The multifamily market is slowing, but private equity’s love affair with the properties is moving right along.

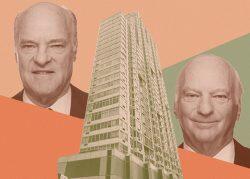

KKR and Co. smashed the multifamily sales price record in Philadelphia with its purchase of the Philadelphia City complex for $357 million, the Wall Street Journal reported. The firm partnered with Mack Real Estate Group on the acquisition from Post Brothers.

The housing complex consists of four 12-story buildings, named for the first four United States presidents. The buildings were constructed in the 1950s and sold to Post Brothers in 2012. The landlord renovated the buildings in 2017 and added outdoor swimming pools and a separate amenities building.

Rents for a one-bedroom unit start at $1,800, significantly cheaper than rents at a high-end building closer to the city center. There are 251 units across the complex.

Billy Butcher, KKR’s chief operating officer, noted to the outlet that the deal was only possible because it assumed the fixed-rate mortgage Post Brothers received at a time of lower interest rates.

KKR may have put the multifamily record out of reach in Philadelphia for the time being, surpassing the previous mark by more than $100 million.

Read more

The deal comes as the multifamily market shows signs of slowing down from a surge in the pandemic’s early years. Affordability concerns are easing rents from recent peaks. Rising interest rates and recession fears tanking demand from investors.

The third quarter saw $74 billion in multifamily market sales, according to MSCI Real Assets, down 17 percent year over year.

But private equity doesn’t seem ready to wave the white flag on the multifamily market quite yet. KKR, particularly, has been on a quest to double its massive real estate portfolio by honing in on markets and sectors poised for a rebound.

In July, KKR teamed with Dalan Management to purchase a 365-unit rental tower at 80 DeKalb Avenue in Brooklyn for $190 million, taking the building off Brookfield Properties’ hands. The KKR Real Estate Select Trust was utilized for that purchase, just as it was for the recent Philadelphia deal.

KKR launched the fund in May 2021, allowing investors to get in on “income-generating commercial real estate,” plus private real estate debt. The fund has 19 percent of its equity in residential properties.

— Holden Walter-Warner