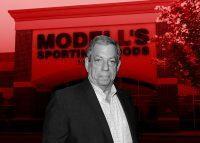

Nine months before Modell’s Sporting Goods filed for bankruptcy, then-CEO Mitchell Modell took a shot at the New York office market.

Looks like he missed.

In June 2019, eight months before the world changed, Modell picked up the newly remodeled 22 West 38th Street for $61 million in a partnership with BEB Capital, whose CEO touted the 12-story Midtown property as a stable asset.

But its primary tenant, Knotel, was heading toward bankruptcy itself and Covid sparked a tenant exodus that put the office building on even shakier ground. Now, Modell faces the loss of the property after defaulting on a $35 million CMBS loan.

Special servicer Rialto Capital slapped the founder of the once-ubiquitous New York sporting good chain with a foreclosure filing Monday, citing the borrower’s missed debt payment in February, court documents show. As of June, Modell was over four months behind on payments, according to Morningstar.

Modell’s problems at the building actually predate the pandemic.

The loan was first watchlisted in February 2020 after Modell doled out a significant number of rent concessions, according to Morningstar. That dragged down revenues and pressured the borrower’s ability to cover debt service, according to servicer commentary.

The loan was transferred to a special servicer in May 2020 for imminent default, Morningstar records show.

Knotel, which leased over half of the building’s total square footage, stopped paying rent in April 2020 and by December of that year had amassed over $1.5 million in rent and utility arrears, court records show.

Modell sued the firm for back rent in December 2020 but a February 2021 bankruptcy filing by Knotel froze the case.

By January 2022, net cash flow at 22 West 38th had plummeted to $160,000, down from $2 million when Modell bought the building.

Six months later, the owner’s debt service coverage ratio hovered at a troubled 0.09, meaning cash flow only covered 9 percent of monthly debt payments.

Now, Modell is on the hook for the loan’s total unpaid principal of $35 million, plus default interest. The owner may also need to cough up cash to cover whatever an auction of the property does not, court documents show.

It’s possible the building will sell for less than the loan balance. The property was last appraised for $34.5 million, half of its value when former owner Dalan Management took out the debt in 2018.

Neither Modell nor Rishi Kapoor, the attorney representing the bondholders in the suit, returned requests for comment.

Read more