Things are getting uglier at Arch Companies, if that is even possible.

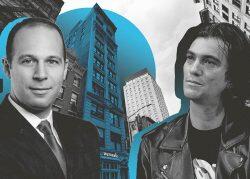

Arch co-founder and managing principal Jeffrey Simpson has been battling his partner, his main investor, and lenders who have threatened to declare loans across Arch’s portfolio in default.

His feud with Arch’s main investor, 35 Oak, reached a boiling point in early November when Oak barred Simpson from Arch’s Manhattan office and he called the police. The judge presiding over the fight for control of its $600 million portfolio had seen enough.

In a rare move, Justice Joel Cohen sidelined Simpson, banning him from Arch’s New York office and placing Oak in charge. Oak still needs approval from Simpson or his former partner, Jared Chassen, on major decisions.

Simpson is not letting go of the firm he and Chassen started in 2017 — not without a fight, at least. If the dispute goes to trial, he is likely to unleash allegations of wrongdoing at his combatants. He blames Oak for refusing to honor capital calls and putting Arch’s property portfolio at risk.

“This case is and has always been about Oak’s refusal to make good on its investment in Arch,” Simpson and his attorney Steven Altman said in a statement.

From the judge’s comments, however, Simpson has an uphill battle.

“I am left with an abiding sense that whatever Mr. Simpson’s talents are as a real estate business person, this business is broken at the moment, and it was broken on his watch,” Cohen said at a recent hearing.

The bizarre saga began this summer as Arch was navigating distress across its New York and national portfolio. Simpson claims that he made capital calls to Oak but that the investor refused to pony up cash if he remained in charge.

Toronto-based Oak, led by brothers Kevin and Michael Wiener, counters that Simpson never handed over books and records and that his erratic behavior and incessant demands for money made Oak nervous about his leadership.

Things spiraled into chaos in early August when Simpson fired Chassen. The next day, Chassen sought to fire Simpson and block access to his bank accounts. In a mad dash to the courthouse, Simpson’s attorney secured an order returning his client to the helm.

Cohen tried to get the two Arch executives to work together, but the effort proved futile. Simpson fired Chassen again, alleging his co-founder was secretly working for Oak. The judge, at his wit’s end over what he termed “immature squabbles,” restored Chassen to his post.

Meanwhile, Oak stepped in with its own allegations. The investor group held a 20 percent stake in Arch and had guaranteed some of its loans.

Around the spring of 2023, Oak’s Michael Wiener and his father toured Arch’s Myrtle Point, a 17-story development project in Ridgewood, Queens, with Simpson. They then drove to another development site, but on the way, Simpson and Wiener got into an argument about a different Arch project.

“Simpson became irate; he was screaming and spitting and cursing and I sincerely believed he would strike me,” Wiener said in a court filing.

Weiner alleges Simpson then jumped out of the moving car and chased the car so he could slam the door. Simpson realized he left his phone in the car and, still screaming, tried to get back into the moving vehicle. The car finally stopped, and Wiener’s father got out and tried to calm Simpson down.

“I started to have panic attacks as I realized my family was being held financially hostage by Simpson,” said Wiener.

The Weiners claim Simpson threatened to put Arch’s projects into bankruptcy and fire employees if Oak did not abide by his demands, and that he misappropriated assets to his automobile business, Rêver Motors.

The Wieners describe Simpson’s temper as volatile. In one call with Arch’s attorney, they allege, Simpson became irate when an Oak representative asked a question. “I am the fucking managing member!” he allegedly screamed, then said the call was over and hung up. He then went around to other Arch employees who were on the call and forced them to hang up.

Meanwhile, distress was mounting at Arch’s projects. Seven received notices of default and three had foreclosure auctions scheduled. Property partners, including Adam Neumann’s investment arm, grew concerned.

Simpson denied Wiener’s allegations and offered a different version of events.

He said during the car ride, Michael Wiener told him, “You are stuck with me, we are attached at the hip,” and “I am $6 million poorer because of you.” Simpson claims he felt verbally abused by Wiener’s and asked Chassen, who was driving, to pull over. Wiener’s father begged Simpson to talk to his son, leading to an apology.

Simpson has consistently argued that he is the best person to run Arch because of his real estate background. His attorney said it should not be a contest “of who has or has not behaved well, but on how best to keep [Arch] alive.”

As an example of Simpson’s real estate expertise, his lawyer pointed to the $199 million sale last year of an Arch portfolio that had a basis below $140 million.

Simpson argues he has been fully transparent with Oak, has not withheld books and records and has shared reporting with the investor for almost six years. It was lack of funding by Oak, he claims, that led to many of the firm’s problems, such as the need to furlough staff.

After the employees were let go, Oak obtained a court order allowing the investment firm to manage Arch in the short-term. It moved into the office Nov. 6.

“Oak is the only one who has the money to solve this problem,” the judge reasoned at a hearing. “This problem has to be solved unless the company is just going to go under.”

Oak brought back the furloughed employees and allegedly discovered that they were intimidated by Simpson. It also found accounts were going into overdraft and employees’ paychecks were set to bounce, so it pumped in emergency cash.

At first, the Weiners sought to work with Simpson, they said, but it became untenable. On Nov. 9, Simpson requested a meeting with Oak to discuss Arch’s 88 University Place property.

Read more

Oak’s executives said they could not meet, but Simpson said he would stop by the office at 11:30. The Wieners told him not to, but he became irate, stating he would come anyway. When Simpson arrived and was denied entry, he called the cops.

Simpson spent the next 30 or 60 minutes outside Arch’s offices. When the police arrived, Michael Wiener said he explained the litigation and that Simpson did not have permission to be in the office. Simpson accused the Wieners of lying to the police and made a remark about Michael Wiener going “back to Canada.”

Simpson and Oak went back to court. Oak’s attorney, Leslie Thorne of Haynes Boone, asked the judge to make Oak the sole managing member of the firm until the litigation ends.

Cohen agreed, with the caveat that at least Simpson or Chassen needs to sign off on important decisions. His order also prohibited Simpson from interfering with Oak’s ability to manage the company.

“I don’t see that trying to slam Mr. Simpson and Oak together again and try to have them work together is really a practical solution,” said Cohen. “I have seen too much, frankly. And I understand that this is a personal battle here, but it’s just not going to work that way.”