Every day The Real Deal rounds up New York’s biggest real estate happenings, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com.

This page was last updated at 5:55 p.m.

Video produced by Sabrina He

MGM Resorts International is selling the Bellagio on the Las Vegas Strip. A joint venture controlled by Blackstone Group real estate investment trust will own the Bellagio in a deal valued at $4.25 billion. MGM will have a 5 percent stake in the joint venture and will continue to operate the hotel and casino, which it will rent for $245 million a year. [WSJ]

Major League Baseball is taking retail space at the base of its new headquarters. The organization is taking 17,000 square feet on the first floor and basement of Rockefeller Group’s 1271 Avenue of the Americas. The landlord is spending $600 million on the renovation of the former Time & Life Building, where MLB is taking 325,000 square feet of office space. [CO]

WeWork hits a new low. The co-working giant’s unsecured 7.875 percent bonds due in 2025 were trading at 79 cents on the dollar today, down from its former low of 81.25 cents last Friday. It comes as the company searches for new ways to raise cash. And the company’s communications chief, former spokesman for Travis Kalanick, is leaving after six months. [WSJ, Bloomberg]

From left: RealPlus’ Eric Gordon, Corcoran’s Pam Liebman, Halstead’s Diane Ramirez, Douglas Elliman’s Howard Lorber and Brown Harris Stevens’ Bess Freedman (Credit: Eric Gordon by Emily Assiran, Getty Images, Halstead, BHS, iStock)

Terra Holdings is selling part of its stake in RealPlus. The Corcoran Group and Douglas Elliman are buying a portion of the listings company, and will share a listing systems with Terra subsidiaries Brown Harris Stevens and Halstead. [TRD]

Brookfield’s Ric Clark and 666 Fifth Avenue (Credit: Brookfield and Google Maps)

Brookfield Asset Management starts $400 million revamp of 666 Fifth Avenue. The renovation is expected to begin after business tenants vacate over the next year and a half and wrap up by early 2023. The company plans to charge an average rent of $100 per square foot and the project is already slated to become one of the most expensive rehabs in the city. Brookfield bought a 99-year ground lease of the property last year from Kushner Companies, which still owns the land. [WSJ]

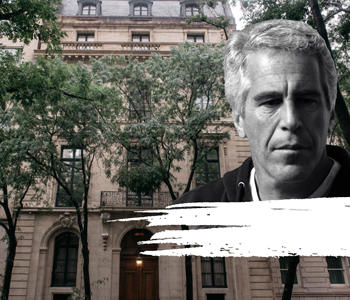

91 East 71 Street and Jeffrey Epstein (Credit: Wikipedia)

Keep an eye out for Jeffrey Epstein’s UES manse. The $56 million townhouse at 91 East 71 Street owned by the disgraced financier is expected to hit the market soon. Contractors are at work dismantling all remaining traces of Epstein and are going so far as to dispose of his former trappings in the dead of night. [NYP]

Real estate industry scrambling to understand New York’s LLC law to address anonymous home ownership (Credit: iStock)

The sweeping law that outlaws anonymous LLCs was an accident. It was supposed to just apply to owners of one- to four-unit buildings, but it’s now been interpreted as being applicable to condominiums too. That was news to the very lawmakers who introduced the legislation. Public agencies are remaining mum about how this all happened, and now the real estate industry is trying to reverse the measure. [TRD]

JPMorgan Chase’s new supertall HQ takes shape. Renderings and photos of a model of the tower, designed by Foster + Partners, have leaked, revealing a glass walled structure with setbacks that narrow it as it climbs higher. The 1425-foot tower is slated to become the third tallest in New York City. Demolition of the current 270 Park tower is ongoing. [YIMBY]

Apollo Global Management is offering $40 per share for Hilton Grand Vacations. The timeshare resort operator is reportedly the subject of a bidding war between Apollo and the Blackstone Group. Blackstone’s bid is not known but the news of Apollo’s offer caused the Orlando-based company’s shares to rise as much as 10.3 percent. Hilton Grand runs 55 resorts and has more than 315,000 members. [Bloomberg]

Sotheby’s auction house refinances its HQ. BNP Paribas issued a $252 million loan replacing HSBC’s $325 million package, according to public records. In recent years, Sotheby’s has been mulling leaving its UES base for a new location, but ultimately settled on staying put. Earlier this year the auction house released plans for a $55 million renovation of the building. [CO]

Retail is a killer, even on Wall Street. Alder Hill Management, a hedge fund that’s held a more than two year position betting against the debt tied to malls, is shutting down. Despite tough times for retailers, bankruptcies and store closures haven’t resulted in loan defaults and the losses apparently got to be too much for Alder Hill’s founder, Eric Yip. [WSJ]