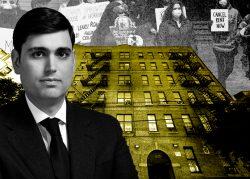

After the 2019 rent law passed, among the first properties to fall belonged to Isaac Kassirer.

The founder of Emerald Equity Group had bought scores of rent-stabilized buildings, aiming to free units from regulation and charge market-rate rents. When the legislation snuffed out that strategy, Emerald properties in 2020 faced foreclosure, then bankruptcy.

Three years later, the red ink is still flowing.

In the past few months, Kassirer has defaulted on $98 million in loans backing 25 rent-stabilized buildings in the Bronx with 663 units, according to Morningstar.

The properties’ cash flow has been eroded by rising expenses and nonpaying tenants, according to loan servicer commentary.

Even owners who bought stabilized buildings with no intent of deregulating units have been crushed by the rent law’s caps on rent increases. Hikes are now limited to what the Rent Guidelines Board approves each year, plus minimal increases to reimburse improvement costs. In 2020, the board imposed a year-long freeze, and subsequent increases lagged the soaring cost of insurance, property taxes and maintenance.

Meanwhile, a Covid-related exodus and eviction moratorium depleted rent rolls. The state’s rent relief program failed to make many owners whole, and in some cases left them worse off.

Kassirer has also been hurt by rent strikes. Some of his tenants withheld rent during the pandemic and again last year, alleging deferred maintenance in a Bronx building.

Falling revenue now threatens Kassirer’s capacity to service his debt on the portfolio.

On the portfolio’s largest loan, a $16.4 million mortgage that Moody’s flagged this week as “troubled,” cash flow does not cover the fixed-rate interest charges.

Kassirer told The Real Deal by email that his firm has been in talks with his lender, Sabal Capital, since early this year and is “in the process of finalizing an agreement.”

The fixed-rate loans don’t mature until 2030. But updated valuations of the properties backing the debt show a dire situation.

Properties that serve as collateral for seven of the eight loans in default were valued at $56.8 million in August, a 55 percent decline from when the loans were underwritten, according to Morningstar. The buildings are now worth less than their $82 million debt.

Valuations of rent-regulated buildings have plummeted since the rent law slashed the recoupable cost of repairs and upgrades and cut off nearly every path to deregulation. Some owners, seeing the asset class as a sinking ship, have moved to sell, even at a loss.

But others have found it impossible to find a buyer, brokers say, and face foreclosure.

Industry observers see little sign the market will improve. If anything, bills awaiting the governor’s signature and proposed amendments to the Rent Stabilization Code could hit property values further.

Kassirer characterized the rent-stabilized market as “an asset class I’ve avoided … for several years.”

Read more