The commercial real estate world has been obsessed with a scary number: $1.5 trillion.

That’s the estimated size of the so-called “wall of maturities,” the amount of commercial debt coming due in the next three years. But what does that number actually mean for landlords, lenders, and the property market?

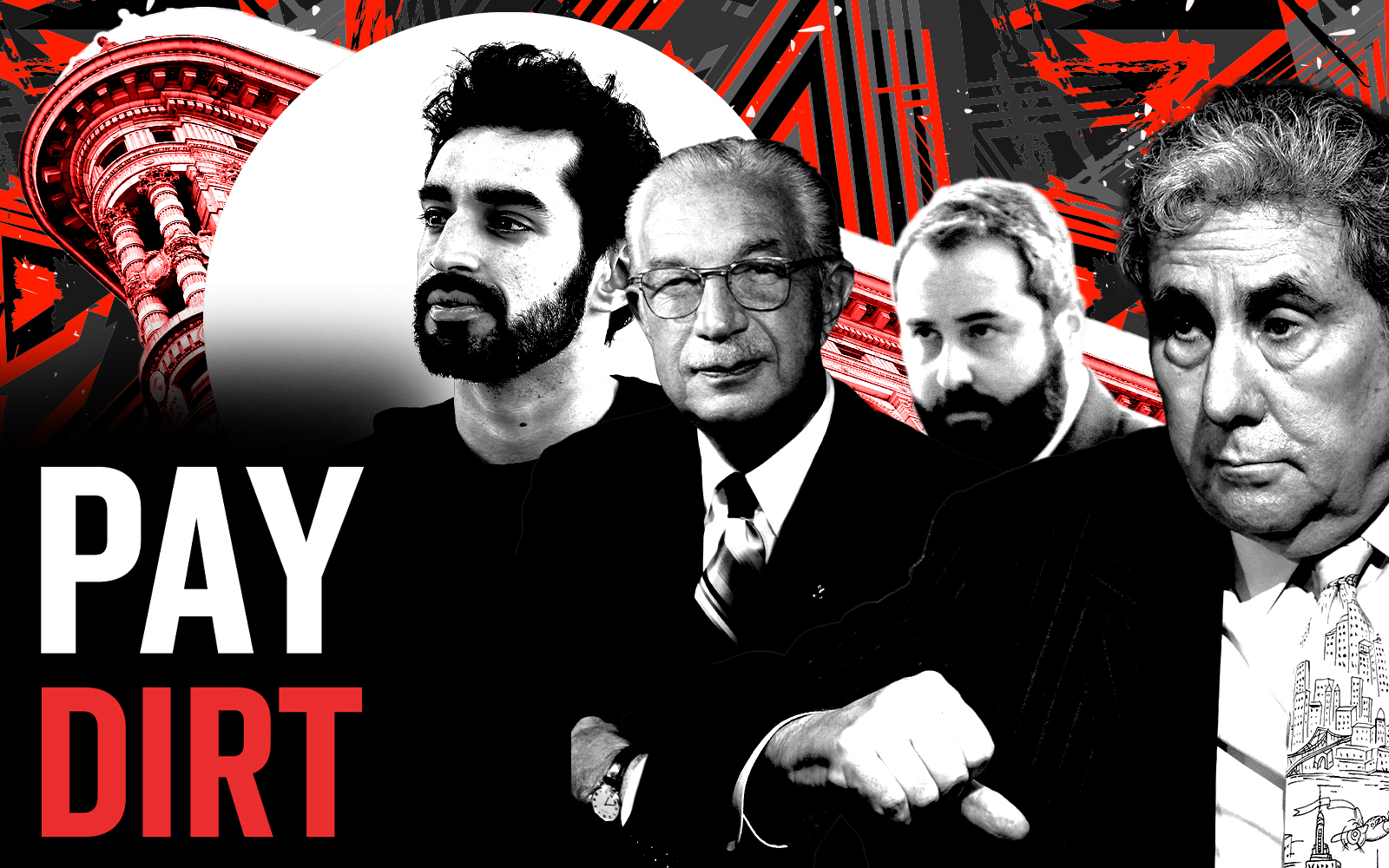

In the latest episode of Paydirt, The Real Deal’s Hiten Samtani breaks it down, explaining that with the triple whammy of higher interest rates, lower valuations and more conservative lending, landlords who need to refinance are in a tough spot.

“You are likely left with three options, all not so great,” he says in the video: put more equity in, find a partner to do it for you and lose some of your upside, or walk away altogether.

Samtani also stresses that despite whatever new argument landlords and their brokers come up with for the pre-eminence of the office, the reality is that its status as the economy’s focal point has been forever disrupted.

“Offices are not back,” he said. “They are still often half-empty. And when your product is not being used with the same ferocity as before, when it is no longer at the centerpiece of the American economy, something’s gotta give.”

Watch the above video to understand what the wall of maturities could mean for the commercial market. And check out more of Samtani’s Paydirt episodes here. https://therealdeal.com/tag/paydirt/

Watch more