The tangled knot of debt around one of the biggest disasters in New York real estate history is one step closer to getting cut.

A foreclosure lawsuit accuses Maefield Development and its CEO Mark Siffin of failing to repay a $750 million loan on 20 Times Square. The financing was securitized in a single-borrower commercial mortgage bond.

Wilmington Trust, the trustee acting on bondholders’ behalf, filed the suit Monday in state court.

It cited five different events of default, including failure to repay the loan by its May 5 maturity date.

Neither Maefield nor Gary Mennitt, a lawyer for the plaintiffs, responded to a request for comment.

The suit is the most dramatic development yet in what’s been a train wreck at the crossroads of the world.

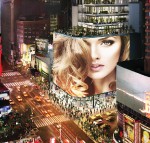

Developer Steve Witkoff purchased the parcel at 701 Seventh Avenue in 2012 and demolished an 11-story office building on the site with the intent of developing a 42-story luxury hotel that would also include retail space. The project broke ground in 2015.

In 2018, Maefield and Fortress Investment Group took control of the project by buying out the development’s other investors with loans provided by French bank Natixis. Those deals valued the development at $1.6 billion.

Natixis kept $650 million of that debt on its balance sheet — with the leasehold serving as collateral — while the rest was securitized in one single-borrower CMBS and four other conduit deals.

But after taking full ownership, Maefield and Fortress ran into trouble. Their partnership set up a dynamic at 20 Times Square where it owned both the leasehold and the fee position, making it the tenant and the landlord, a conflict of interest that resulted in Maefield and Fortress paying rent to itself.

Read more

The Marriott-branded Edition hotel opened in the building in March 2019. Just months later, the conduit loans were quietly passed to a special servicer. While the hotel had a strong opening, it was shut down after a year because of the pandemic.

At the same time, the company struggled to lease the 76,000 square feet of retail space. Hershey’s opened a store in the building but took just 7,500 square feet. A joint venture between the National Football League and Cirque du Soleil took 50,000 square feet, but the business closed within a year.

The setbacks put Maefield in the red on its myriad of loans. It defaulted on the $650 million leasehold loan that Natixis kept. The lender bought the leasehold at auction and handed management over to SL Green, ending Maefield’s owner/tenant relationship. However, sources told The Real Deal last year that the leasehold is “virtually worthless.”