Vornado sold its Rego Park development site for a sizable discount as the REIT unloads assets in an inhospitable sales market.

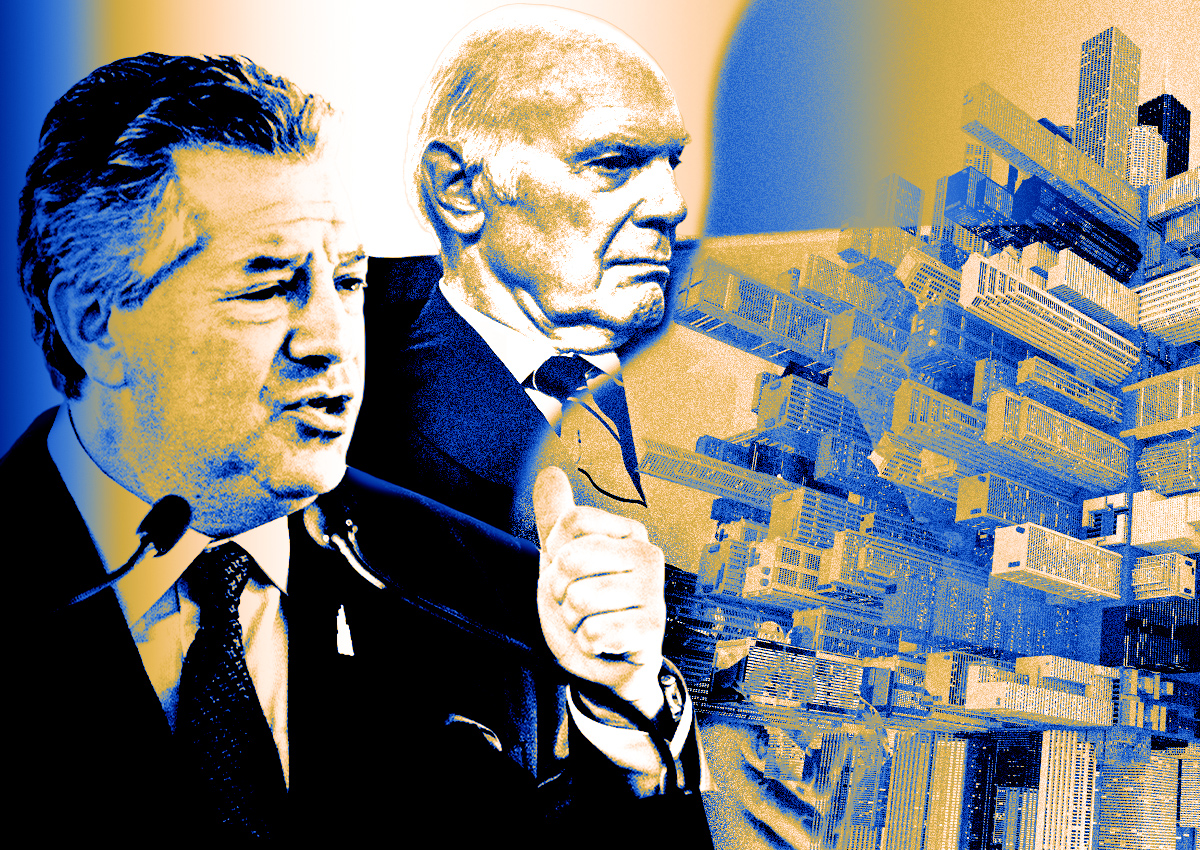

The Steve Roth-led company sold the site at 93-30 93rd Street in Rego Park for about $70 million to Queens developer Chris Jiashu Xu, sources told The Real Deal. Traded NY first reported news of the sale.

The price tag is 16 percent shy of the $85 million Vornado was eyeing when it put the property up for sale roughly two years ago. In June 2021 the company was looking to get a sale done quickly so that a buyer could qualify for the 421a tax break, which expired a year later.

It wasn’t immediately clear if Vornado got entitlements for the site, but the lack of a tax break would make the property worth less. Interest rates are also much higher now, which pushes property prices down as well.

A representative for Vornado was not immediately available for comment. A JLL team led by Bob Knakal and Stephen Palmese brokered the sale.

Xu, the founder of United Construction and Development Group, is the developer of the tallest building in Queens, the 67-story Skyline Tower in Long Island City. He could be planning another condominium project on the Rego Park site, as developers have all but stopped building rental housing on sites that do not qualify for 421a.

A year ago, Xu bought a Flushing development site for $103 million. In 2016 he paid north of $100 million for another Flushing site.

His newest purchase is next to Vornado’s Rego Center shopping mall and across the street from the 312-unit Alexander apartment building the company developed in 2015. It holds about 670,000 square feet of development rights.

It’s a tough time to be a seller — or a buyer, given the lending environment and loss of 421a — but that isn’t stopping Vornado from looking to raise cash by selling assets.

That’s a change in strategy. The company as recently as February said it was not considering selling. But since then Vornado’s stock has fallen by more than half, prompting the REIT to suspend its dividend for this year and authorize a $200 million share buyback.

Company executives said on their May earnings call that Vornado will look to sell a mix of retail and office assets, but declined to say which ones.

Read more

Roth dismissed the notion that Vornado is a forced seller.

“We are not a distressed seller. We are not a weak seller,” he said. “In fact, we are focusing on a very select pool of assets … where we consider ourselves to be offensive sellers.”