When Zillow Group recently reduced its StreetEasy office space in NoMad by 80 percent, it was no outlier. A subleasing trend has been building since June.

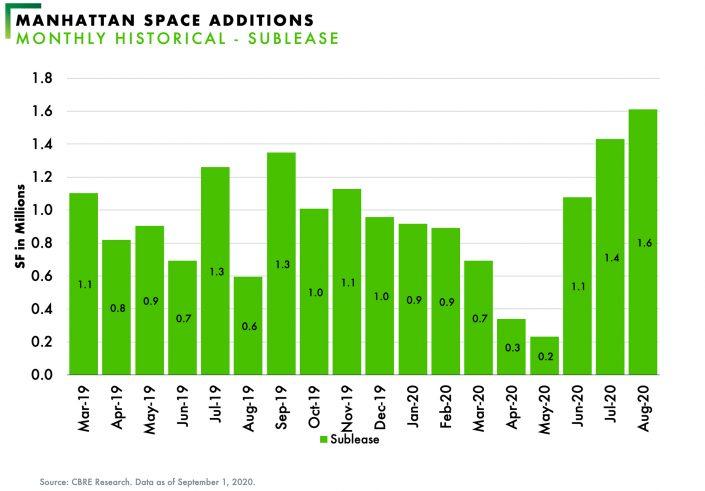

Between January and March, monthly sublease space hitting the Manhattan office market averaged about 0.8 million square feet. Then the pandemic hit, and monthly sublet additions plummeted to 0.3 million square feet in April and 0.2 million in May, according to CBRE.

(Click to enlarge)

When the city started reopening in June, the figure spiked to 1.1 million square feet and continued rising, reaching 1.4 million square feet in July and 1.6 million in August.

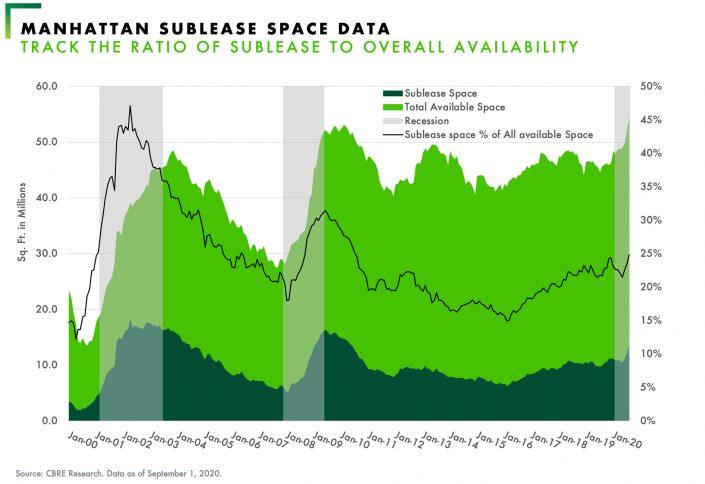

Office sublease space has now reached 25 percent of total availability in Manhattan, according to CBRE’s Manhattan sublease report for August issued this week.

Read more

“As the pandemic lingers on, businesses have started to think about the cost of their real estate footprint and what their space needs are,” said Mike Slattery, CBRE’s research manager.

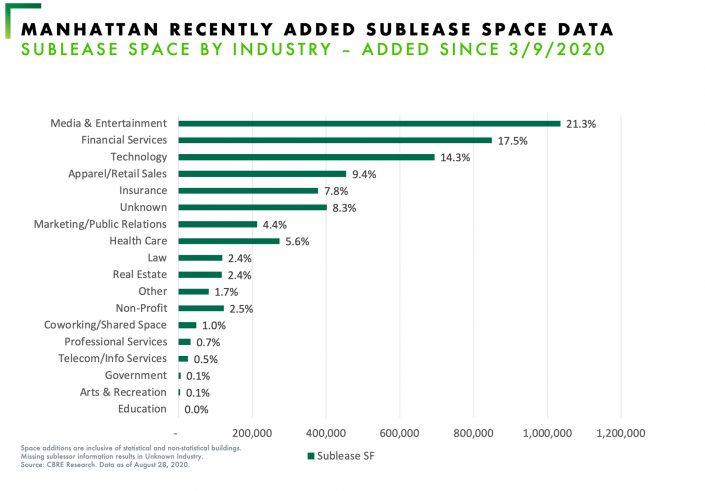

Until recently, the increase in subleasing was driven by businesses that had faced headwinds even before the pandemic, such as media organizations and traditional advertising and retail companies.

(Click to enlarge)

“All the trends before the pandemic have just been accelerated,” said Howard Fiddle, a CBRE broker.

Even firms that had been doing well, such as tech companies in the hospitality and travel business, followed suit and put space on the market.

The media and entertainment sector accounted for 21.3 percent of the 4.9 million square feet of subleasing availability added to the market since mid-March, CBRE’s August report shows. The financial services industry followed at 17.5 percent and technology was third at 14.3 percent.

In July, R/GA Media Group listed 113,000 square feet of its 173,000-square-foot office space at 450 West 33rd Street, also known as 5 Manhattan West. The digital-advertising firm signed the lease in 2014 as one of the first tenants after Brookfield Property Partners unveiled a $200 million renovation plan for the 16-story tower.

Asked if R/GA’s decision to sublet space was to cut costs, Wes Harris, the company’s EVP global chief operating officer, said in an email that the pursuit of “agility” drove the move.

“While we’ve had to make difficult decisions for our business this year, we have been lucky to retain an engaged, networked workforce and want to ensure our in-office and remote work settings are optimized for their creative and collaborative efforts,” he said.

Harris added that the firm still values physical space and plans to experiment with satellite offices in the city that are closer to employees’ homes.

(Click to enlarge)

The decision to sublet most of StreetEasy’s Nomad office came after Dan Spaulding, Zillow’s chief people officer, wrote in a blog post in late July that the group’s preference for in-person collaboration had been debunked by the pandemic. In the same post, he introduced a flexible work-from-home policy to allow about 90 percent of employees to work from home even after the pandemic.

With its 103,000-square-foot sublet listing, Zillow is “informally exploring” options to “right-size” its office space in the city, a company spokesperson told The Real Deal.

The sublet space is part of the company’s 130,000-square-foot digs at 1250 Broadway. Zillow signed the 10-year lease about two years ago to expand its footprint in New York.

“While no decisions have been made, Zillow will continue to have a physical presence in New York City,” the spokesperson said.

Contact Akiko Matsuda at akiko.matsuda@therealdeal.com