In trying to set the record straight, Steve Roth might have sent some investors’ heads spinning.

The Vornado Realty Trust CEO used the company’s recently issued annual report to take another stab at downplaying four-month old comments that many observers interpreted as an about-face on the developer’s Penn District overhaul.

“I inadvertently created a whirlwind when I made what I thought was an obvious comment on our third quarter 2022 conference call that, ‘the headwinds in the current environment are not at all conducive to ground-up development,’ which was interpreted as our abandoning the grand plan,” he wrote in a letter to shareholders. “Nothing could be further from the truth. A pause necessitated by economic conditions is not abandoning.”

But as he tried to calm everyone down, in the same note, published in Vornado’s April 7 annual report, he resorted to a dire warning to justify the decision, writing, “We are now approaching the eye of the economic storm, and I expect it will get even worse.”

Not surprisingly, investors did not rush out to buy Vornado stock, which is now down 65 percent in the past year and 78 percent in the past five years. The Hochul administration is exploring alternatives to the Penn District plan.

A sunnier message would likely have been dismissed anyway as Pollyannaish or disingenuous. Perhaps that is why Roth did not mince words in explaining just what office landlords like his REIT are facing.

“Defaults and ‘give back the keys’ have already started, led by some of the industry’s largest companies,” he wrote. “There is no new debt available for office, so no buying, no selling, no new builds. When a loan comes due, the only refinance available (and that with a fight) is from the existing lender.”

Vornado’s investments are 86 percent New York and 77 percent office assets, facts it does not bury in the back of its 23-page report. In fact, it’s the second sentence. Those are major reasons its stock has performed so badly, even while revenue poured in from the most profitable condominium ever.

Work-from-home has been more prevalent and enduring in New York City than just about anywhere, despite the prominence of the finance industry (known for basically chaining its workers to their desks) and the Adams administration’s demand (recently abandoned) that most of its 300,000 employees come in every day.

The good news for Vornado is that 77 percent is not 100 percent: It does own other real estate assets. The bad news is that a lot of them are retail, which isn’t doing so hot either.

The firm has street-level retail in 56 of its 62 Manhattan buildings, accounting for 2.6 million square feet. In December, a Vornado-led joint venture defaulted on a $450 million loan on its retail property at 697-703 Fifth Avenue. The real estate investment trust is trying to work out an agreement on the loan’s $421 million balance.

In February, Vornado said the asset was “not refinanceable” and might eventually have to be relinquished to lenders.

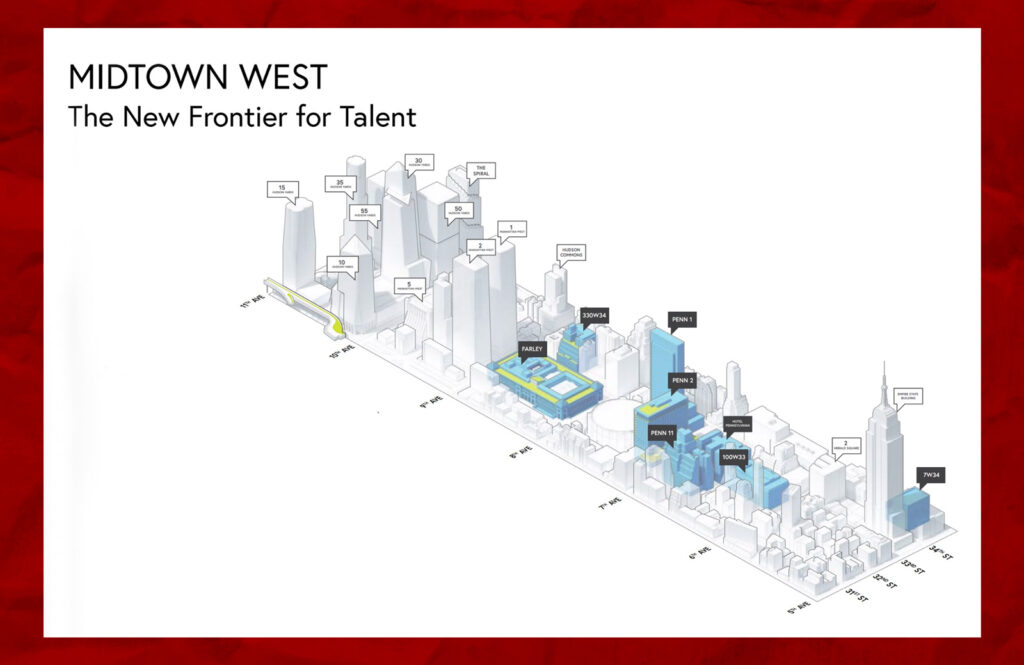

Roth continues to insist that Vornado will ultimately complete its grand plans around Penn Station, which — even before his November remarks — the Hochul administration had estimated would not be finished until 2044, when Roth would be more than 100 years old.

“My excitement and conviction about our Penn District grows quarter by quarter,” he wrote. “I still believe that a winning strategy is to allow investors to choose between the high-growth, development-oriented Penn District or our other, pretty terrific in their own right, Class A traditional core assets, or both.”

“Nonetheless,” he continued, “we have decided to pause.”

Not that he has any choice — given the lending environment, doubts about the future of office, and New York politicians’ loss of faith in the Penn plan — but Roth wrote that he’s in no hurry.

“I believe it wise to delay until Covid and the current economic storm are resolved, workers return en masse to the office, construction is further along, etc.” he wrote. “No rush, let’s get it right.”

Read more