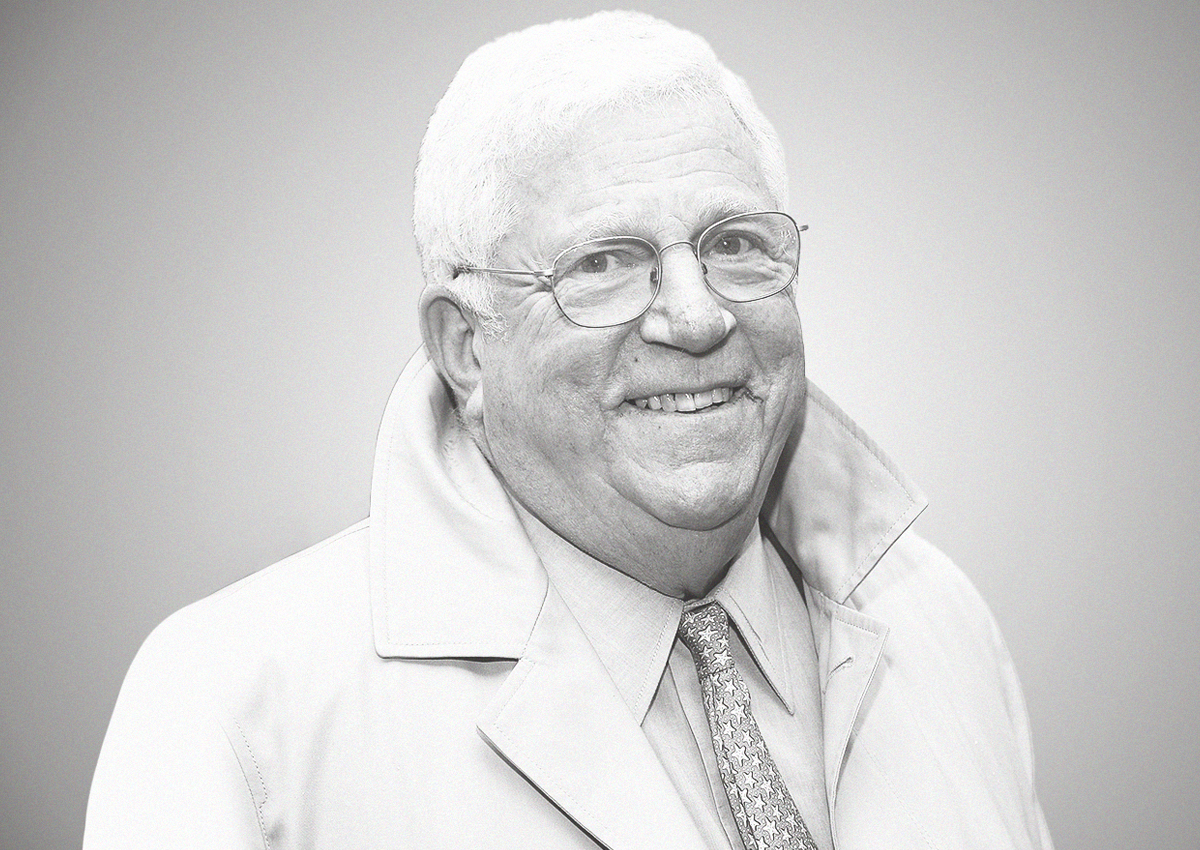

Angelo Mozilo, who led top mortgage lender Countrywide Financial and is largely viewed as one of the villains of the 2008 financial crisis, died on July 16. He was 84.

Mozilo died in Santa Barbara, the New York Times reported. His family’s philanthropic organization announced his death, but did not specify a cause.

The Bronx-born Mozilo helped to found Countrywide and build it into one of the largest mortgage lenders in the country. The company’s propensity to make risky loans led to wild success and then implosion with the onset of the Great Recession, leaving a polarizing legacy.

“Independent of how people outside of the industry may perceive this man, insiders know what an incredible force he was,” the late executive’s son Eric Mozilo posted on LinkedIn.

Mozilo made his first foray into the financial industry at 14 years old while working as a messenger boy for a mortgage company. He attended Fordham University and went on to start Countrywide with David Loeb in 1969.

At one point, Countrywide was the largest mortgage lender in the nation. In 2007, it had $200 billion in assets and made $500 billion in loans. Mozilo set his sights on Countrywide attaining an unprecedented 30 to 40 percent market share.

That aggressive growth, however, was Countrywide’s undoing. The company began targeting subprime borrowers with weaker financial profiles and making risky “no-doc” loans, which didn’t require income verification.

When the housing market crashed, borrower defaults skyrocketed, sending the economy into a prolonged recession. Bank of America ultimately acquired Countrywide for $4 billion in 2008.

In 2010, Mozilo agreed to a $22.5 million settlement regarding federal charges alleging he misled investors about the risks of Countrywide’s loan portfolio, a record settlement between the Securities and Exchange Commission and a public company’s senior executive. He also forfeited $45 million to settle other charges, such as insider trading, while not admitting any wrongdoing.

Read more

In the years after the recession, Mozilo continued to deny responsibility for the financial crisis. A decade later, Mozilo told the Wall Street Journal the crash came from a liquidity crunch and a subsequent pandemic.

“Not subprime mortgages, not Countrywide, not Angelo Mozilo. I wish I had that kind of power,” he said.

— Holden Walter-Warner