One of the biggest rent-stabilized portfolios in New York City is facing a financial reckoning.

Multiple sources with direct knowledge of the matter say the Dawnay Day portfolio has a large amount of debt and its owner, Isaac Kassirer’s Emerald Equity, is struggling to pay its obligations. Selling is probably not an option because rent-regulated buildings’ values plunged when the state passed a tenant-friendly rent law in June.

Emerald Equity bought the storied East Harlem portfolio in late 2016 with a plan to renovate rent-stabilized apartments and convert them to market rate. But with the stroke of Andrew Cuomo’s pen, Emerald Equity’s business plan was disrupted. The new law blocked nearly all pathways to deregulation and also severely curtailed rent increases to stabilized units.

Now, the firm is seeking a tax abatement from the de Blasio administration to make ends meet. Known as an Article XI agreement, it depends on an audit by the Department of Housing Preservation and Development to assess the net operating income and determine the level of need. The local City Council member must also sign off.

According to HPD, nearly all such proposals are approved.

Read more

The Article XI agreement would require that no more than a third of the units be market-rate and could provide a property-tax abatement for 30 to 40 years. Under the regulatory agreement, future tenants of the buildings would have to meet income requirements — making those apartments eligible to count toward Mayor Bill de Blasio’s goal of 300,000 affordable units created or preserved, according to a spokesperson for HPD. Rent stabilization does not involve means-testing of tenants.

Emerald’s efforts on Dawnay Day are being watched closely by Mack Real Estate, which has a nine-figure preferred equity stake in the portfolio, according to sources.

“We are exploring all options, with the objective of ensuring quality and sustainable building operations for our current residents, now and into the future,” Isaac Kassirer said in a statement to The Real Deal.

Victor Sozio, Shimon Skury and Michael Tortorici of Ariel Property Advisors, who are representing Emerald Equity, did not comment. Mack Real Estate declined to comment.

When Emerald paid $357.5 million for the 1,181-unit rent-stabilized portfolio ($302,000 a unit) in 2016, the investment environment was dramatically different. The landlord received a $300 million acquisition loan from Brookfield and implemented a strategy of renovations, improvements and buyouts to move low-income tenants out and raise rents, using tools allowed under the rent law at the time.

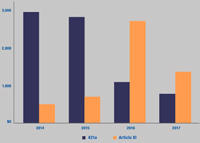

By the end of 2017, some 251 units in the East Harlem portfolio had been moved to market-rate, according to tax bills and public data.

Brookfield, as the senior equity lender, could expect to see a return on its investment, and was the first to be repaid. The firm, which declined to comment for this story, is no longer connected to the portfolio.

In January 2019 Sabal provided Emerald Equity with a $189 million Freddie Mac–insured loan for 33 of the 47 buildings in the portfolio. The landlord planned to renovate 52 percent of the units in those buildings, according to Sabal’s press release at the time.

Sabal CEO Pat Jackson said in a phone interview that Emerald Equity’s business strategy “as savvy as they get,” but noted that the approach of buying entire buildings, renovating units and raising rents was severely curtailed by the new rent law.

“The investor requires a return,” Sabal said. “If you can’t see a path to that occurring in the near term, then the consequences are pretty easy to follow.”

The new law hampered the strategy Emerald Equity had previously used to deliver returns to its investors and lenders, including Brookfield and Sabal, LoanCore and later Mack Real Estate. The recoverable cost of renovations is now limited to $15,000 — or $83 per month — over a period of 15 years. Landlords can no longer raise the rent 20 percent when a tenant leaves. And a unit cannot be removed from regulation based on the rent exceeding a certain threshold.

Write to Georgia Kromrei at gk@therealdeal.com