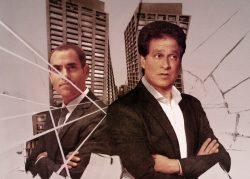

With his signature project slipping from his control, HFZ Capital Group’s Ziel Feldman is slinging some mud.

The embattled developer amended a complaint in a lawsuit he filed earlier this year against former HFZ executive Nir Meir. In the new filing, Feldman pulls out all the stops to blame Nir for HFZ’s collapse.

The complaint calls Meir a sociopath 17 times, accusing him of driving HFZ’s $2 billion XI condo project into the ground and keeping Feldman in the dark about its problems. It compares Meir to Bernie Madoff, disgraced attorney Marc Dreier and convicted former health care executive Richard Scrushy.

Not even Meir and HFZ’s lender, the UK-based Children’s Investment Fund, is spared Feldman’s wrath. The complaint quotes a line from Ray Liotta’s character in the movie “Goodfellas,” comparing the hedge fund to gangsters who burn down a restaurant once they’ve extorted everything they can from it.

“It is an apt analogy because … not only are Mr. Feldman and HFZ facing potential judgments in the amount of nearly $300 million, but TCI has also sought to take control of the valuable XI project through a UCC foreclosure sale,” the amended complaint reads.

Larry Hutcher, co-managing partner at Davidoff Hutcher & Citron, who represents Meir in the lawsuit, said it’s “ludicrous” for Feldman to say “he had no knowledge of what took place inside his own business.”

“This was a desperate act by Ziel to salvage his otherwise unsalvageable reputation,” said Hutcher.

Read more

The lawsuit alleges that Nir illegally charged personal expenditures to HFZ, including $10,000 weekly sushi dinner parties, millions of dollars’ worth of wine, five different Mercedes (including an AMG model), a Cadillac Escalade, two Porsche 911s and an Aston Martin. It accuses Nir of misusing HFZ funds to lease a $150,000-per-month Miami Beach home.

The complaint comes after TCI scheduled a foreclosure auction to take control of HFZ’s ownership stake in the XI, a mixed-use development on the High Line.

Earlier this month, a judge ordered HFZ and Feldman to pay $136.2 million to TCI over defaulted loans tied to the XI. HFZ and Feldman are appealing.

HFZ originally filed a tamely worded complaint against Meir in April, accusing the former executive of defrauding the development firm and hoarding fringe benefits including a pricey Hamptons home.

But after filing the original complaint, HFZ retained Morrison Cohen litigator David Scharf, an attorney known for representing high-profile real estate clients such as Donald Trump — and for crafting legal complaints geared as much toward public relations as to laying out a legal argument.

The Real Deal was sent the complaint earlier this week by HFZ’s new spokesperson, Stu Loeser, who represented Michael Bloomberg for six of his 12 years as mayor.

The new filing brings TCI into the mix, arguing that the hedge fund went along with Meir’s alleged misuse of project funds on the XI and willfully ignored its due diligence duties because, HFZ argues, the lender knew that if the project went bust it could snap it up in foreclosure at a rock-bottom price. (TCI is not a defendant in the case.)

The amended complaint increases the damages HFZ is seeking from Meir from a piddling $43 million to an attention-grabbing $688 million, based mostly on the new claim that Meir lied to HFZ about the XI being on sound footing, causing more than $600 million in damage.

This is not the first time that Feldman has painted Meir as the main culprit for HFZ’s mounting financial woes.

HFZ has alleged in previous lawsuits that Meir forged his signature on loan documents. In one case against a purported lender to HFZ, Feldman’s legal team hired a forensic handwriting expert to analyze his signatures. The expert could not determine whether Feldman’s signatures were forged.

Feldman founded HFZ in 2005, focusing on converting pre-war Manhattan rental buildings into high-end condominiums. Meir and Feldman parted ways in December as the HFZ’s real estate portfolio started unraveling and its properties faced foreclosure. HFZ has claimed that Meir was fired, while Meir previously told TRD through a spokesperson that he was stepping down from HFZ but remained a “vested partner.”