Barnes & Noble is planning to add a net of 30 stores to its portfolio next year.

The big-box bookseller is set to open more stores than it’s closing, the Wall Street Journal reported. The expansion plans put Barnes & Noble alongside Burlington, Ross Stores and TJX Companies, all of which are planning to increase their retail footprints.

Retail leases for at least 20,000 square feet are on pace to hit 60 million square feet this year, according to CoStar, though that remains well below pre-pandemic levels.

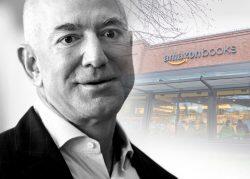

The previous economic crisis and rising competition from e-commerce behemoth Amazon left Barnes & Noble reeling in recent years. The company peaked with 726 locations in 2008, but is down to roughly 600 locations now, including roughly 20 net stores it closed since the onset of the pandemic.

One of the more high-profile closures for the company came in Manhattan’s Upper East Side. After 12 years at 150 East 86th Street, Barnes & Noble closed its 50,000-square-foot location, giving way to a Target.

But the company said it planned to find another location in the area and it has done so, very close by. Barnes & Noble signed a 7,000-square-foot lease a block away from the shuttered location, part of an effort to eschew the operation of solely large stores, instead trying to pick locations and sizes based on demand and cost.

Read more

Barnes & Noble’s expansion marks a leg up in its race against Amazon. Two of its new Boston-area stores replaced locations formerly belonging to Amazon Books. The e-commerce giant decided this year to close all of its brick-and-mortar bookstores, an about-face for a company that prompted the end of Borders, as well as smaller booksellers.

Available retail real estate is at a premium. In the third quarter, retail availability across the country dropped to 5 percent, according to CBRE, the lowest level of availability since it began tracking 17 years ago.

— Holden Walter-Warner