Below the spire of Marble Collegiate Church lays a barren hole with construction tools, fire extinguishers and ladders hastily stacked around the edges. Three cranes excavating the West 29th Street site have been abandoned. A sign on a fence directs congregants, “confessions this way,” with an arrow pointing to the sanctuary.

HFZ Capital Group had planned to build a boutique office tower at the NoMad location aimed at technology and media tenants, before the developer’s multibillion-dollar real estate portfolio started to unravel.

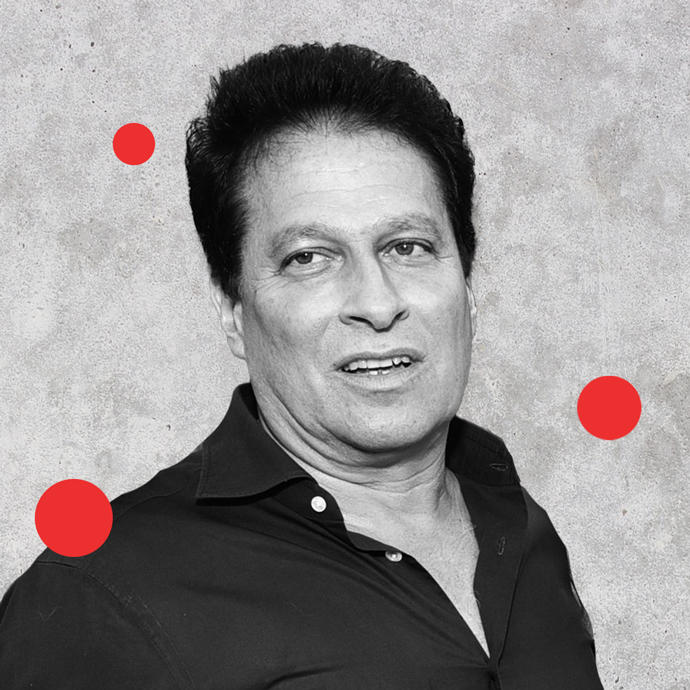

HFZ CEO Ziel Feldman (Getty)

But the money pit isn’t just HFZ’s cross to bear. The nearly 400-year-old Marble Collegiate Church, the oldest Protestant church in the country, entered into a joint venture with Ziel Feldman’s firm several years ago. And now that HFZ has defaulted on one of the project’s loans, the church’s investment is set to be wiped out alongside its partner’s in foreclosure.

That’s a financial blow to the church, and it’s also a warning to other mission-based organizations — even those like Marble Collegiate with sophisticated real estate operations — that are sitting on valuable properties and thinking about getting into risky real estate developments.

“We counsel nonprofits on this stuff all the time,” said Paul Wolf, co-founder of the brokerage Denham Wolf. “Typically, we say don’t take a risk that could jeopardize the core mission.”

Wolf, who is not involved in the project, added that Marble Collegiate has an experienced real estate arm that’s done development projects before, but never one that got so deep underwater.

“They just got caught by this,” he said.

Fellowship then foreclosure

The real estate industry’s appetite for these kinds of projects involving church properties was at its height around 2015, when HFZ inked a joint-venture agreement with Marble Collegiate to develop its site.

“Many other developers had tried for years to do a deal with the church,” HFZ’s Feldman told the Wall Street Journal in 2015. “We came in with a great land cost, and find the site to be fantastic. The church itself is easy to work with, and the physical structure is a beautiful cornerstone for building.”

Feldman did not respond to requests for comment for this story. Marble Collegiate also did not respond.

HFZ’s plans first called for a 64-story residential tower. But by 2019 the developer had shifted to a 600,000-square-foot, 34-story office building designed by architect Bjarke Ingels and dubbed 29th & 5th.

A rendering of 29th and 5th (Rendering by BIG/HFZ)

Marble Collegiate planned to use the money from the development to restore its landmarked building and fund its programs. It would create a fellowship hall and community facility at the base of the tower that would be physically connected to its building. The value of its stake in the joint venture was reported to be around $40 million.

Investor documents show the projected value of the development to be $1.3 billion as of 2019, with the developers’ equity stake totaling $238 million, or roughly 18 percent of the total.

But as the walls started falling in around HFZ, the company fell behind on its $90.9 million mezzanine loan with the Vanbarton Group, which in December scheduled a UCC foreclosure auction for the project’s equity stake.

Experts in the nuances of joint-venture agreements said churches and nonprofits can structure their deals to keep them in a project when the development partner gets taken out through that foreclosure process.

But loan documents show Marble Collegiate’s real estate arm is party to the Vanbarton mezzanine loan alongside HFZ, and a source close to the auction said the church’s stake is set to be taken over through the foreclosure.

Jeffrey Gilbert, an attorney with the firm Saul Ewing Arnstein & Lehr in Miami who works with real estate attorneys and developers, said foreclosing on church real estate is usually a last resort.

“Lenders don’t want to be the bad guy foreclosing on a house of worship generally, it’s a PR issue that you don’t want to turn into a nightmare,” Gilbert said.

A representative for Vanbarton declined to comment.

In addition to its long history in New York, Marble Collegiate has attracted attention for its high-profile members and leadership.

Celebrity congregation

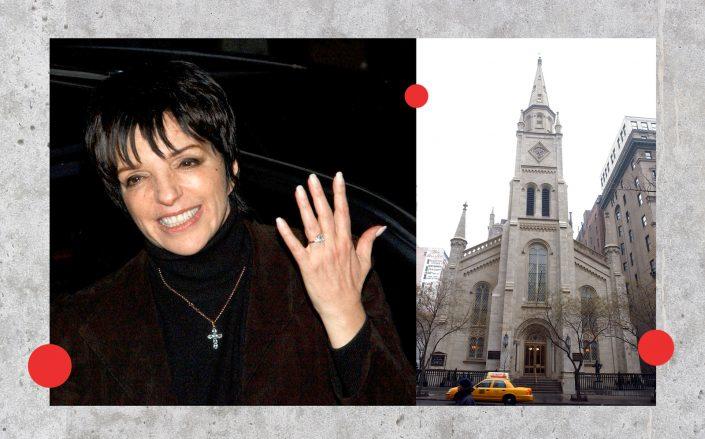

Liza Minnelli and David Gest tied the knot at the church during a star-studded ceremony in 2002, where A-listers like Michael Jackson, Elizabeth Taylor and Diana Ross filtered from Fifth Avenue into the Neo-Romanesque Gothic building.

Liza Minnelli and Marble Collegiate Church (Getty)

It’s probably best known for longtime pastor Norman Vincent Peale, author of the influential book, “The Power of Positive Thinking,” who in 1977 officiated the wedding of Donald and Ivana Trump. Peale died in 1993.

Donald Trump had been a longtime member, attending the church for decades with his parents. And when questions about his religious devotion surfaced during the 2016 presidential election cycle, Trump told reporters he attended Marble Collegiate.

“Dr. Norman Vincent Peale, ‘The Power of Positive Thinking’, was my pastor,” Trump said during the Republican primaries in 2015. “To this day one of the great speakers I’ve seen. You hated to leave church. You hated when the sermon was over.”

The church quickly distanced itself from Trump, but one thing it does have in common with the former president is an eye for real estate.

Marble Collegiate runs a real estate arm called Collegiate Asset Management Corp. that for more than two decades was headed by Casey Kemper, a former real estate executive at now-defunct property development firm Olympia & York.

The church has acquired a sizable real estate portfolio across Manhattan since its founding in 1628, four years after the Dutch settled New Amsterdam. It gets its name from the white marble quarried in Hastings-on-Hudson in Westchester County and used on its current home on Fifth Avenue. It moved there from Lower Manhattan in 1854.

Over the years, Marble Collegiate has used some of its properties to generate revenue and support its mission, and it hasn’t shied away from flexing its real estate muscle.

In the early 2000s, for example, Kemper partnered with Olympia’s successor, Brookfield Properties, with the intention of developing parcels where the original church had stood. But the Metropolitan Transportation Authority later condemned the site then seized it under eminent domain to make way for the Fulton Street Transit Center.

In 2018, the real estate arm sold properties next to its West End Collegiate Church on West 78th Street for $158 million to Alchemy Properties’ Ken Horn, which planned to develop a 19-story residential condominium tower.

Collegiate Asset Management’s tax filings show that from 2014 to 2017, the book value of its assets swelled from about $395 million to almost $545 million.

Officials have said its real estate activities were always designed to aid the church’s mission.

”The purpose of our being landlords is to support our four churches — their programs and their benevolences for the community,” Kemper told the New York Times in 2001. ”That’s why we’re in the real estate business.”

Kemper’s real estate arm had been assembling sites near church headquarters on 29th Street and Fifth Avenue, and by 2006 the investment platform was marketing the entire property as a development site for a 277,000-square foot hotel and timeshare.

Around that time, Marble Collegiate wasn’t the only nonprofit looking to cash in on its real estate. As the city’s real estate market caught fire through the early- to mid-2000s, numerous religious institutions and mission-oriented organizations looked to leverage properties they owned.

Many sold their properties to real estate developers — some relocated to far-flung corners of the city — while others stuck around to take part in the upside through partnerships.

Savills broker David Carlos, who specializes in advising nonprofits, said he always warned his clients of the dangers of venturing into real estate development.

“I’m a big proponent of them taking as little risk as possible because, just by definition they are not developers,” he said. “To have an entity that is a nonprofit or mission-based entity participate like a very high-risk developer, their missions just aren’t aligned. I don’t think the organization is built for it.”

Kemper retired from Collegiate Asset Management in 2018, and was succeeded by Dan Lehman, a former C-suite officer at the nonprofit Children’s Aid New York. Neither executive responded to requests for comment.

Investing with faith

The church isn’t the only investor with skin in HFZ’s game that’s set to lose out on its contribution to the NoMad project.

Beny Steinmetz (Getty)

Israeli billionaire and diamond mogul Beny Steinmetz reportedly has a loan on the project. In January, Steinmetz was sentenced to 5 years in a Swiss prison for paying bribes to a public official in the West African country of Guinea in order to secure rights to an iron ore mine.

The Brazilian mining company Vale alleges Steinmetz laundered money through New York City real estate projects by HFZ and RFR Realty. It has asked Manhattan’s federal court to probe the developers’ projects — including the Marble Collegiate JV — to uncover the alleged loans.

HFZ has on several occasions denied any involvement with Steinmetz.

Feldman also pulled in money for the church property project from individual Chinese investors who participated in the cash-for-visas EB-5 program. Those investors put about $63 million into the project as preferred equity — an investment that provides a return similar to that of a loan but doesn’t have the security in the form of collateral that debt vehicles offer.

That preferred equity stake is also set to get taken out in the UCC foreclosure action. In most of the recent UCC foreclosures in New York City, the mezzanine lender often credit bids the debt it’s owed and takes over the property, which in this case would put Vanbarton Group in the driver’s seat.

Vanbarton could develop the Marble Collegiate property itself or partner up with another builder to someday fill the empty pit and build the skyscraper, but the church likely won’t have anything to do with it.