An unscripted Harry Macklowe took to the microphone at 1 Wall Street on Thursday at an event to celebrate the completion of the giant condo conversion, where the first closings are expected in early March.

“I guess I’m the cheerleader, the director,” said the high-profile developer, dressed as if on his way to a gallery opening, with pink socks popping from his soft noir outfit. “But I’m just at the head of the iceberg, and there’s an awful lot that makes it float.”

But keeping the ambitious project afloat has been a struggle for the developer, now in his mid-80s.

It has been nine and a half years since Macklowe bought the Art Deco tower across the street from the New York Stock Exchange building. At least five years after contract signings began, not a single deal has closed. And construction is not quite done.

A little more than a year ago, Macklowe replaced Core Real Estate with Compass as the brokerage responsible for selling the building’s 566 units. Last year, Macklowe tried unsuccessfully to get a $1.1 billion refinancing.

The clock is ticking on a $750 million, five-year loan issued by Deutsche Bank in late 2018. Macklowe and his Qatari backer, Sheikh Hamad Bin Jassim Bin Jaber al-Thani or HBJ for short, had tried heading off that deadline last year by seeking the refinancing, which Bloomberg reported would represent 48 percent of the project’s $2.3 billion cost.

Documents show a sellout price for the condo of only $1.7 billion, but that excludes some of the most expensive units, such as its penthouse, as well as its retail portion.

As the largest pre-pandemic office-to-residential conversion, 1 Wall Street epitomizes the challenges facing such projects, which politicians have pitched as an all-in-one solution to the city’s housing shortage, affordability problem and office glut.

In a handwritten note from 2014, Macklowe jotted down how 1 Wall Street would pencil out: Buy the property for $500 per square foot or less, invest an equal amount, and sell apartments on the top 15 or 20 floors of the north tower for $3,000 to $4,000 per square foot.

Six months later, he paid $850 per sellable square foot for the office building, according to public financial documents. Converting it also cost far more than his initial projection, in part because of the pandemic. And delays allowed early buyers to get out of their contracts, undoing some of Macklowe’s success marketing units during a trip to Hong Kong in 2018.

Unlike at 432 Park Avenue, where Macklowe appealed to the ultra-rich seeking pieds-à-terre on Billionaires’ Row, 1 Wall Street calls to the merely wealthy who might plunk down seven figures for a Financial District apartment. “I’m long on New York,” Macklowe said Thursday.

To be sure, 1 Wall Street does not skimp on luxury and workmanship. Macklowe has built modern, clean-lined apartments with subtly preserved Art Deco qualities, including stepped moldings and chevron wood flooring. A lobby known as the Red Room preserves the property’s authenticity.

On the 39th floor, a restaurant for residents (decorated with knock-off David Hockney paintings) is to offer three meals a day, with a terrace that juts out into the Downtown skyline. Other amenities include a co-working space, a 75-foot pool, an expansive club where residents can grab a workout or a haircut, a Whole Foods on the ground floor and, sometime next year, the French department store Printemps.

A three-bed, two-bath unit that Macklowe himself staged with a baby grand piano and a Kritios Boy sculpture is listed at $9.75 million, or $3,280 per square foot. The priciest unit in the building’s offering plan clocks in at $12.75 million or $3,500 for each of its 3,640 square feet and 1,400 square feet of terrace.

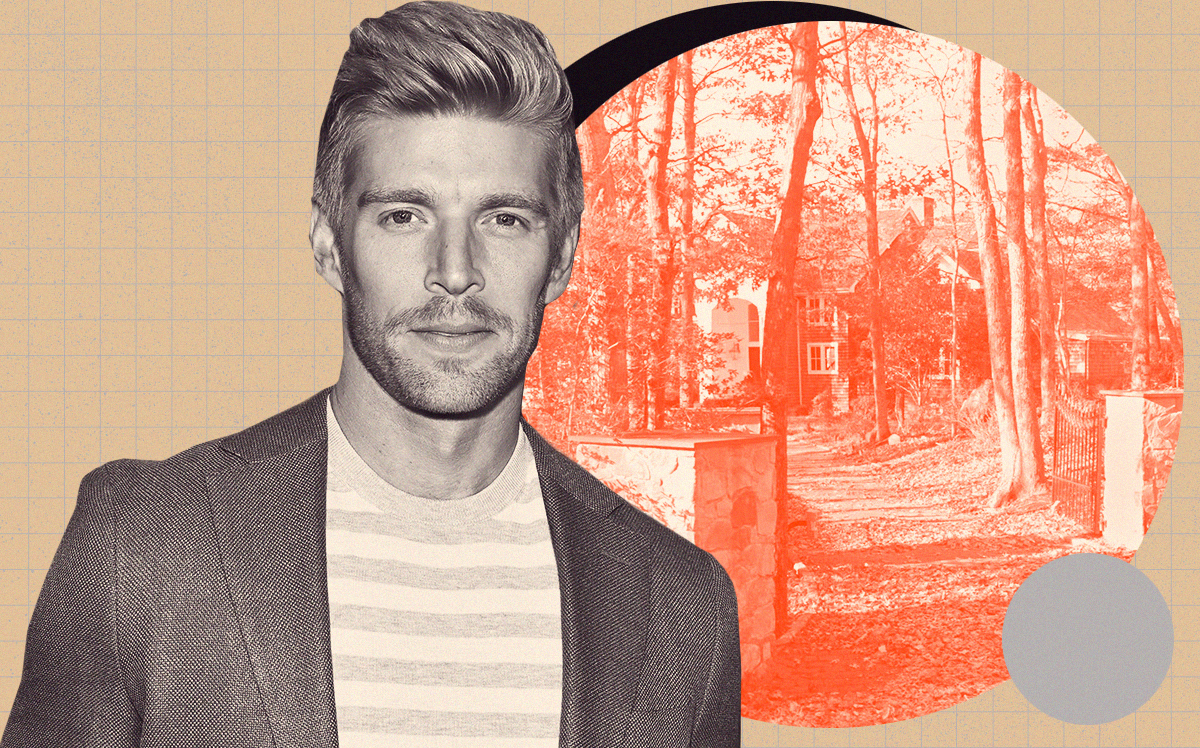

The sales director, Kirk Rundhaug of Compass, said he expects the 13,000-square-foot penthouse apartment to list for about $80 million.

The most expensive unit in contract has three bedrooms and two-and-a-half bathrooms at $2,490 per square foot, according to StreetEasy. The least expensive unit waiting to close, a 500-square-foot studio, was listed at just under $1 million.

Half the building’s units are ready to list, Macklowe said, while the remainder are nearly ready, with contractors working through a punch list of finishing touches. The timing — always a roll of the dice for condominium developers — is less than ideal, as the market has softened in response to rising borrowing costs and recession fears.

The impending closings at 1 Wall Street signal that at least 15 percent of units are in contract, meaning the condo has been declared “effective” and can close deals. The provision protects buyers in speculative projects.

If 1 Wall Street has been wearing down the octogenarian developer, Macklowe, famous for his vision and risk-taking, showed no signs of it at Thursday’s event. Asked whether he was considering more office-to-residential conversions, Macklowe said yes. Then his phone rang, and off he went.

Read more