Israeli auto magnate Yoav Harlap notched a victory last April when a judge ruled his company could go after former HFZ Capital Group principal Nir Meir for $19 million on a delinquent loan.

But nearly a year later, Harlap’s company says Meir has not paid a dime of that judgment, instead racking up lavish personal expenditures and concealing funds in a game of “catch me if you can.”

Harlap’s YH Lex Estates claims that Meir hid his assets in shell companies while living with his wife in a $150,000 a month rental in Miami Beach, splurging on fine wine and chartering private jets and yachts.

Meir’s attorney, Larry Hutcher of Davidoff Hutcher & Citron, disputes that.

“We challenge these allegations and continue to deny them and ultimately they will be resolved in a courtroom,” said Hutcher.

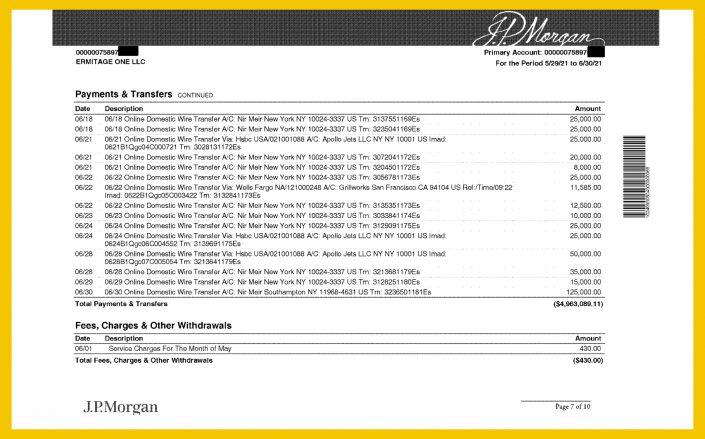

But statements for a JPMorgan Chase checking account of Ermitage One, a company managed by Meir and owned by his wife, Ranee Bartolacci, show the couple has been living large despite lawsuits from investors, allegations of fraud by Meir’s former partner and the collapse of his former firm, HFZ.

The bank statements, in court filings by Harlap’s attorney, show that between April and October 2021, Ermitage One spent hundreds of thousands of dollars on Apollo Jets and Apollo Yachts, and over $1.5 million on gold bullions and coins. Other expenses include $77,225 at high-end Miami furniture store Minotti.

The statements also show $250,000 transferred to white-shoe law firm Quinn Emanuel and $261,000 wired to a Qatari national, Ahmad Yousuf Kamal.

Meir’s legal team said the money was Meir’s wife’s and the spending does not indicate wrongdoing.

“Nir had a healthy lifestyle when he was at HFZ, nothing to apologize for,” said Hutcher, Meir’s attorney. “He was doing well, and his wife has elected to continue to live a lifestyle.”

She contends the money is hers to spend as she wants, according to Hutcher, who accused The Real Deal of reporting on the allegations “to benefit a creditor.”

“You should be careful as to what you report,” he warned.

Harlap’s attorney, Mark Hatch-Miller of Susman Godfrey, declined to comment, but his court filings disputed Meir’s arguments.

“YH reasonably infers that Ermitage was created to serve as the primary pipeline for the concealment and use of the fraudulently transferred funds,” Hatch-Miller wrote.

Hatch-Miller claims that the money actually came from the $43 million sale of Meir’s Hamptons mansion to New England Patriots owner Robert Kraft last year and was to pay the judgment but was diverted to Meir’s wife and her business.

The case became more convoluted when Meir’s attorneys argued that Bartolacci, not Meir, owned the company that controlled the house. They had previously claimed that Meir was the owner.

In February, YH Lex Estates filed a separate lawsuit against Meir, Bartolacci and Ermitage One seeking to take over a fleet of luxury vehicles that Harlap alleges is Meir’s.

The lender’s suit claims Ermitage transferred at least $3.7 million back to Meir after April 2021 and that some money has gone to Applied Bank, Delaware institution that offers asset protection.

Meir and Bartolacci attempted to secretly auction their luxury cars through eBay and car brokers in New Jersey and California to “dissipate their assets,” the lawsuit charges. The vehicles include a 2010 convertible Aston Martin, a 2001 Mercedes-Benz G500 Cabriolet, a 2018 Porsche GT2, a 2019 Porsche 911 and a 2021 Mercedes-Benz GLS63 AMG.

Meir’s lawyers deny the allegations. Meir claimed in an affidavit that many of the cars were owned by Bartolacci or Ermitage.

Harlap may have other opportunities to recoup what YH Lex Estates is owed. A New York appellate court recently granted it a summary judgment of more than $18 million against HFZ and its principal, Ziel Feldman — Meir’s former business partner. The ruling allows YH Lex Estates to go after both Feldman and HFZ for the judgment, in addition to Meir.

HFZ Capital was once among the most active luxury condo developers in New York, backed in part by Beny Steinmetz, an Israeli diamond magnate who was recently convicted of bribery in Romania and Switzerland.

As HFZ became besieged by creditors, Meir left the firm in December 2020. At the time, his spokesperson, Matthew Hiltzik, said Meir was stepping down from running the HFZ’s day-to-day operations but “remained a vested partner.” However, Meir swore in an affidavit submitted this week that he was terminated without warning by HFZ.