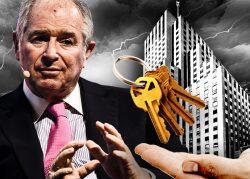

The Class A office tower at 300 East 42nd Street is expected to sell for well under its previous valuation after its owners, Keith Rubenstein’s Somerset Partners and Jeffrey Kaplan’s Meadow Partners, resorted to handing the 237,000-square-foot building to its lender, Fortress Investment Group.

The venture purchased the 31-story tower in August of 2019 for $122.5 million, taking out a loan from Brookfield and pouring millions of dollars into capital improvements and amenities including a reimagined entrance, new lobby, elevators, mechanicals and façade as well as revolving art in the lobby.

At the time, Rubenstein told the New York Post, “There are large terraces to build out and we will make great amenity space in the lower portion.”

But the building, which is being marketed by JLL, is on the southeast corner of Second Avenue. Even as the Grand Central Terminal area has become a coveted office district since a Long Island Rail Road terminal opened and Covid-fearing commuters soured on subway connections, 300 East 42nd Street is a bit too far east for many tenants in a market replete with other options.

Last year, with Newmark handling leasing at the building and seeking rents in the $60s, the architecture firm CannonDesign and the Jamaican consulate signed leases — the address is near the United Nations — but 300 East 42nd has not been able to sustain the momentum.

Fortress refinanced the building in late 2021 with a $110 senior loan and $27 million mezzanine debt.

In June 2022, the broker for CannonDesign, Jeffrey Peck of Savills, told the Commercial Observer, “Cannon recognized that this was a typical Grand Central building but with ownership behind it that treats it like a Class A trophy building. It’s not often that you get a building which is more of a value play that also has ownership that is creative enough to attract upscale tenants.”

But the current owners are on their way out.

“We’re still working with Fortress and trying to create as much value as we possibly can,” Rubenstein told The Real Deal by text. “We did 60,000 square feet of leasing last year and have a couple of deals we are working on. It’s really a great building.”

Like other Class A properties, it has seen an uptick in tours over the past few weeks as is typical after Labor Day. But the decision to let the property go is an increasingly common outcome as the value of struggling office buildings falls below the outstanding debt on the properties, interest rates remain elevated and the prospects of a leasing turnaround dim.

Rubenstein previously owned 450 Park Avenue, which he bought for $509 million in 2007 and sold for $575 million in 2014.

He also bought up huge swaths of the Mott Haven area in the Bronx, bringing in local retail tenants and restaurants while selling off portions that have since been developed with several apartment towers.

He is also working on plans to redevelop the extensive and picturesque grounds of the former Nevele Hotel in the Catskills into an upscale haven of homes.

JLL and Meadow Partners declined to comment.

Read more