Developers selling pricey luxury condos in Manhattan had their best week of sales since 2018.

There were 22 sponsor units that found buyers last week, according to Olshan Realty’s weekly report on contracts signed for Manhattan homes asking $4 million or above. That’s the highest number since mid-February 2018, when 22 sponsor units went into contract.

“In the golden years of new development, we’ve had bigger weeks,” said Donna Olshan, the author of the report. “[But] I think there’s a lot of pressure on developers to clear the inventory… At the same time you have some very dynamic buildings that came out.”

Read more

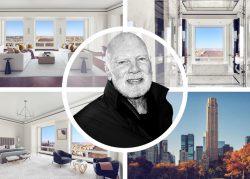

The most expensive contract inked last week was for a 6,901-square-foot condo at Alchemy Properties’ 378 West End Avenue. The five-bedroom unit occupies an entire floor and has 2,349 square feet of outdoor space spread between balconies and terraces on nearly every side of the building. The unit was last asking $29.95 million.

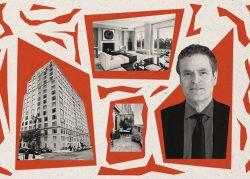

The second largest transaction was for a three-bedroom unit at 220 Central Park South. The unit, 36B, will be the second resale in the building. The seller bought the condo for just under $21.9 million off of floor plans in a deal that closed in September 2019. The apartment spans more than 3,000 square feet and was first listed in September for $26.9 million. It went into contract last week asking $24.9 million.

“New developments with large apartments and buildings that are packed with amenities seems to be the formula,” Olshan said.

At 378 West End Avenue, amenities include a 75-foot saline lap pool, squash court, half basketball court, pet grooming, fitness center and children’s playroom. At 220 Central Park South, amenities include an 85-foot saline pool, golf simulator, kids’ playroom, squash court and full basketball court.

Across all luxury properties, there were 47 contracts signed, down slightly from the previous week’s 51 contracts. Still, it marks the 11th consecutive week where Olshan’s report included more than 30 contracts. It’s an unprecedented streak that hasn’t occurred since the report began tracking the market in 2006.

The median asking price for last week’s deals was just over $8 million with an average listing discount of 7 percent. The average time on the market for the properties was 565 days.