Hudson Yards has for years been a punching bag for progressives. They called it a giveaway to Big Real Estate, a bad risk for taxpayers and a billionaires’ playground. When the pandemic set the project back, they called it karma.

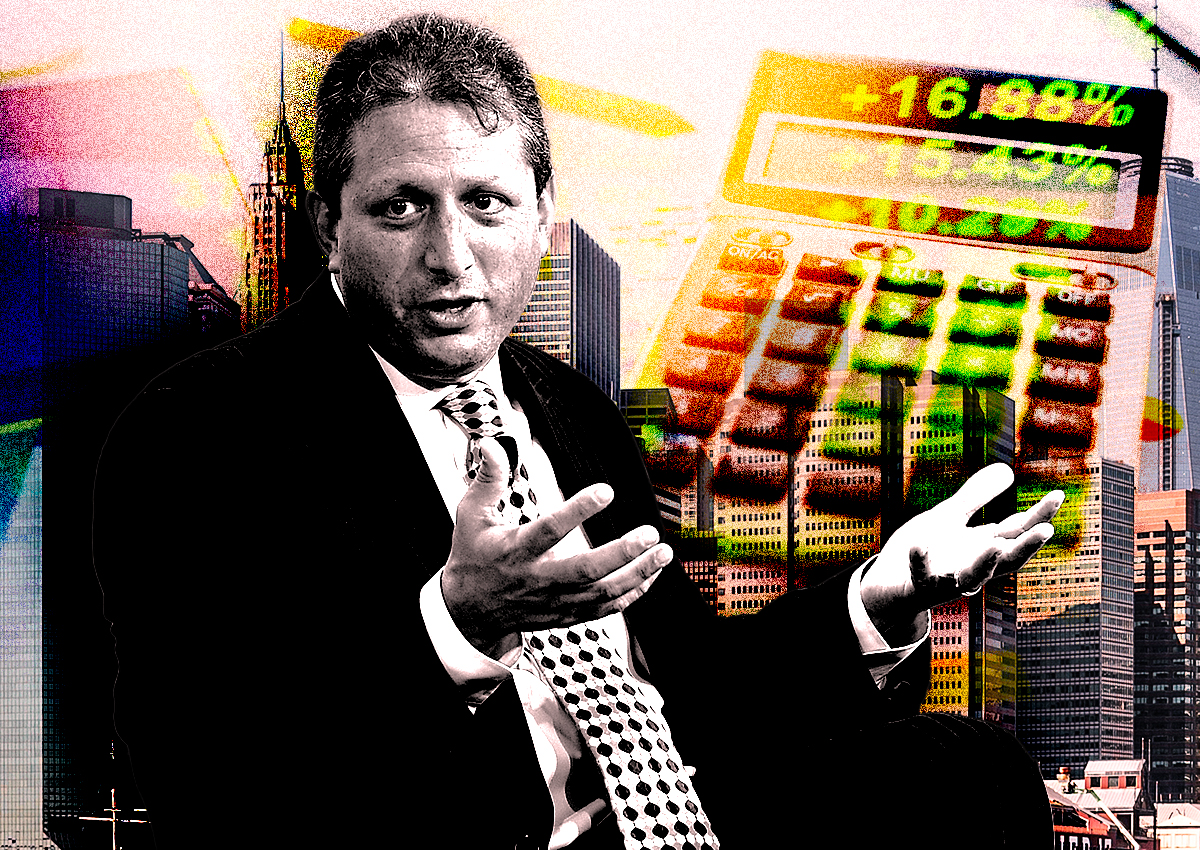

So it was surprising, even shocking, when City Comptroller Brad Lander — successor to Bill de Blasio as the city’s top elected progressive — openly admitted the Bloomberg administration was right about Hudson Yards’ public financing scheme.

It’s not just working, but working better than anticipated — even after the development was slammed by Covid.

“One really interesting thing we looked at this month, in the Class A, in the trophy parts of the market, things are actually really rebounding well,” he said on NY1. “Hudson Yards is giving about $200 million more a year than we expected, and that’s going to grow to $300 million.”

The interviewer, Errol Louis, a veteran of city politics and a former candidate himself, did not miss the significance of Lander’s statement. A couple of minutes later, he returned to the subject.

“You had been a skeptic of the financing of Hudson Yards,” Louis noted.

In response, Lander, in an unusual move for politicians, made no attempt to downplay, mischaracterize or divert attention from the position he had taken more than a decade ago on the strategy hatched by Dan Doctoroff, the deputy mayor for economic development under Michael Bloomberg.

The city issued bonds to pay for billions of dollars’ worth of infrastructure, notably an extension of the No. 7 line (which the MTA was not prepared to fund itself), to make the massive development possible. Bondholders would be paid back by the resulting increase in property tax revenue, Doctoroff promised. If revenue fell short, city taxpayers would be on the hook.

Lander was one of the voices on the left who openly questioned the administration’s financial alchemy. But after looking at the numbers — which, as comptroller, is his job — he has come around. All the way around.

“I own this,” Lander said. “You know, one thing you try to do in the comptroller’s office is collect the data and have it test your priors. In this case, I was a critic of the Bloomberg administration’s financing scenario. They basically used the city’s credit card to finance Hudson Yards and put the city at risk, and I and others raised concerns that it would expose the city.”

Politicians rarely get that far into a mea culpa, or even begin one, but Lander kept going.

“As it has played out, Hudson Yards is financing that debt and now returning, again, a couple hundred million dollars more to the city than we expected,” the Park Slope Democrat said. “So this is one place I gotta say I got it wrong.”

He’s not the first to be wrong about Hudson Yards, but he might be the first to admit it. The left-leaning New School is never going to walk back its $6 billion figure for Hudson Yards’ “tax breaks and other government assistance,” as the New York Times put it, even though $3.6 billion of that was for the subway extension, a pedestrian bridge and public parks.

Subways, pedestrian improvements and parks are things that government is supposed to pay for. No one thinks of Central Park as a subsidy for Billionaires’ Row, Prospect Park as a handout for Brooklyn property owners or Grand Central Terminal as welfare for Midtown.

Another fact long forgotten is that the Related Companies only got to develop Hudson Yards because Tishman Speyer pulled out, deeming it too risky in the wake of the Financial Crisis. If Related got a “sweetheart deal,” it’s worth asking why a rival developer turned it down.

To be sure, Hudson Yards has not gone exactly according to plan. At one point, the city had to kick in $359 million to cover bond interest payments as revenue from Hudson Yards fell short of projections. After the Great Recession, Hudson Yards’ leasing took longer than expected to get rolling.

The 28-acre, $25 billion, still unfinished development also took a public thrashing from the Times’ architecture critic and saw anchor tenant Neiman Marcus quit its ultra-fancy mall. It endured a fight with organized labor and a stunning acceleration of remote work, internet sales and mortgage rates. The upper levels of its signature attraction have been shut down for safety reasons.

Warehouse space, the only consistently strong real estate asset in recent years, is the only one Hudson Yards doesn’t have.

Yet Lander’s new analysis indicates that the development has found its footing.

“The data has helped me see some changes there,” Lander said on NY1. “Still some questions about the architecture, I guess, but on the financing, at an important moment for the city, it’s making a big difference.”

Read more