Since last August, New York Life Insurance Company has been trying to foreclose on a Fifth Avenue retail space owned by Jeff Sutton and SL Green Realty.

Now Sutton’s fighting back.

In new court filings, the retail titan blames New York Life for killing a deal to refinance a $300 million loan on 717 Fifth Avenue, where Dolce & Gabbana and Armani are tenants. Sutton claims he reached an agreement last year that would allow a pair of British billionaires to acquire the debt, but New York Life sought to impose a hefty fee that caused the deal to collapse.

Sutton’s allegations shed new light on the restructuring talks over the debt secured by one of Manhattan’s most valuable retail properties.

New York Life and TIAA provided Sutton’s Wharton Properties and SL Green with a $300 million loan on the property, in two $150 million pieces, back in 2012. The owners also took on a $355 million mezzanine loan, according to an SEC filing.

Several years later, in 2021, New York Life purchased TIAA’s portion of the debt. Sutton claims that he initially tried to work with New York Life to extend the senior loan, but to no avail. That was when he turned to Reuben Brothers, a private equity firm led by British billionaires Simon and David Reuben, who were aggressively buying up commercial real estate assets and debt across New York City, Miami and Los Angeles.

Sutton claims that on July 27 of last year, he struck a tentative deal with Reuben Brothers to provide a replacement mortgage. The only problem: According to Sutton, New York Life wanted to tack on a $15 million late fee.

“I was surprised by plaintiff’s demand,” Sutton said in a court filing.

By Sutton’s account, the fee didn’t align with a provision in the loan documents regarding the defrayed costs of handling a delinquent loan.

Sutton said the fee imposed by New York Life was particularly alarming because the lender was already charging default interest of 8.45 percent, or $70,000 a day, which should have covered its costs.

Sutton claims he reached out to New York Life for a payoff letter, but the lender did not provide one for five days, resulting in an additional $350,000 in default interest. When the lender finally provided the letter on Aug. 5, it included a late payment of $10 million, plus default interest of $1.8 million.

Sutton objected to the late fee, which he claimed was excessive and disproportionate to any actual damages.

On Aug. 23, Reuben Brothers confirmed their commitment to take on the loan, but only on the condition that there would be no penalty charge or exit fee, according to Sutton.

Sutton claims that on a Zoom call the following day, he advised New York Life about Reuben Brothers’ conditions, but the lender refused to withdraw its demand for a $10 million late fee. That same day, Sutton said, he learned that New York Life had commenced a foreclosure action on the property.

New York Life has yet to respond to Sutton’s allegations in court.

Sutton, along with partners including late retail magnate Stanley Chera, bought the retail space in the 26-story office building in 2004. Two years later, Sutton bought out his partners and SL Green took a stake in the property. Sutton acquired most of SL Green’s stake in 2012, leaving the firm with 10.92 percent, according to SEC filings.

Anbang bought the office portion of the tower — known as the Glass Corning Building — from Blackstone in 2015.

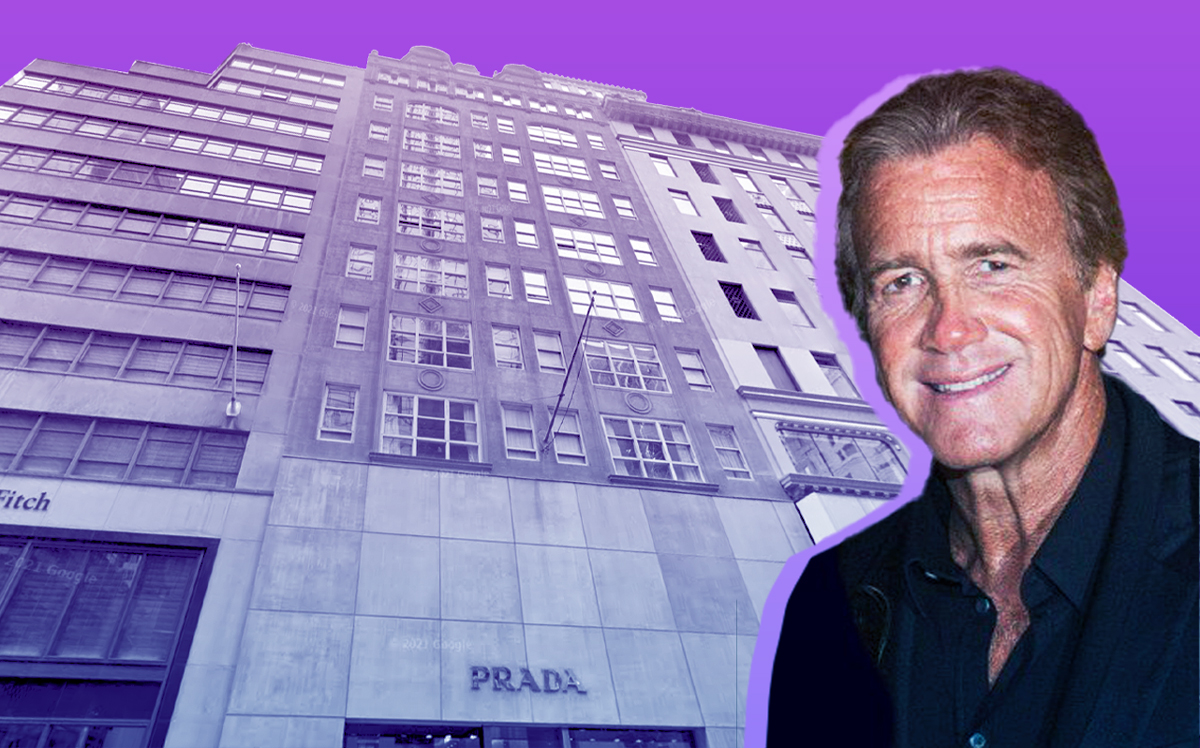

Sutton is one of the city’s largest retail landlords. His Wharton Properties portfolio includes several other prime Fifth Avenue retail assets, including 724 Fifth Avenue, which houses Prada’s flagship store.

Neither Sutton nor his attorney returned a request for comment. An attorney for New York Life Insurance also did not return a request for comment.

Read more