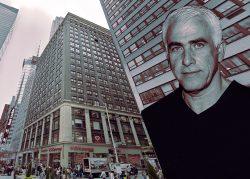

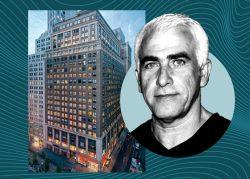

CIM Group, caught in a perfect storm of remote work, rising interest rates and WeWork exposure, will hand the keys to 1440 Broadway back to its lender.

The Los Angeles–based landlord, which picked up the large office property with Australian pension fund QSuper in 2017, saw the $399 million loan backed by the Midtown building go to special servicing this month, according to Trepp.

When the CMBS loan was made only two years ago, the property was valued at $540 million, according to Morningstar.

“The special servicer comments are not encouraging,” a Trepp email alert reads, noting that WeWork, which had been the building’s top lessee, has vanished from the tenant list. A WeWork spokesperson said the firm is still a tenant at 1440 Broadway and a change in building ownership would not affect that.

The CMBS loan had gone to a special servicer because “there is no single lender to negotiate with and the loan must first be transferred to special servicing in order to enter into any negotiations,” CIM said in a statement. But the firm did not deny that it will turn over the property itself.

CIM refinanced the Times Square office tower in March 2021 with floating-rate debt securitized by JPMorgan into a single-asset CMBS deal.

Three months later the loan had been watchlisted, according to Morningstar, although the Federal Reserve did not start raising interest rates until March 2022. By March 2023, cash flow at the property was covering just 75 percent of monthly debt service, according to Trepp.

In the same period, the Fed hiked interest rates by 4.5 percentage points. Rates have ticked up another 50 basis points since.

When the loan was made, ratings agency DBRS Morningstar flagged its “significant exposure to WeWork,” which leased 40.5 percent of the property’s rentable area. In early 2021, WeWork had already shuttered or downsized numerous New York City locations as it scrambled to become profitable, a status it might never achieve.

In March, 1440 Broadway was 91 percent occupied, according to Trepp. And in August, Amazon renewed a 210,000-square-foot sublease with WeWork at the property. Amazon occupies a majority of the co-working firm’s space.

Last month, WeWork, in a bid to avoid bankruptcy, told investors it would renegotiate “nearly all” of its leases.

Citywide, WeWork landlords owe $2.6 billion in CMBS debt, the majority of which is already facing distress. In the past two months, WeWork lease exits and rent arrears have caused big-name owners to default on some building loans.

Walter & Samuels is facing foreclosure at 315 West 36th Street after WeWork quit paying rent this year on its lease comprising 93 percent of the building.

RFR and Kushner Companies defaulted on the $180 million loan backed by their Dumbo office complex in September after the owners failed to refinance it. WeWork had previously vacated a lease for nearly 100 percent of one of the complex’s four properties.

The loan backed by 1440 Broadway was set to come due in May. CIM and QSuper may have decided to take a page out of Scott Rechler’s book and cut their losses rather than repay a loan that exceeded the building’s value.

QSuper did not respond to a request for comment.

Read more