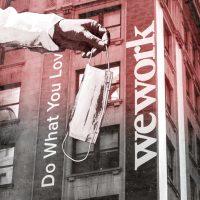

As WeWork makes headlines for rental woes, disputes with members and co-founder Adam Neumann’s SoftBank feud, Sandeep Mathrani sought to assuage concerns in his first TV appearance since becoming CEO.

The office-space giant paid rent at 80 percent of its locations in April and May and collected rent from 70 percent of its members, Mathrani said on CNBC’s Squawk Box Tuesday morning. WeWork had about 830 locations at the end of the first quarter, he said, up from 740 three months earlier.

The CEO has angered some customers by continuing to charge them fees during the pandemic. Last week, a faction of upset members called that “unlawful” in a letter to WeWork’s general counsel because many state and local officials had demanded non-essential workers stay home. WeWork has said it must keep its locations open for users who are considered essential.

“We are working with small, medium businesses on deferrals, freezing of rents and different aspects,” Mathrani said. As for its own unpaid rent, the executive said WeWork was engaging in “friendly” conversations with its landlords and plans to meet its obligations.

The company in April tapped JLL and Newmark to help it negotiate rent relief or switch traditional leases to profit-sharing agreements with landlords. WeWork was reportedly looking to reduce its rent liabilities by as much as 30 percent.

WeWork is also considering subleasing its own headquarters on West 18th Street in Manhattan’s Chelsea neighborhood, Bloomberg reported.

Read more

First-quarter earnings reports for public companies offer a glimpse at how WeWork’s collections compare with those of traditional landlords. SL Green Realty Trust and Empire State Realty Trust, two prominent New York City office property owners, reported receiving 92 percent and 73 percent of rental payments, respectively.

When asked what the future of office space might look like, Mathrani said the flexible-office company was taking lessons from its nearly 100 locations in China, and detailed the implementation of new HVAC systems and sanitization measures.

He also said WeWork is on track for profitability in 2021. After SoftBank’s most recent financial commitment to the firm, he said, WeWork has “over $4 billion of liquidity.”

As for Neumann’s lawsuit against SoftBank over its scrapped $3 billion agreement to buy shares, Mathrani said it was something that only concerned existing shareholders and the Japanese conglomerate.

“It’s noise in the background as far as I’m concerned,” he said. “My focus is to right this ship.” [CNBC] — Danielle Balbi