Burberry is no Valentino, at least where 693 Fifth Avenue is concerned.

The Midtown building recently nabbed the British brand to fill the cavity created when its largest retail tenant, Valentino, cut out early. But it’s a short-term lease with a hefty discount and leaves the property short of revenue to cover its $250 million loan.

Burberry took 14,000 square feet of retail space — 15 percent of the property — at 693 Fifth earlier this month, filling the four floors Valentino vacated in 2020. But it’s paying just $372 annually per square foot, a third of the $1,144 that Valentino agreed to pay when it inked a 15-year lease in 2013. (The average asking rent in Manhattan’s retail corridors last quarter was $638, according to CBRE.)

Valentino’s rent comprised over 80 percent revenue at the building, whose owner, Financière Marc de Lacharrière, or FIMALAC, is in default, its lender asserts. The rent roll is less than half what it was at its peak.

Burberry will make 693 Fifth its main location while its flagship at 9 East 57th Street undergoes renovations beginning in June. “The improvement in cash flows will be limited,” notes a Morningstar commentary on 693 Fifth’s loan.

That lasting hit to revenue could jeopardize FIMALAC’s ability to keep servicing the debt, which JPMorgan Chase originated in 2016. At the time, the building’s annual net cash flow was $15.7 million and its debt-to-service coverage ratio was a healthy 1.55.

Since Valentino vacated in 2020, the building’s occupancy has hovered around 50 percent, and cash flow in 2021 was a paltry $274,000. That left DSCR at a precarious 0.02.

Last year the building piled up $4.8 million in red ink through September as its DSCR fell to negative 0.3.

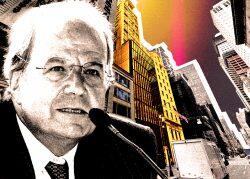

The landlord, run by 82-year-old billionaire Marc Eugène Charles Ladreit de Lacharrière, has stayed current on debt payments since Valentino vacated, funding shortfalls from its own coffers, according to Morningstar.

But absent a high-paying tenant, it’s unclear how long the landlord will be able to keep up — and Burberry is now occupying 693 Fifth’s most valuable space. The property’s loan comes due in June 2026 and is embroiled in litigation.

Wells Fargo, which bought the loan from JP Morgan, sued through a special servicer in 2022 after Financière Marc de Lacharrière reached a $100 million settlement with Valentino over vacating its lease early.

The bank claimed the landlord terminated the lease without getting its permission. The landlord countered that the bank ignored requests for consent and didn’t offer a 30-day notice to cure the default as required by its lease.

Wells Fargo argued that the agreement includes no such requirement, according to legal documents.

The bank is seeking $107 million for the early termination of the Valentino lease and has moved to accelerate the debt. In an amended complaint last May, Wells Fargo claimed the landlord owed more than $227 million immediately.

Robert Cyruli, an attorney representing the landlord, declined to comment. Neither the attorney representing Wells Fargo nor Financière Marc de Lacharrière returned requests for comment.

Read more