Regulators are once again gearing up to overhaul bank lending to lower-income communities.

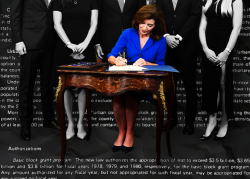

The Biden administration announced a proposal to modernize the 1977 Community Reinvestment Act on Thursday, the Wall Street Journal reported. The proposal aims to update rules around lending to recognize how online financial services have changed banking.

The current set of rules are centered on banking through brick-and-mortar locations. The overhaul would look more closely at CRA obligations in areas where banks make 100 mortgage loans or 250 small business loans over a two-year period, even if there’s no physical branch.

“Today’s proposal seeks to expand access to credit, investment, and banking services in [low- and middle-income] communities,” said incoming Federal Reserve Vice Chairwoman Lael Brainard in a prepared statement.

The proposal is supported by the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. A public comment period will be in place through early August before the final rules are written; the approval of Congress is not needed unless nonbank lenders are covered by the changes.

The CRA was created to encourage banks to provide loans in low- and moderate-income communities, where homeowners had been subjected to redlining. Lenders would draw a “red line” around neighborhoods deemed too risky for federal mortgage loans based on demographics. This typically forced Black homeowners to seek more expensive loans.

Read more

Banks have become frustrated with the rule, however, because it failed to account for the uptick in online services. A poor CRA rating can stop a bank from opening new branches or completing a merger.

In 2020, the Federal Reserve proposed modernizing and strengthening the act along the same lines being proposed by the Biden administration. The plan came after the OCC released its own overhaul of the legislation.

Ultimately, the current administration scrapped the Trump-era overhaul, which divided regulators and had some fearing unintended consequences that could lessen lower-income lending activities.

[WSJ] — Holden Walter-Warner