UPDATED 4:00 p.m., Dec. 15: Burton Resnick, who helmed his family firm Jack Resnick & Sons for over three decades, building up its holdings and clout to count it among the dynasties of New York real estate, died Saturday. He was 83.

“Burt’s dedication to improving our city and representing the best interests of our industry was unmatched,” the Real Estate Board of New York, a powerful industry trade group which Resnick twice chaired, said in a statement. The Resnick family confirmed to The Real Deal that Jonathan Resnick, Resnick’s middle son and the firm’s current president, will lead the firm going forward.

Resnick, who grew up in the Bronx and New Rochelle, attended the University of Chicago before heading back to apprentice at the real-estate firm his father, Jack Resnick, had started in the Bronx in 1928, just before the Great Depression hit. One of the first projects he oversaw was the redevelopment of a Loew’s Theater at 142nd Street and Alexander Avenue. It was work that Resnick estimated should have cost, at most, $60,000.

“My father was a great one for on-the-job training,” Resnick recounted in an interview with Michael Stoler in 2011. “I knew nothing about building a building — I was a philosophy major at school. Bills came in and the job cost $100,000 to build. And you would think that a 40 percent overrun would have made my father furious. No. He was the kind of guy who said “it was the cheapest education I ever paid for.”

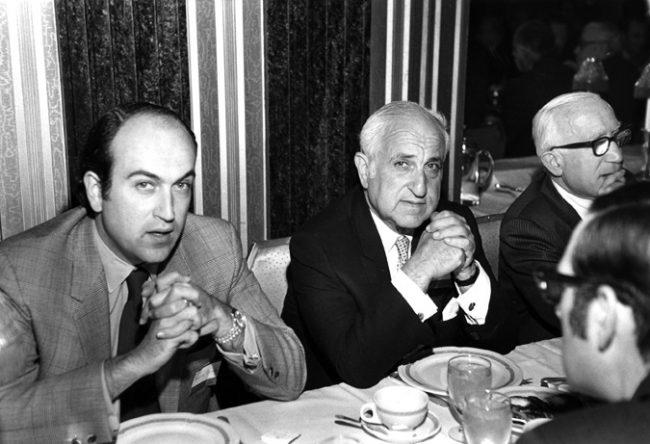

From left: Burt Resnick with his father Jack (Credit: Jack Resnick & Sons)

In the 1960s, Resnick took over the firm, and set it on course to become a major office developer, putting up buildings such as 110 East 59th Street, 1755 Broadway, 880 Third Avenue and One Seaport Plaza. It also developed 900 Park Avenue, a rental tower that was later converted to condominiums. In 2015, Forbes ranked the family as one of the wealthiest in America, pegging its net worth at $1.8 billion. Its holdings today include about 900 rental apartments as well as over 6 million square feet of office space, the lion’s share of it in the world’s premier office market, Manhattan. Resnick and his wife Judith had three sons: Jonathan, Scott, who struck out on his own in 2007 to form development firm SR Capital; and Peter, who works in venture capital.

The Resnicks are among the premier families of New York real estate, alongside the likes of the LeFraks, the Dursts, the Fishers and the Rudins. Not all their bets paid off, however. Court documents released in 2009 showed that the Resnicks were among those who had invested with Bernie Madoff, the Ponzi schemer whose list of victims included other real estate luminaries such as Larry Silverstein, Leonard Litwin and Jules Demchick of J.D. Carlisle. The Resnicks said at the time that the family lost only a small portion of its fortune in the scheme.

As was standard fare for men of his perch, Resnick played an outsized role in New York civic life. He served as co-chairman of the Real Estate Council of the Metropolitan Museum of Art, campaign chairman of the UJA-Federation, New York and as trustee and vice chairman of Carnegie Hall.

“Burt was a gentlemen; a friend of my father and a mentor to me,” Douglas Durst, chair of the Durst Organization, said in a statement. “We will miss his wisdom, his sense of humor and his dedication to our city.”

Resnick steered Jack Resnick & Sons through several real estate cycles, from the city’s fiscal morass of the 1970s to the exuberance of the mid-2000s and the yearslong slump that followed.

“If you look back at the oil crisis in the city in the ’70s, it was the real estate industry and primarily the families that bailed the city out,” he said in an interview with the Architect’s Newspaper in 2010. “When the call went out to pay a full year’s taxes in advance because the city was running out of cash, most if not all the families did it with all their buildings. I remember Lew Rudin saying, ‘we cannot move our assets out of the city, so we’ve got to do this.'”

He served as REBNY chair from 1989 to 1991 and again from 2001 to 2003 after Bernie Mendik’s death.

“Burt was a wonderful coach and friend, opening doors and giving me guidance at critical moments,” said CBRE’s Tri-State CEO Mary Ann Tighe, who served as REBNY chair from 2010 to 2012. “He was always generous and caring, and I trusted him completely. Our periodic lunches were always fun, but I also knew I was getting wisdom from a master.”

Even in his later years, Resnick remained an energetic and highly visible presence on the industry scene — retirement is a “death penalty,” he told the New York Times in 2009 — and advocated vigorously for industry interests both through REBNY and through his sizable political donations.

“You’ve got to be a cockeyed optimist to be in the real estate business,” he once told the Times. “Because if you’re not, then get out of New York.”