David was hot on Goliath’s heels in 2022.

Despite a downswing in the market, several boutique and startup New York City residential brokerages outpaced growth at the city’s larger firms last year, according to Corofy’s annual brokerage report.

“A lot of these boutique brokerages have a set of clients, a regular clientele, so they felt a little bit less affected by the lower transaction volume that was impacting all the major players,” said Corofy CEO Eddy Boccara. “The question for the past three years was: Is there room for boutique firms to exist?”

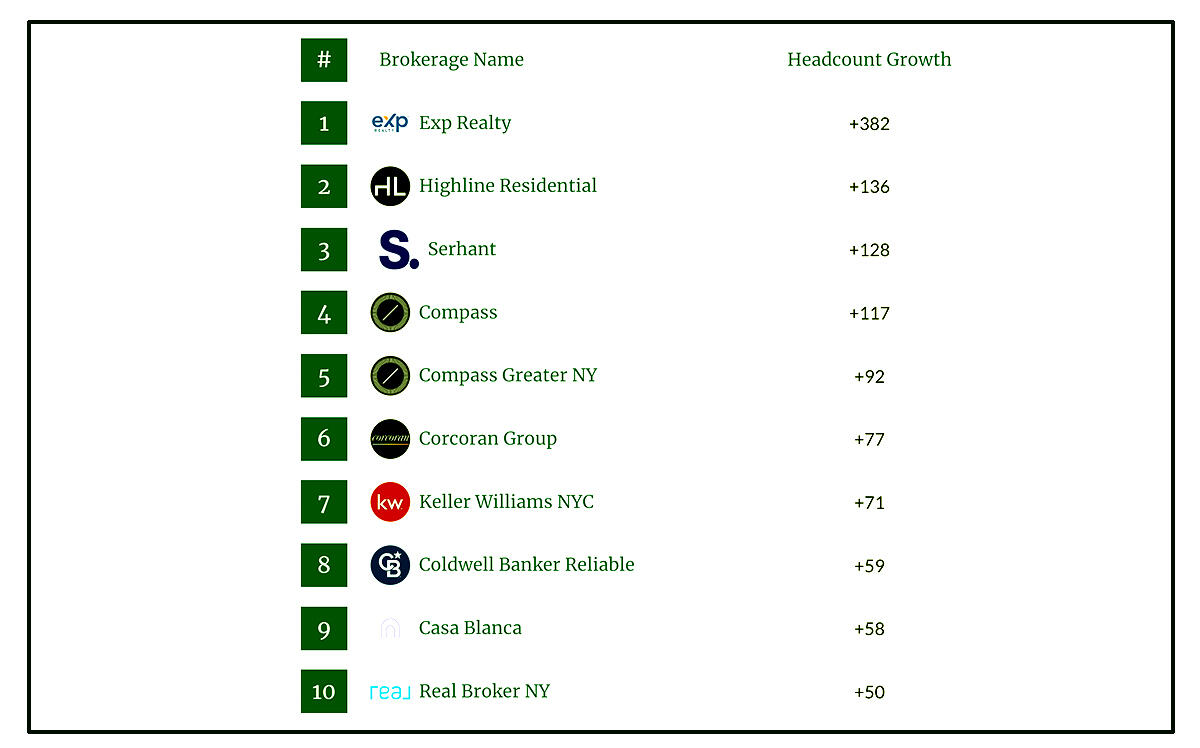

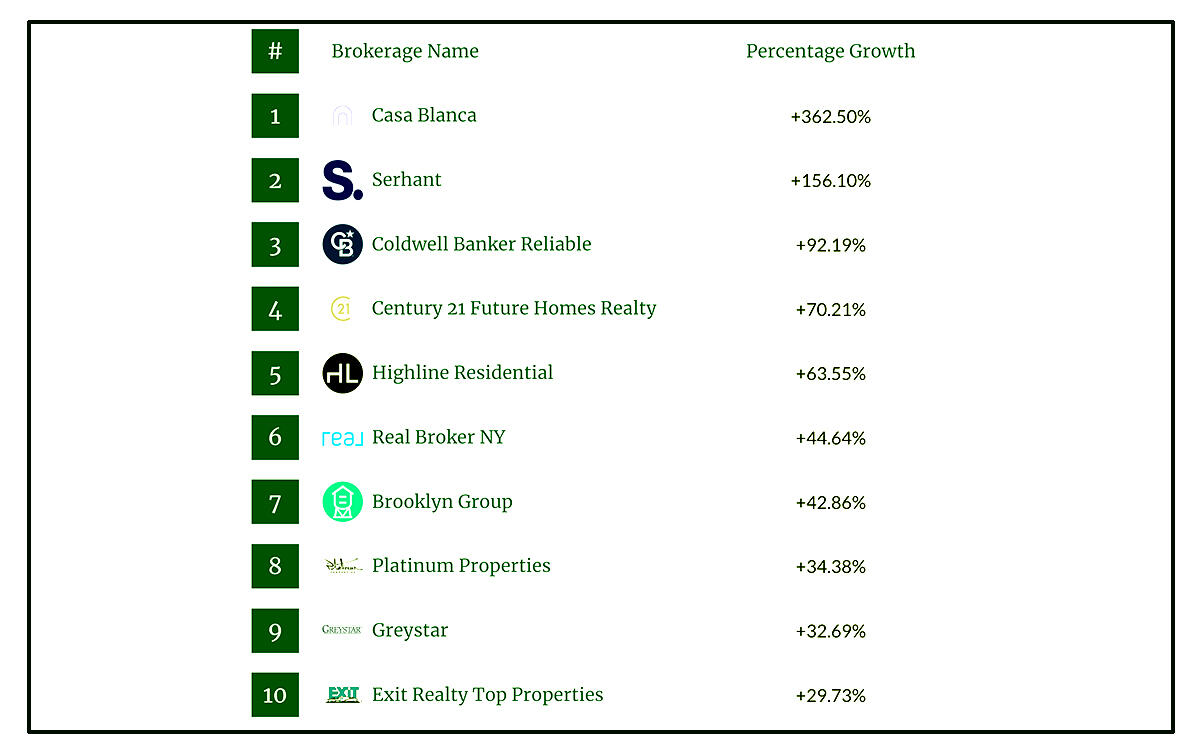

Casa Blanca, which bills itself as a “mobile-first” brokerage, grew its headcount by 360 percent, though the startup did so by adding just 58 brokers, placing it in ninth place in terms of new members.

Serhant had the second fastest growth rate and added the third most brokers, according to Corofy. The two-year-old brokerage was the top-growing firm among the industry’s big names, more than doubling its headcount by adding 128 brokers.

(Corofy)

Founder Ryan Serhant said it’s evidence that his firm’s brand-centric approach is resonating with brokers, he said the company has no growth teams or recruiters.

“I haven’t even started focusing on growth, to be honest,” he said.

Two boutique firms, Brooklyn Group and Platinum Properties, made their debut in the top 10 with 42 percent and 34 percent headcount growth for seventh and eighth place, respectively.

(Corofy)

Read more

Highline Residential had a banner recruitment year no matter how you slice it: It added 136 brokers and had the fifth best growth rate. The only NYC brokerage to add more agents last year was eXp, which brought in 382.

“Our recruiting process is simple, we show agents our technology and let them decide if they want to continue the conversation,” Highline President Bilal Khan said. “Experienced agents are offered a mentorship role, and the ability to mentor inexperienced agents for a percentage of their earnings.”

(Corofy)

The city’s top major players, Douglas Elliman, Compass, and Corcoran remained in the top three spots in terms of agent count. Compass finished fourth in terms of headcount growth, with 117 added agents, and Compass Greater NY fifth, with 92. The brokerage saw its growth rate drop to just over 4 percent, down from 9 percent in 2021 and 24 percent in 2020.

The Agency made its debut in New York City rankings at 17 after acquiring Triplemint in May 2022.

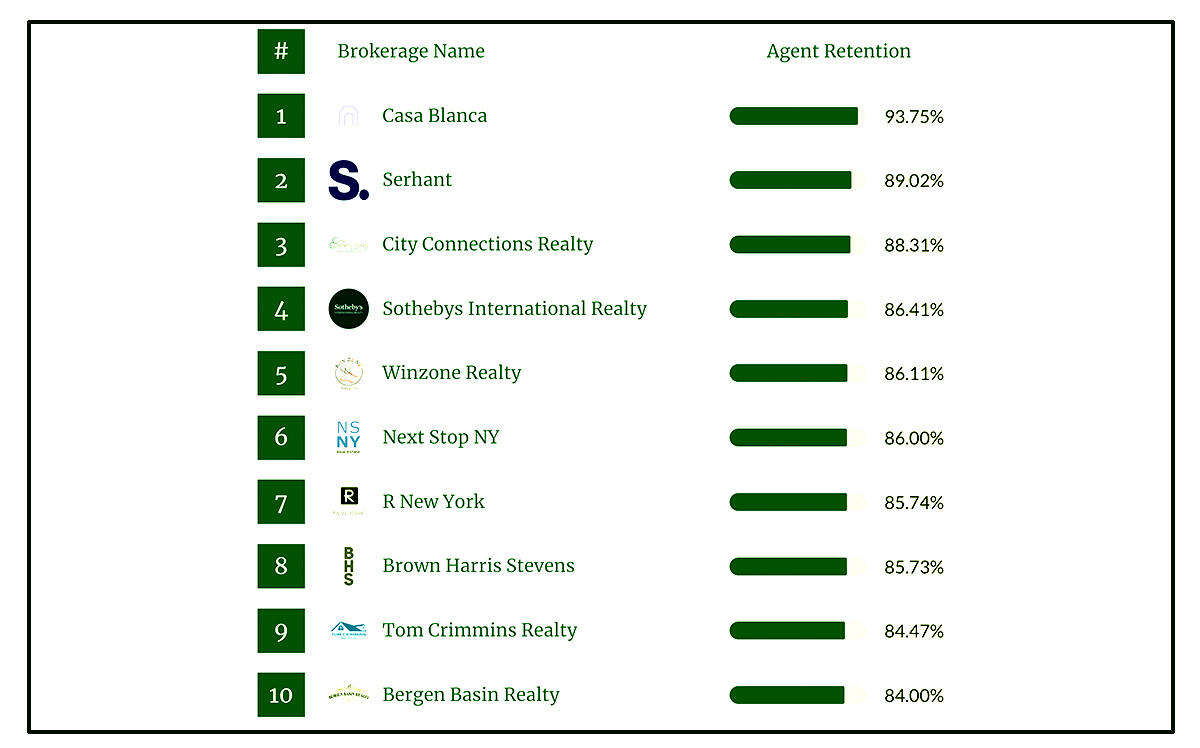

Casa Blanca scored the top spot for retention at over 93 percent, followed by Serhant in second place at 89 percent.

Looking ahead to the rest of 2023, Boccara said he expects boutique brokerages to keep pulling brokers from major players.

“I think we’re gonna see them gaining more and more market share,” he said. “A smaller environment helps agents be a big fish in a small pond.”