The mezzanine lender on a Midtown hotel development tried to take advantage of social distancing rules to rig a foreclosure auction and take over the property, a remarkable new lawsuit alleges.

In a complaint filed Thursday, Hidrock Properties accuses Henry Silverman’s 54 Madison Partners of an “improper and shameless attempt to capitalize on the Covid-19 pandemic” and take over the 161-key project at 12 East 48th Street, which is to become a Hilton Grand Vacation Club.

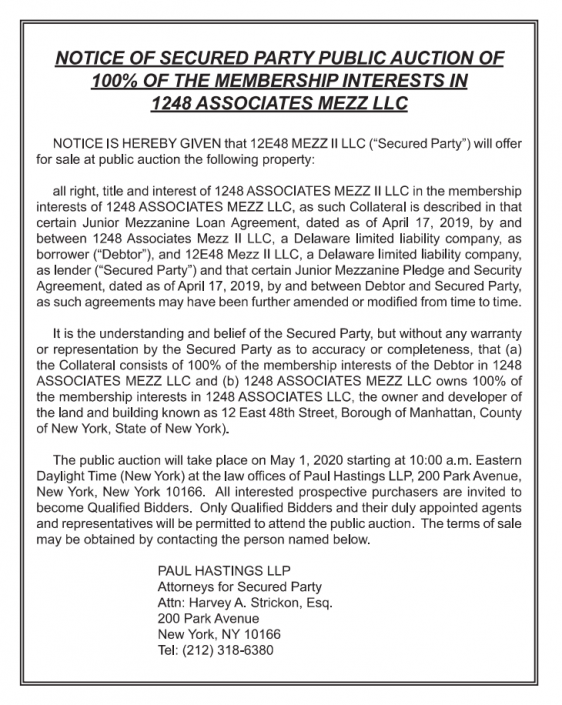

Silverman’s firm allegedly announced an in-person “public” auction of the entity that controls the property at the MetLife Building on Friday, May 1 — despite the ban on non-essential gatherings.

“In its transparent effort to deter public interest” in the entity, 1248 Mezz LLC, 54 Madison “has told all potential buyers that the only way to bid … is either to risk their own well-being and flout the legal restrictions … or at most try to use an electronic system that provides no real substitute,” the complaint states.

A court order issued Friday has temporarily halted the sale. Hidrock and 54 Madison did not respond to requests for comment.

Read more

Hidrock secured $100.5 million in senior construction financing for the project from Midland National Life Insurance in 2016, as well as $23.2 million in mezzanine debt from 54 Madison. Silverman’s firm provided an additional $7 million in junior mezzanine debt in April 2019, according to the lawsuit.

The new debt required the project to be substantially complete by the end of 2019. Hidrock notes that construction was “more than 80 percent” done by Dec. 31, but the parties disagreed on whether that was enough.

In early 2020, Hidrock began negotiations with Apollo Commercial Real Estate to refinance the property, and 54 Madison participated in those discussions. But then the pandemic threw a wrench into the machinery and on March 17 Apollo broke off negotiations, the lawsuit says.

The developer says at the end of March it was informed that 54 Madison was planning to sell the collateral — essentially, the hotel site. An April 17 advertisement of the sale made no mention of the option to participate remotely — although the “terms of sale” do include such an option.

Hidrock alleges that the mezzanine lender is creating a “farce that it is conducting a public sale while intentionally closing off public access.” Even if an interested buyer could attend the auction, the pandemic would greatly complicate due diligence and financing — and 54 Madison retained the right to reject any bids, the developer’s suit says.

Additionally, Hidrock alleges that a 54 Madison employee informed the project’s contractor that it would make payments to continue construction after “we take control of the asset.”

Silverman’s firm has been asked to show on May 18 — via Skype — why it should be able to move forward with the sale during New York’s state of emergency. Hidrock estimates that it needs six months and less than $12 million to complete the hotel once construction restrictions are lifted.

(Caption: Notice published in Commercial Mortgage Alert’s April 17 newsletter. The auction was canceled by court order. Source: New York State Unified Court System)