcoran Group’s gross commissions last year came from just 37 of its 1,239 brokers.

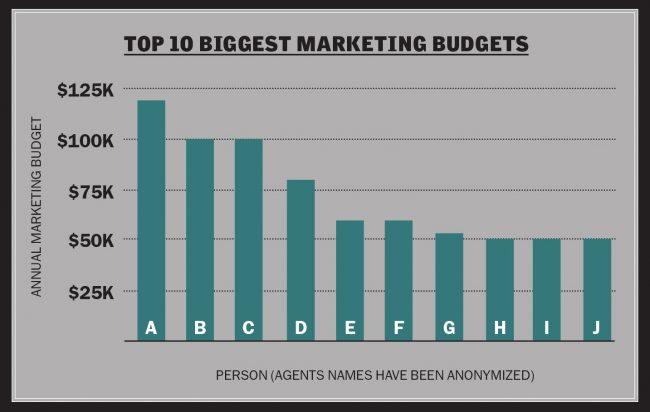

The New York firm gave at least one top agent a $120,000 marketing budget.

And, besieged by well-funded rivals who’ve poached top producers, Corcoran has shelled out sums as high as $275,000 for agents to use at their discretion.

These are some of the revelations gleaned from documents leaked to every Corcoran agent last month, and analyzed by The Real Deal.

The trove of information also contains agents’ gross commission income, or GCI — the fees generated by deals before the firm takes its cut — and the commission split for each. Further details include various perks, such as marketing budgets and car service allowances. TRD is publishing an anonymized analysis of the documents for several key reasons including: to examine the health of the firm, which is touted as the most successful subsidiary of publicly traded Realogy Holdings; and to shed more light on how the residential brokerage industry manages its agents.

Corcoran has previously stated that it’s investigating what it’s called a criminal incident with the help of law enforcement and a third-party forensic investigator retained by Realogy. No arrests have been made yet.

In a statement, a representative for Corcoran said the analysis of data was “distorted” and its publication “irresponsible.” Previously, the firm called the leaked information inaccurate.

“Publishing this information serves no purpose other than to perpetuate and magnify the wrong that has been done to Corcoran and its agents,” a spokesperson said in an emailed statement. “The person or entity who did this was trying to create maximum damage by spreading erroneous data.” (Corcoran’s full statement is appended.)

These details are rarely disclosed outside a close-knit circle of executives who use splits and perks as bargaining tools to woo agents. Any attempt by brokerages to standardize fees could be classified as price-fixing, thus running the risk of violating antitrust laws.

The data analyzed by TRD is not comprehensive. Most critically, it does not include figures for Corcoran Sunshine Marketing Group, which is one of the city’s largest new development marketing firms and is overseeing sales efforts at Hudson Yards and 220 Central Park South. And sources said a spreadsheet of earnings, dated Sept. 8, 2019, is incomplete because some top agents don’t submit pending deals until they close.

In the aftermath of the breach, brokerage leaders at rival firms expressed empathy for Corcoran and feared there could be bigger implications for the industry, which has been struggling to deal with new well-funded rivals, an incursion of Big Tech into the brokerage space, the rise of superagents and a softening high-end market. “Generally, we all have similar business practices,” Scott Durkin, Douglas Elliman’s president and COO and a Corcoran alumnus, said a week after the breach. “I don’t wish this upon any competitor.”

Heavyweights take a hit

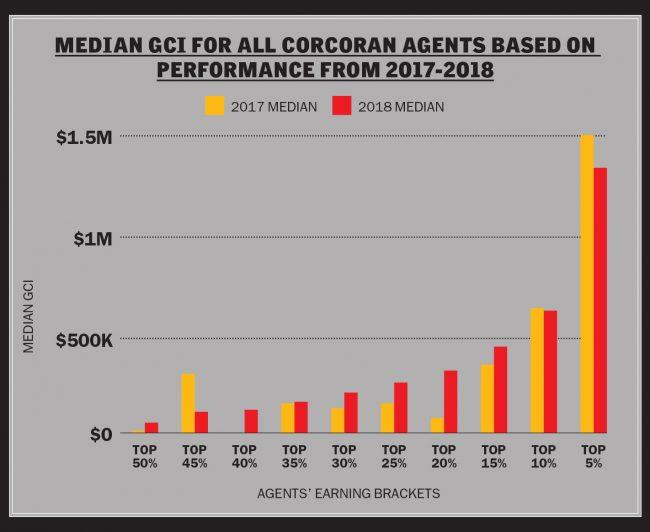

It’s an adage of sorts in residential brokerage: 20 percent of agents do 80 percent of the deals. Based on Corcoran’s leaked finances, that rings true.

Last year, the top 5 percent of Corcoran’s 1,239 agents accounted for 44 percent of the total GCI shown in the documents.

The top-producing offices hold a few surprises. While Corcoran’s East Side flagship dominates with roughly 25 percent of the firm’s 2018 GCI, the documents show, its offices in Brooklyn Heights and Park Slope were the second- and third-highest grossing offices last year, earning 8.9 percent and 8.4 percent of the firm’s total GCI, respectively.

Florida, where Corcoran has been expanding with a new office in West Palm Beach and another in Miami Beach, accounted for 8.3 percent of the firm’s total sales shown in the documents.

This comes as South Florida’s condo market has taken a beating over the last two years. For Corcoran agents there and in New York, which is going through similar challenges, the earnings reflect the new reality.

Among Corcoran’s top 10 agents company-wide — including Carrie Chiang, Robby Browne, Deborah Rieders and Paulette Koch — GCI dropped to $37.6 million last year, down 24 percent from $49.5 million in 2017, according to a document that listed agent perks.

In an interview earlier this year, Corcoran CEO Pam Liebman didn’t shy away from the fact that the market has turned, resulting in the firm closing $4.5 billion sell-side deals in 2018, a 28 percent drop from the year prior.

“It’s nothing to be embarrassed about; $4.5 billion is a great number,” Liebman said at the time. “We’re not crying, we’re OK.”

Going Dutch

Despite a sluggish market, Corcoran’s top earners have continued to make bank.

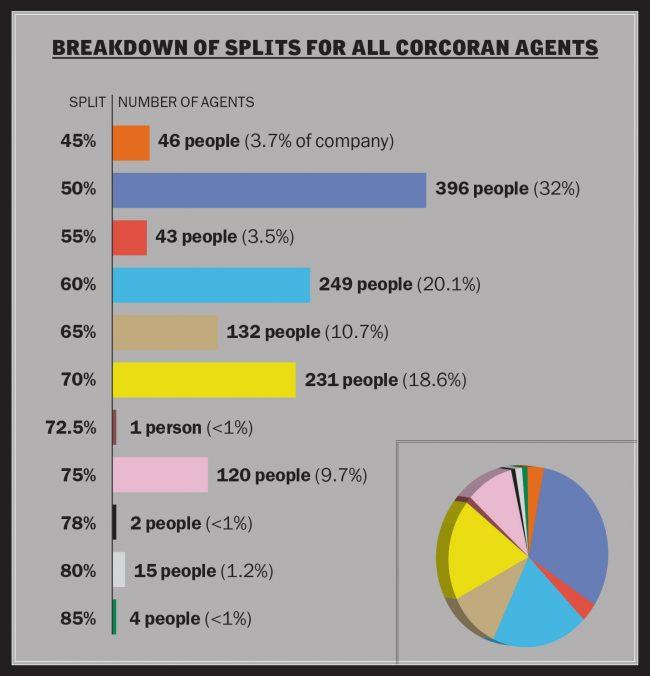

The leaked data shows Corcoran’s splits — the sliding fee structure based on sales volume — range from 45 percent to 85 percent. The average split company-wide, based on the leaked data, was 60.3 percent, and the most common was 50 percent. In Florida, where commission splits skew higher, Corcoran agents saw average splits of 75 percent, according to TRD’s analysis.

What that means for agents’ take-home pay is complicated. According to a 2014 split schedule, Corcoran splits start at 45 percent for agents with GCI under $100,000, meaning an agent responsible for those commission dollars takes home $45,000. Agents with GCI of $395,000 can earn 70 percent or more.

TRD’s analysis of the leaked documents found that the four agents with splits of 85 percent or higher had a median GCI of $3 million last year. (All four are in Florida.) Meanwhile, agents with splits of 70 percent had a median GCI of $402,433.

But across the industry, rising commission payouts over the years have squeezed profits for firms, including Corcoran parent Realogy.

Under CEO Ryan Schneider, the company has attempted to rein in costs by standardizing commissions in select markets. But if it’s a choice between losing money and letting an agent go elsewhere, Schneider said the company will opt for the latter.

“We’re not going to lose money just to retain people,” he said during this year’s second-quarter earnings call.

Perking up

The leaked documents, however, show that Corcoran has no bones about paying to keep and attract agents.

A three-page document lists 267 agents who have riders on their independent contractor agreements showing a slew of perks — including marketing budgets, junior agents and car service allowances. Of that group, 74 agents received a “Normandy Advance Payment,” a type of bonus compensation offered to agents to help them recoup lost business from their prior firm.

The leaked documents show the highest such payment was for $500,000, followed by $350,000 and $160,000. The average Normandy payment was $57,745, according to TRD’s analysis.

The rationale for Corcoran’s Normandy agreements is that residential firms, in general, have enacted tough policies for agents who leave. Such clawback policies routinely roll back commission splits to 40 percent on pending deals, and some firms now charge agents “returnable costs” (including reimbursement of marketing dollars).

For the most part, Corcoran’s recruiting appears to have been steady over the years. But the firm got an influx of new agents last year from Town Residential — at least 50, according to a TRD analysis — including Million Dollar Listing New York star Steve Gold, along with Danny Davis, Dana Power, Nicole Hechter and Asaf Bar-Lev.

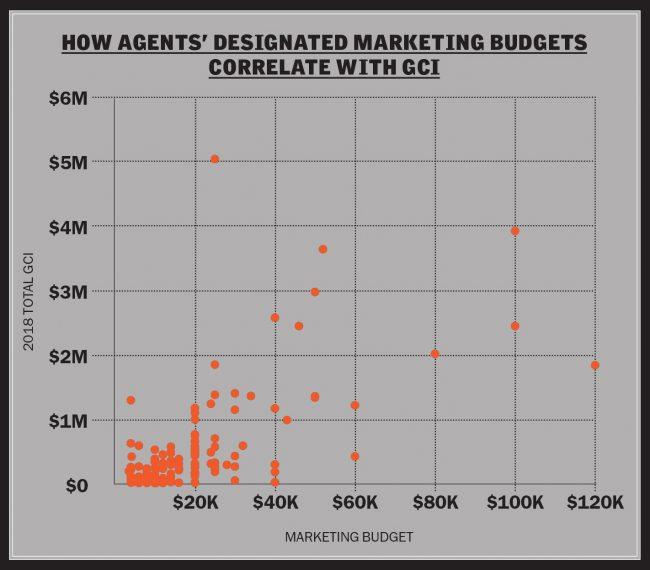

Along with Normandy agreements, Corcoran offered annual marketing allowances to 182 agents, ranging between $2,000 and $120,000. The median was $8,000, according to TRD’s analysis.

Seven agents also have access to discretionary funds, ranging from $5,000 to $275,000. The median discretionary purse was $78,000. It should be noted that because the funds are to be used as an agent sees fit, the money can go toward marketing, for a junior agent, etc. Another four agents got dedicated car service allowances ranging from $1,000 to $10,000.

According to the documents, a total of 132 agents were allotted money to hire a junior agent, receiving between $5,000 and $227,810 for that purpose. (The average was $45,257.)

The revelation of agent perks comes as Corcoran and Realogy have been stung by losses to competitors — namely Compass. For years, Compass, most recently valued at $6.4 billion, has drawn criticism from competitors who accuse it of offering high splits and six-figure bonuses — though the firm denies such practices. In July, Realogy accused its rival of “predatory” poaching and illegal business practices in a new lawsuit.

Analysts that follow Realogy seem to generally view agent-recruitment perks as positive but say more is needed.

“This is a multifront battle where [Realogy] needs to invest and innovate,” read a September report from Barclays. “The capital and dollars behind the competition in many ways undermines RLGY’s efforts.”

Corcoran’s full statement:

The Real Deal analysis of unverified Corcoran data is filled with inaccuracies. Many of their conclusions are simply wrong and do not at all reflect reality.

Publishing this information serves no purpose other than to perpetuate and magnify the wrong that has been done to Corcoran and its agents. The person or entity who did this was trying to create maximum damage by spreading erroneous data.

The improper disclosure of this misleading information to numerous unauthorized recipients was for the purpose of damaging Corcoran’s good will and reputation, and to interfere with employee and agent relationships.

We will not comment any further on this criminal matter and firmly believe the publication of this distorted analysis is irresponsible.