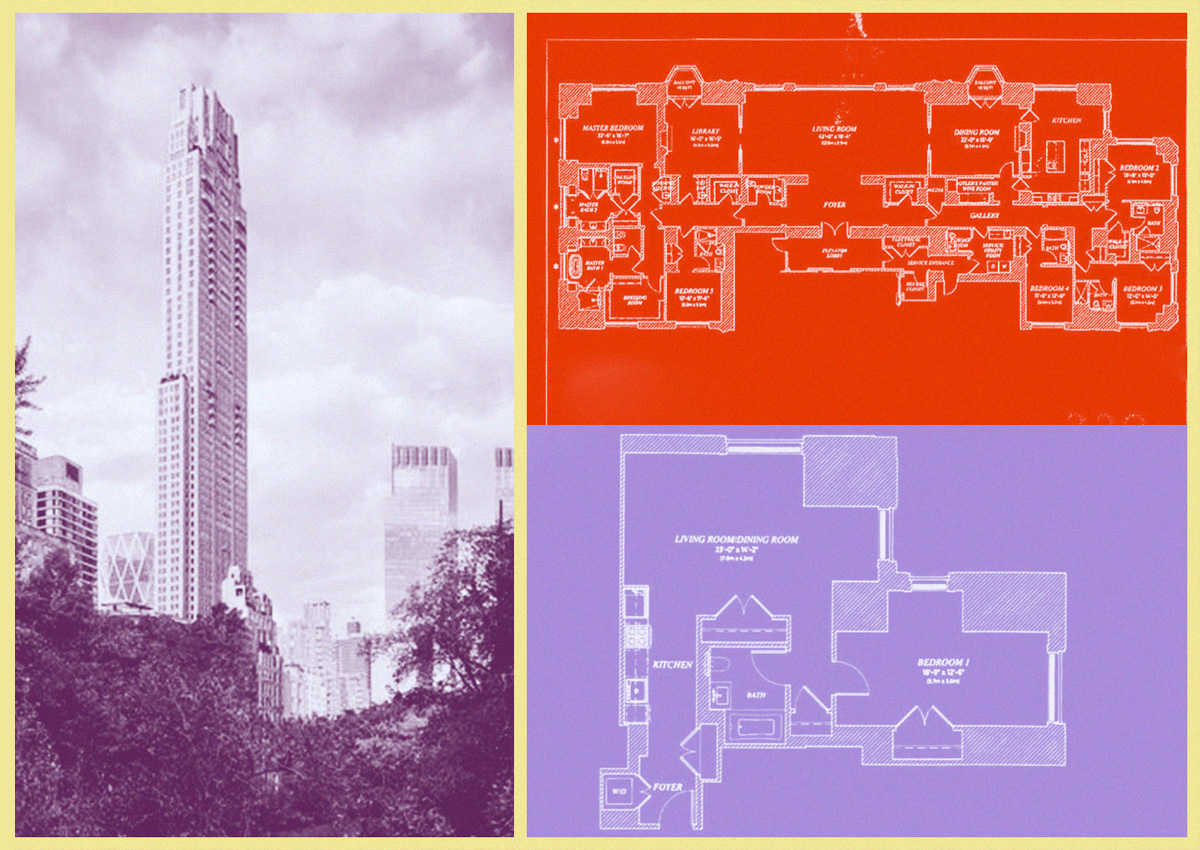

Vornado’s 220 Central Park South locked down one of the city’s priciest deals so far this year with another sky-high resale.

An unknown buyer paid $80 million, or roughly $10,000 per square foot, for an apartment at the Billionaires’ Row tower, The Wall Street Journal first reported.

The seller was an entity connected to investment firm Nima Capital, a family office that invests in real estate. The company, led by entrepreneur Suna Said, purchased the 8,000-square-foot apartment for $65.6 million in 2020.

The Modlin Group’s Adam Modlin and Douglas Elliman’s Paige Nelson represented the seller. MGS Group Real Estate’s Maggie Gold Seelig brought the buyer.

Vornado’s supertall earned its reputation as the world’s most profitable condo after it reached $1 billion in profits in 2020, two years after closings began. At the time, the 70-story, Robert A.M. Stern-designed building had a projected sellout of $3.4 billion.

The high-rise has seen a host of pricey resales since last year, including when billionaire investor David Och sold his 73rd-floor penthouse for $188 million, more than doubling the $93 million he paid for it in 2019.

Earlier this year, New York-based developer Ofer Yardeni sold his 3,000-square-foot condo for $33.8 million, about 52 percent higher than the sale price in 2019. Yardeni paid $22.2 million for the 37th-floor unit.

The 117-unit tower broke the record for the most expensive residential deal in the United States when Ken Griffin bought a 23,000-square-foot quadplex for $240 million. Sting and Trudie Styler are also among buyers at the building, paying $66 million for a penthouse villa in 2019.

The developer is approaching sellout at the supertall with just six units left on the market in March, according to Crain’s New York. The building’s pricey sales have been a bright spot for Vornado, which announced in February that it would pause all new development and wrote down its Midtown portfolio by 30 percent.

Read more