Borrowers “handing back the keys” to commercial properties is not a new occurrence in real estate, but it is something the industry could see a lot more of this year.

With mortgages maturing into an inhospitable refinancing environment — or properties that are underwater on their loans — many owners are coming to the cold, hard conclusion that the rational thing to do is hand a property over to their lender. (Or, at least, to threaten to do so to gain leverage in negotiating a loan modification.)

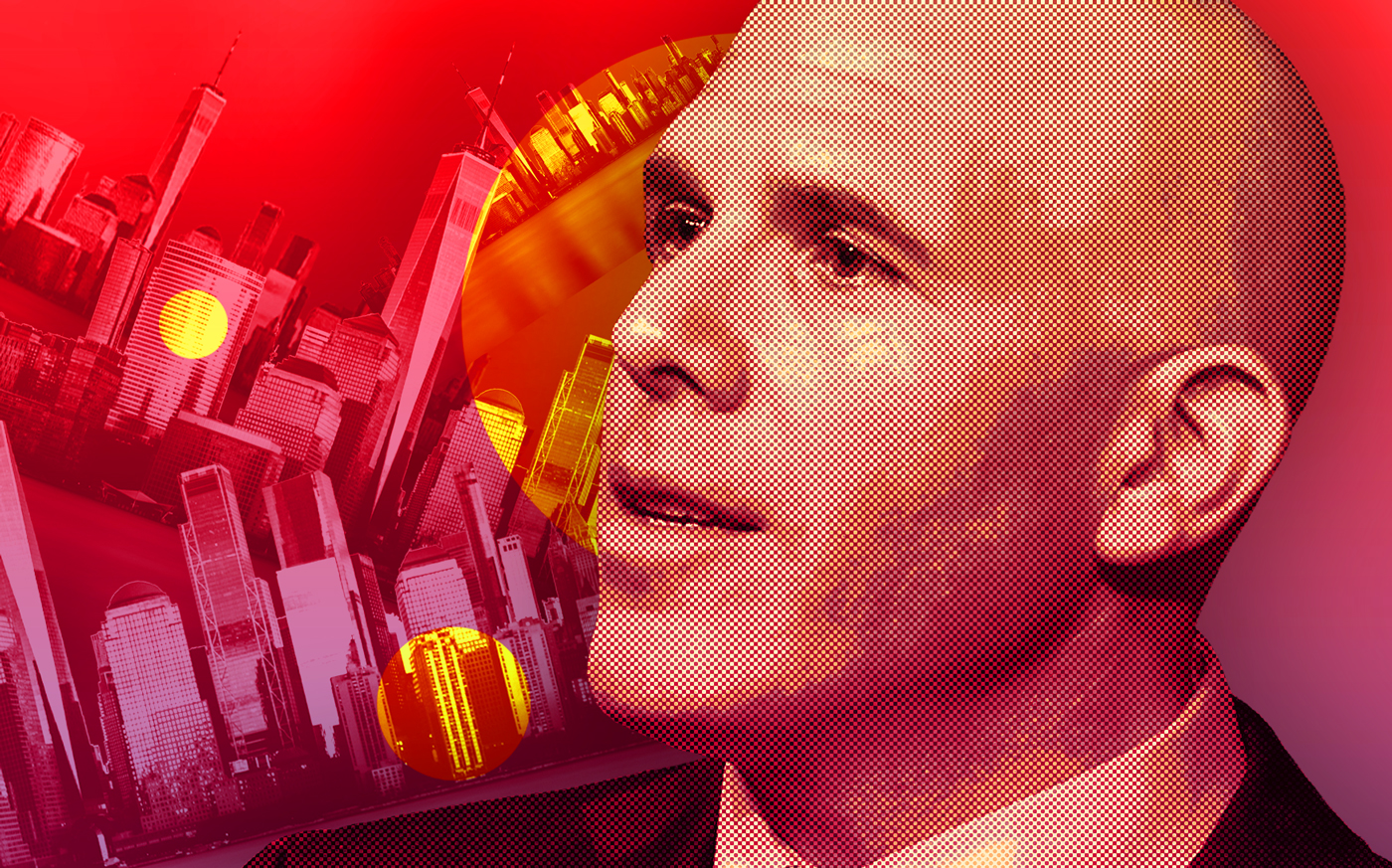

This month alone, RXR’s Scott Rechler confirmed that his company is considering handing two outdated office buildings “back to the bank,” halting debt payments and relinquishing control of the properties. Related Companies and BentallGreenOak have agreed, sources say, to surrender a mostly empty office campus in Long Island City to whoever buys the debt on the buildings.

And there’s a possibility that Vornado Realty Trust could walk away from a prominent retail strip along Fifth Avenue after executives revealed Tuesday that the REIT defaulted on a $450 million non-recourse loan.

Kramer Levin’s Jay Neveloff said that when the time comes for an owner to walk away, both sides have an interest in a clean break.

“The lender is motivated by speed. It gets the asset faster and gets rid of the borrower faster so it can assign the deed or flip the property to a third party,” he said. “For the borrower, the pain stops.”

But how exactly does an owner walk away from a property?

There are two main options, according to experts in the space: a deed-in-lieu of foreclosure or a friendly/uncontested foreclosure.

The first is exactly what it sounds like. An owner will transfer the title on their property without the lender needing to file a foreclosure action. In return, the borrower will want a release from things like a payment or completion guarantee, and a commitment from the lender not to pursue legal action to enforce the loan in the future.

But it’s not so straightforward. Many pieces of the agreement need to be negotiated, such as who pays some of the costs.

“The biggest consideration is going to be the transfer tax,” said Michael Lefkowitz at Rosenberg & Estis. “Who’s going to pay that? Is it the borrower who’s saying the property’s not worth it to me anymore? Is the lender going to go after the borrower to get it recouped?”

Another thing for a property owner to think about is tax consequences. A deed-in-lieu can be considered a release of debt, which will require them to recognize a discounted payoff or cancellation of debt on their books.

One of the main features of going this route is that the capital stack remains largely the same. That’s where a friendly or uncontested foreclosure differs. In this case — like in any foreclosure — any other claims, such as mezzanine debt or mechanics liens, get wiped out.

“You’re able to clean up the title through a foreclosure,” Lefkowitz said.

In an uncontested foreclosure, the borrower may simply not put up a defense. In the friendly case, the borrower can work with the lender to ease the process.

Neveloff said there are degrees to this cooperation.

“There’s friendly… and then there’s friendly,” he said.

Conventional foreclosures are notoriously time consuming, particularly in a state like New York where they can drag on for years. And while a friendly foreclosure moves more quickly, it is still a court action. That means it takes time and attorneys’ fees.

Whether a friendly foreclosure or a deed-in-lieu, borrowers are usually mindful of the fact that the way they handle the process will likely come up in the future.

“Part of the origination process on a new loan is the lender asking, ‘Have you ever given the keys back on a prior loan?” said Richard Fischel of Brighton Capital Advisors. “The smart people will disclose this, because ultimately the lender is going to find out and you’re going to have a lot to explain why you didn’t disclose it.”

Read more