The profit potential of affordable housing will never get the Billionaires’ Row developers like Steve Roth and Gary Barnett too excited, but a major purchase by Fairstead and Invesco Real Estate is a reminder that there is money to be made on the asset class. It just takes a lot of units.

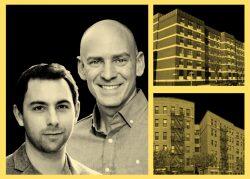

The firms are paying more than $350 million for a portfolio of 48 Bronx buildings totaling 2.3 million square feet across almost 2,000 apartments, according to Crain’s. Property Resources Corp. is the seller.

The properties are scattered throughout the borough and include buildings in Morrisania, Longwood, Crotona Park and Tremont. Crain’s reported that the firms will keep the buildings affordable.

Read more

The portfolio of mostly five and six-story buildings includes some with retail space on the ground floor. Apartments in the buildings are available to households earning between 30 percent and 100 percent of the area median income, under their subsidy agreements.

Berkadia and Deutsche Bank provided financing for the acquisition, but did not reveal how much they each contributed. The deal was brokered by Victor Sozio and Shimon Shkury of Ariel Property Advisors.

Fairstead plans to incorporate job training and financial literacy programs into the portfolio, according to Crain’s. It will continue a relationship with the Renaissance Youth Center to provide funding for music programs for residents.

“We are proud to be serving thousands of Bronx families, giving them peace of mind that their homes will remain affordable and providing them with access to important social services and programming,” Fairstead CEO Jeffrey Goldberg shared in a statement.

This is Fairstead’s second notable affordable housing deal in as many months. Last month, it bought a 13-property, 691-unit affordable housing portfolio in Newar, spending $85 million in a joint venture with LIHC Investment Group. The deal came after Fairstead committed $500 million to grow its multifamily holdings.

Two years ago, Invesco partnered with Ron Moelis’ L+M Development Partners on a $1.2 billion purchase of the 2,800-unit portion of the Putnam portfolio. Two-thirds of the units involved in the purchase were designated to remain affordable.

Elsewhere in the Bronx, Camber Property Group recently acquired a portfolio of three project-based Section 8 communities for $105 million. One was the Target V Apartments in the Morris Heights section, one was in Brooklyn and one was in Manhattan.

[Crain’s] — Holden Walter-Warner