Since hitting the market for a whopping $65 million in late 2019, the penthouse occupying the 18th and 19th floors of 15 Central Park West experienced all the hallmarks of selling through a pandemic.

Listed by a cautious owner — who wasn’t quite sure whether he really wanted to sell — the duplex endured months while in-person viewings were banned, followed by a summer and fall in which Manhattan’s condo market remained at a crawl.

Then came the great rebound of 2021. The unit again began attracting attention from buyers, including one from overseas who sent a camera crew to film it. The penthouse ultimately went for $47 million in April, well below its aspirational asking price, but still enough to make it one of the ten most expensive homes sold in the city all year.

“We had much higher offers at some points, and somehow he never accepted them,” said Felise Gross, with Brown Harris Stevens, who had the listing. “But at this point, he was just ready to make a deal.”

After a slow 2020, the market turned in sellers’ favor in 2021 as deep-pocketed buyers returned to the city en masse, eliminating any lingering suspicion of a Big Apple exodus.

Brokerages, in turn, had record-breaking years almost across the board.

“I think the agents are exhausted. They worked so hard, and they’re still working really hard,” said Pam Liebman, CEO of Corcoran Group, which retained its status as the top-selling brokerage in Manhattan, closing $6.5 billion in volume across more than 2,600 deals — up 46 percent from $4.4 billion in 2020.

“While a certain company out there likes to broadcast the fact that their agents do more business than anyone else, we don’t talk about it,” Liebman added. “We just do it.”

To rank the borough’s top-performing brokerages of the year by sell-side transactions, The Real Deal pulled Manhattan listings from real estate data firm LavaMap and cross-referenced them with closed deals in public records and with the brokerages. Off-market transactions and deals brokered in-house by developers’ own sales teams were excluded.

Douglas Elliman came in second, with just over $6 billion in sales volume, doubling its 2020 output to overtake Compass, which ranked third with nearly $5.8 billion.

“So many of our agents had their best years in their careers this past year,” said Richard Ferrari, Elliman’s New York City CEO.

A hot market

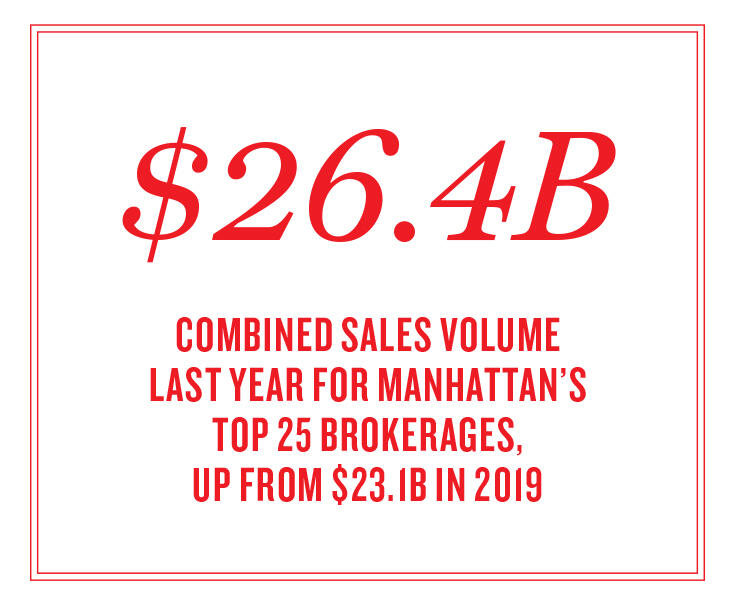

In total, the top 25 brokerages closed $26.4 billion worth of sales, nearly doubling the $14.1 billion recorded in 2020 and up 14 percent from $23.1 billion in 2019.

Brokerage executives noted that unlike in typical years, when the market slows in the winter, 2021 started with a bang as pent-up demand from 2020 exploded into the market. In the first quarter of the year, 2,457 deals closed, up 29 percent over the previous quarter, according to a report by appraiser Jonathan Miller for Douglas Elliman.

The proliferation of vaccines and lifting of lockdown restrictions in the spring and summer fueled the momentum, and the second quarter was even stronger, with 3,417 deals closed, up 39 percent from the first quarter of the year and 152 percent from the same period in 2020.

In the third quarter, more homes were sold in Manhattan than in any other quarter in more than three decades — the borough’s 4,523 closed sales exceeded the previous record set in the spring of 2007, when 3,939 sales were recorded.

“It was really like a lightning bolt that just sort of hit and reverberated for quite a while,” said Jared Antin, director of sales of Elegran Real Estate, which ranked 17th with $95 million in volume across 62 Manhattan deals. “And it’s still happening now.”

The year couldn’t have been more different from 2020, when transactions were at a standstill and the Covid discount defined the year.

“Talk about an uncertain time for most people to make their biggest financial transaction ever,” said David Walker, co-founder and CEO of Triplemint, which closed $189 million in volume across 157 sales.

Sellers, eager to cash in on renewed demand, pumped the market with new listings at a rate far exceeding the previous ten-year average, according to a report by real estate data firm UrbanDigs, but buyers diminished that supply at an even faster clip, driving net new inventory — the number of monthly new listings, minus contracts signed and listings taken off-market — below zero for most of the year. In November, net new inventory was negative 861 units.

As inventory fell, demand remained. By October, Manhattan contract signings had already surpassed the previous annual record of 12,520 set in 2013, according to UrbanDigs. In mid-December, closings reached 14,774, more than double the total recorded in 2020.

As a result, brokers were forced to manage the expectations of eager sellers, especially those who read the headlines describing a hot market.

“There is an ongoing challenge always in persuading sellers that they don’t necessarily have the prettiest baby in the class,” said Frederick Peters, president of Coldwell Banker Warburg, which ranked sixth in Manhattan with $343 million in sales volume.

Triplemint’s Walker said sellers often base their decisions on national headlines, which can leave the perception that an apartment is worth more in the current market than it actually is.

“The biggest thing that we did to help our sellers really set themselves up for success was to bring it hyperlocal,” Walker said.

Working with buyers can also prove challenging, as prices go up and wary deal hunters are forced to decide how committed they truly are.

“Part of our job is therapy,” said Michele Kleier, president of Kleier Residential, which brokered $47 million worth of sales.

Elegran Real Estate’s Antin said he’s often forced to differentiate between “need-based” and “want-based” buyers.

The need-based cohort “require a little bit of a different advice in the negotiation, because they may have competing commitments or some other factors that are contributing to them wanting to buy or needing to buy today,” Antin said. “Want-based buyers, they may be aspirational, or they may be looking for a good deal or a good investment. And they may be a little bit more patient.”

Compass agent Stephen Ferrara said off-market transactions have become increasingly vital as inventory lags behind. His team alone orchestrated $300 million in off-market transactions last year, he said.

“It’s about having the relationships with both the buyers and the sellers. It’s also about having the relationships with other agents,” Ferrara said.

Corcoran did over $500 million in off-market deals, according to Liebman. Many clients did not initially want to list their properties, but were tempted to do so by the hot market.

“There was a lot of telephoning going on,” Liebman said.

One trend that emerged at the start of the pandemic carried on through the year. As remote work endured, buyers pushed for larger — and more luxurious — homes. In 2021, 1,877 contracts were signed in Manhattan for homes asking $4 million and above, according to a report by Olshan Realty, the highest total recorded in any year since the report began tracking luxury contracts in 2006. It was nearly triple the number of luxury contracts signed in 2020 and twice as many as in 2019.

Buyers also showed increased interest in townhouses, where residents don’t need to share common areas, amenities or elevators.

In 2021, 295 townhouses sold, up 159 percent from 2020 and almost 50 percent above pre-pandemic levels, according to a report by Douglas Elliman.

“The last 10 years of condo development has brought a lot more four- and five-bedroom homes to the marketplace. And that has certainly provided more competition [for townhouses],” Richard Pretsfelder, said senior partner at Leslie J. Garfield & Co., which specializes in townhouse sales. “But the pandemic has altered that trend.”

A changing landscape

Ryan Serhant spent 2021 amassing a brokerage army.

Since launching his eponymous brokerage in 2020, the former Nest Seekers agent and “Million Dollar Listing” star has grown it to 117 agents, with more planning on joining in the coming weeks, along with 50 full-time staff.

In January of this year alone, Serhant poached a top-producing broker, Tamir Shemesh, from Douglas Elliman as well as the Palanca and Bogard New York teams — both from Compass.

Agents who jumped to Serhant’s firm noted its use of video, social platforms and overall branding for its agents as a way to up their own media game.

“If you’re going to build a successful brokerage, how are you going to help your agents build their brands for 2030 and beyond?” Serhant said. “No brokerage could answer that question for me when I interviewed with all of them.”

“I blame every other brokerage for forcing me to start my own company,” he added.

In its first year on the ranking, Serhant came in at 11th, with $235 million in sell-side deals. But despite its early success in luring brokers from the major firms, it remains a relatively small fish in terms of headcount.

When it comes to the number of agents, Compass dominates Manhattan with 2,347 salespeople, according to a TRD analysis of New York state department data as of Dec. 15. Douglas Elliman trailed with 1,652 agents, followed by Corcoran with 1,508.

The sales rankings were rearranged by Coldwell Banker’s acquisition of Warburg Realty, marking the first time Coldwell Banker has had a company-owned presence in the city.

“There were too many ways in which I had begun to fear that I was going to remain provincial,” said Peters, who was CEO of Warburg before the sale. “And those fears were assailing me at a time when you just can’t afford to do that if you want to be competitive.”

The brokerage world was also rocked by some major IPOs.

In April, Compass began trading, with a valuation of $7 billion, slashed from its original target of $10 billion. Its initial public offering was one of the most closely watched in the real estate industry, with the firm billing itself as more of a tech company than a traditional brokerage.

In April, Compass began trading, with a valuation of $7 billion, slashed from its original target of $10 billion. Its initial public offering was one of the most closely watched in the real estate industry, with the firm billing itself as more of a tech company than a traditional brokerage.

Nationwide, Compass said it brokered a quarter of a trillion dollars’ worth of transactions last year, a 68 percent increase over 2020. But after reporting a net loss of nearly $500 million last year, its shares were trading below $8 as of late February, down from its debut above $20 in April 2021.

Elliman also went public in December, splitting from parent company Vector Group. Its stock debuted at $10 on Dec. 30 and climbed as high as $10.64 in mid-January before dipping below $8 in recent weeks. It closed at $7.25 on Feb. 25. Scott Durkin was promoted to chief executive officer in August, succeeding longtime CEO Dottie Herman in the leadup to the spinoff.

Other major brokerages had internal shuffles. Diane Ramirez, who became executive chair of Brown Harris Stevens when it merged with her Halstead Property 2020, left BHS and joined Berkshire Hathaway HomeServices in August. A month later, Richard Grossman, the brokerage’s New York regional president, stepped down to lead the East Coast expansion of San Francisco–based Avenue 8.

Further change occurred in the political landscape which could help the city, and, in turn, the brokerage business. Kathy Hochul was sworn in as New York’s first female governor, replacing former Gov. Andrew Cuomo, in August. Eric Adams was elected mayor, succeeding Bill de Blasio. Not only have the two been amicable toward each other so far, a departure from their predecessors, both were heavily backed by real estate donors.

“I can’t emphasize enough how important it is that we have a governor and mayor that want to work together and make the place better,” said Bess Freedman, CEO of Brown Harris Stevens.

Punching up

The ranking has generally been dominated by the same big names, but several smaller players made a name for themselves last year.

High-end specialist Modlin Group jumped from 15th place in 2020 to eighth in 2021, with $295 million in volume across just 37 sell-side deals. President and co-founder Adam Modlin said the last two years have been the best in the firm’s two-decade history.

“Ironically, at the time of the pandemic, our client-base saw its greatest creation of wealth in the last two years,” he said. “Ultra-high-net-worth clients relate to a family-office style practice.”

The firm’s relatively low profile helps give it an edge on controversial or sensitive listings. Modlin’s largest deal of the year was for the Upper East Side townhouse previously owned by late financier and convicted sex offender Jeffrey Epstein, which sold for $51 million in March.

“The challenges were twofold: One was history of ownership, and the other was Covid,” Modlin said. “And it required a buyer that could get comfortable with both of those challenges.”

For some brokerages, it’s a matter of finding the right niche, such as Leslie J. Garfield’s specialty in townhouse sales or Elegran’s focus on the buy side.

“In earlier years, we were having to make that case that we’re the little guy, we’re a boutique,” Pretsfelder said. “But now, we’re really not having that conversation very much anymore, because we do so many townhouse sales and we have such a large percentage of market share that we’re big players.”

Despite the hustle of the market, there’s still one buyer largely missing: the foreign one.

Foreign purchases of U.S. homes plummeted from April 2020 to March 2021, according to the National Association of Realtors, down 27 percent to $54.4 billion.

In November, restrictions were lifted on travel from 33 countries, including some in the European Union as well as the United Kingdom, China, Canada, Mexico, Brazil and India. Still, international buyers mostly have yet to flood back into the New York market, but agents say their absence is only temporary.

“The international buyer has been a fixture in New York,” said Marissa Ghesquiere, a sales executive at Sotheby’s International Realty who leads the firm’s East Side brokerage.

Some international buyers were able to remain in the market thanks to video tours, which gained prominence in 2020 and were not abandoned in 2021.

“You don’t need to go physically stomp around 50 apartments,” Triplemint’s Walker said.

Though brokerages have high hopes for the next year, tightened inventory has already started to result in bidding wars and rising prices — a trend already seen in other markets, like the Hamptons and Miami.

“At some point New York City will start to see a bit of a slowdown,” Freedman said. “It can’t be champagne and caviar forever.”

—Kathryn Brenzel contributed reporting.