The United States’ housing policy response to the coronavirus crisis “leaves significant gaps,” with renters most exposed to the economic fallout, according to a new report from Amherst Capital Management.

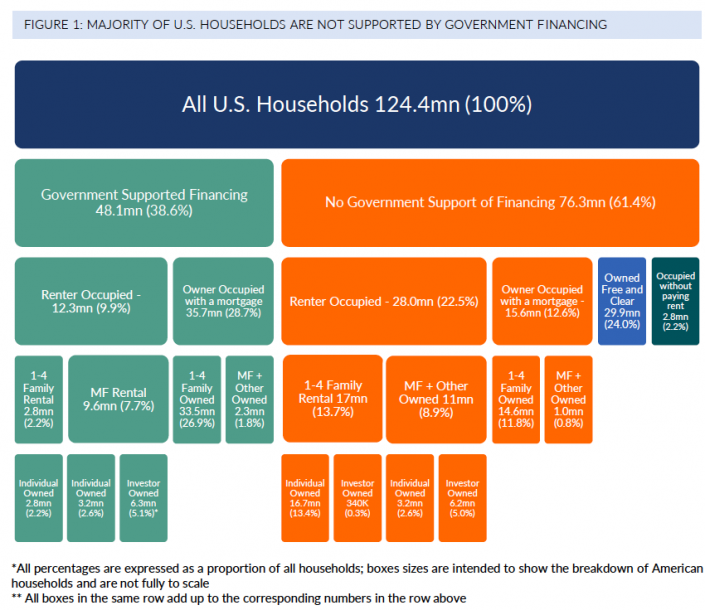

In addition to one-time stimulus checks and expanded unemployment benefits, housing assistance — including forbearance and eviction protections — has been focused on properties owned by or with mortgages backed by government agencies such as Fannie Mae, Freddie Mac and Ginnie Mae, the report notes. Such assistance has “has been helpful in mitigating the financial impact of the crisis” for 38% of American households, or 48.1 million.

As the below graphic shows, about three-quarters of those households (35.7 million) are homeowners and one quarter (12.3 million) are renters. Meanwhile, another 28 million renter households have not received these forms of assistance.

“A gap exists between government and non-government supported households that does not address the financial needs of the consumer, and is instead driven by who financed the homes they live in,” the report states.

Renters are more vulnerable to the crisis because they have lower income on average, spend a higher proportion of their income on housing, and have a higher chance of becoming unemployed.

“Absent additional intervention, our analysis indicates there is a risk of a number of evictions and foreclosures in excess of the levels we saw in the wake of the Great Recession,” Amherst researchers conclude.