The failure of Silicon Valley and Signature banks have set off some nerves across New York City.

Though the concerns of Manhattanites may pale in comparison to those in the Bay Area, news of the banks’ implosions has taken up residence in the minds of brokers, buyers and sellers in the Big Apple.

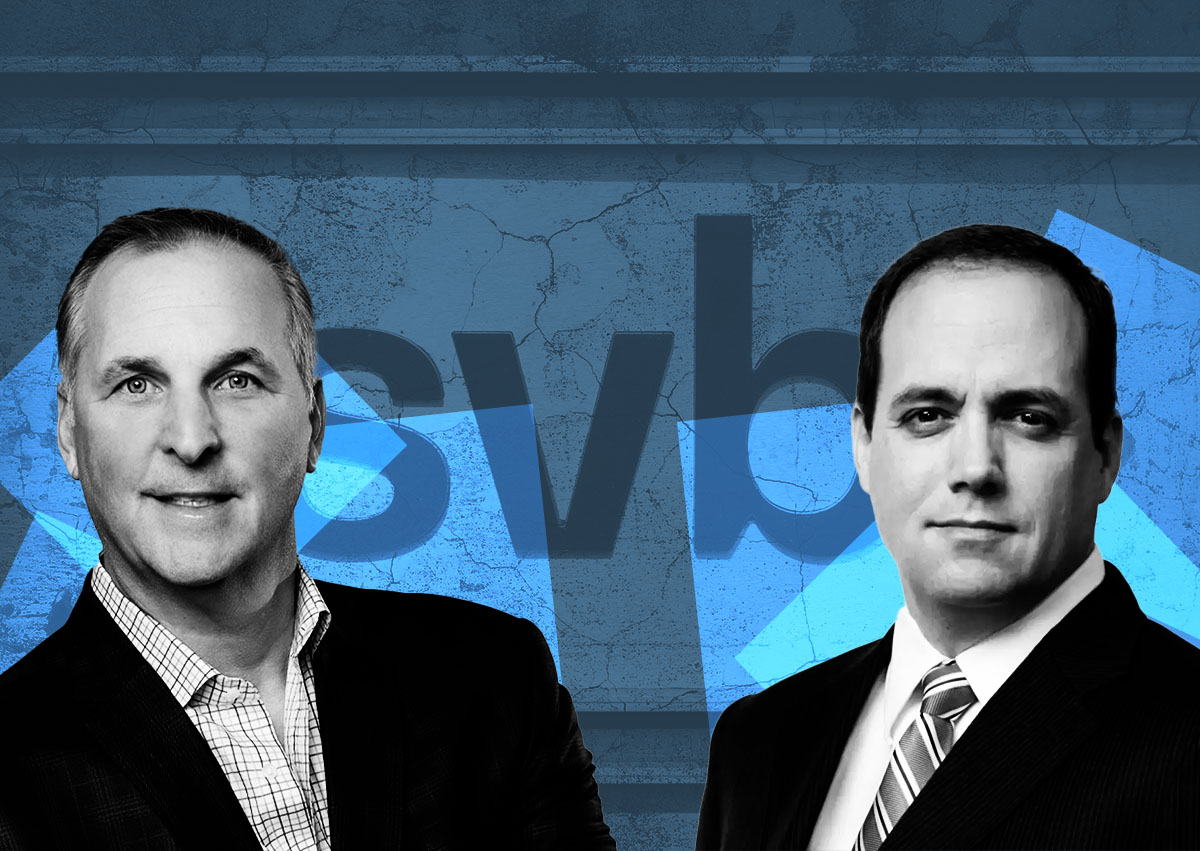

Brown Harris Stevens organized a companywide call Tuesday to break down the news for brokers with their chief economist Greg Heym and Compass broker Pamela D’Arc said her sellers are wondering if buyers will back out of deals.

Some opportunistic buyers are using the concern of a potential wider economic worries to haggle with sellers, D’Arc said, pointing to a recent listing that got an offer 15 percent below the ask.

“When a buyer is putting together an offer they commonly use whatever negative aspect is going on to support their pricing,” she said. “From time immemorial that’s what people do.”

Regulators shut down Silicon Valley Bank last week, sending shockwaves through the technology and banking sectors. Signature Bank followed suit two days later, with regulators closing the bank and assigning the Federal Deposit Insurance Corporation as receiver on Sunday.

Signature Bank is a top multifamily lender in New York, but the residential sector only accounted for 1.1 percent of its loans last year, according to SEC filings.

“So far nobody’s account has been compromised in any way and people feel it is being well-handled,” she said. “Their funds are safe and everybody will be made whole.”

The Federal Reserve reassured those affected it would back all affected deposits, but there’s been concern that Signature and SVB’s failures may cause a run on other regional banks, which in turn could lead to a wider economic consequences.

Those concerns caused shares in Credit Suisse and San Francisco-based First Republic to plummet before rebounding in the middle of the week. The S&P cut First Republic’s stock to junk following concerns of clients pulling deposits from the California bank.

“As far as we know, so far it’s an isolated incident with two poorly run banks that made bad decisions,” said Heym. “They didn’t address their risk issues and we’ll have to see if other banks fall into the same pattern.”

The uncertainty around the failures caused mortgage rates to tick down in the days following as investors sought stability in government bonds — an unexpected development after Fed Chair Jerome Powell said more aggressive rate hikes might be on the way as the agency looks to combat inflation.

Read more

The Fed’s reaction — namely whether it decides to continue increasing rates — will likely have a much broader economic impact than the closures themselves, said Melissa Cohn, a senior executive at William Raveis Mortgage.

If the economic repercussions end up being on the lighter side, the situation could be a boon to the market, said Compass broker Eugene Litvak.

“Every time everyone prepares for a doomsday and it doesn’t happen, there’s a huge bounce back,” he said.