Vornado Realty Trust has suspended its dividend for the rest of the year, the latest troubling sign for the real estate investment trust.

New York City’s second-largest office landlord announced the move late Wednesday evening, Crain’s reported. The firm won’t be giving regular distributions to shareholders again this year, bucking the norm among REITs and suggesting serious financial concerns at the company.

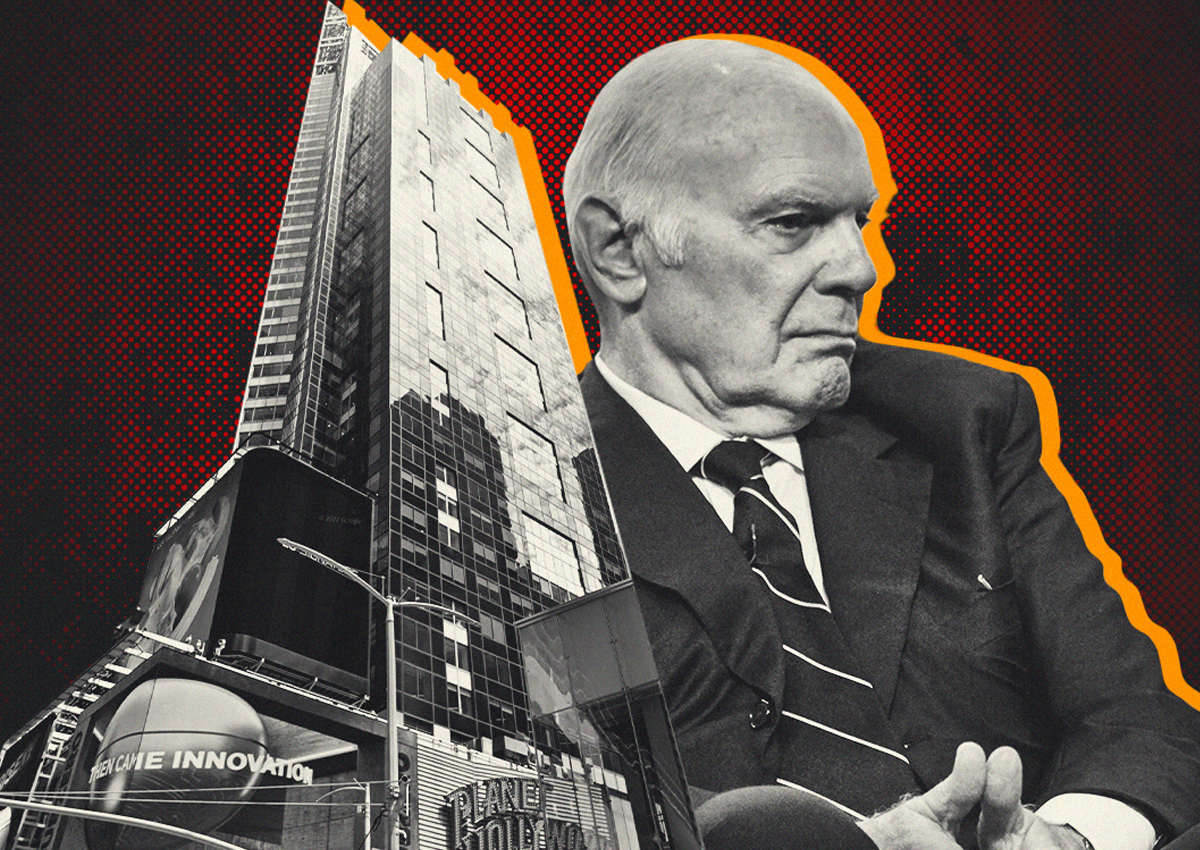

The REIT led by Steven Roth paid out more than $400 million in dividends last year.

The firm plans to pay shareholders a dividend next year, which could wind up being cash, stock or both, according to a statement. To raise money, Vornado will try to sell some of its portfolio. It will also repurchase up to $200 million of shares in a buyback program.

Vornado shares fell roughly 7 percent during after-hours trading.

Signs of trouble have mounted in recent months as the landlord is among those struggling to contend with elevated interest rates and the continued popularity of remote work.

Vornado’s stock was removed from the S&P 500 effective Jan. 4, with the index saying shares became “more representative of the midcap market space.”

Vornado cut its dividend by almost 30 percent shortly thereafter, pointing to the economic downturn and rising interest rates. A dividend cut was not unexpected, but analysts were shocked by the size of the slash, which was expected to save the firm $30 million in the first quarter.

Read more

The company later that month wrote down the value of its real estate portfolio by $600 million.

About 80 percent of the writedown was derived from a handful of Midtown properties. Seven of the buildings in the writedown were valued at $5.6 billion four years ago, but were worth $4 billion in February, a 30 percent drop.

— Holden Walter-Warner