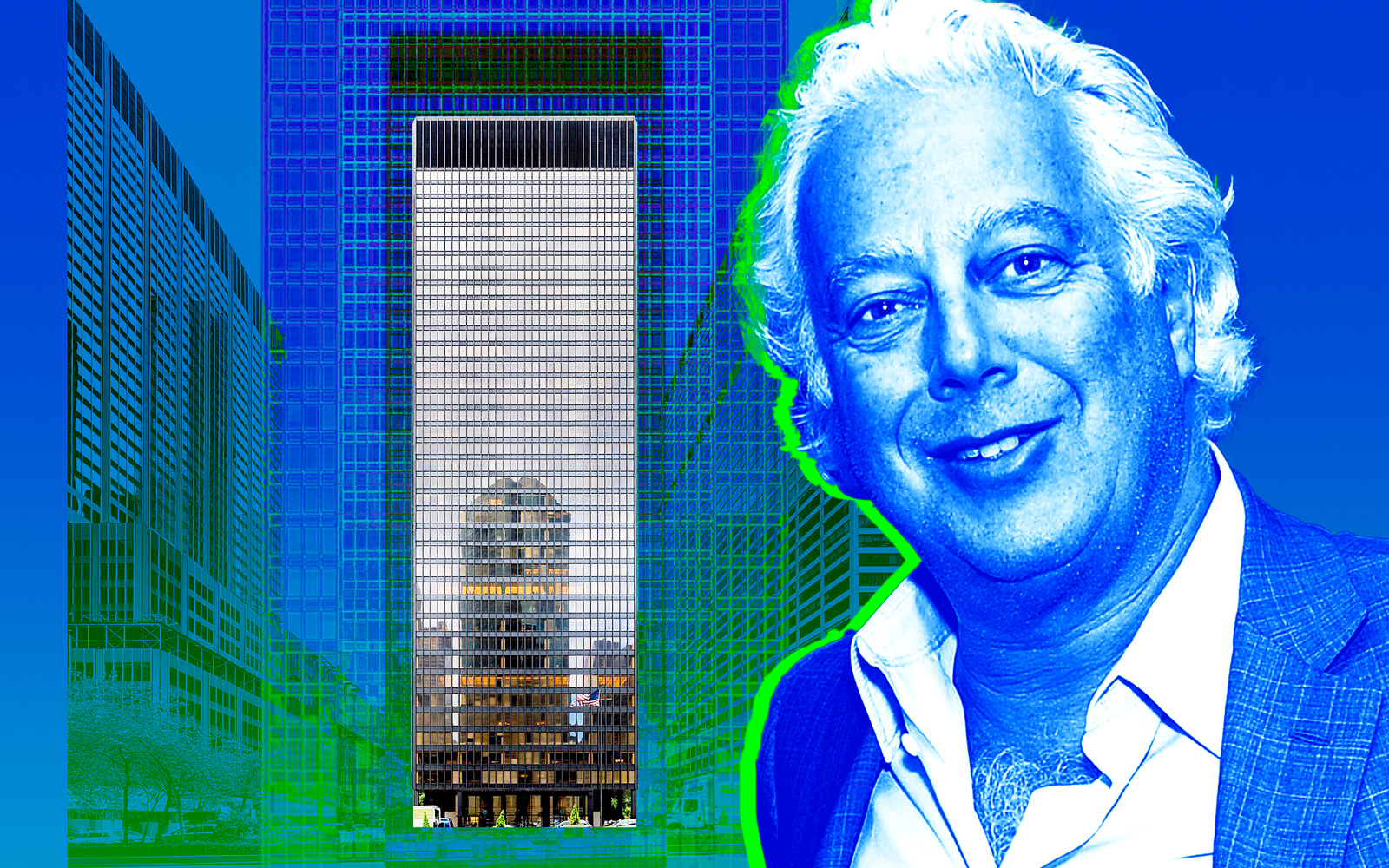

It took 10 months and an extension, but Aby Rosen’s RFR Holding finally has its refinancing package of the Seagram Building in place.

RFR landed a $1.1 billion recapitalization of 375 Park Avenue in Midtown Manhattan, the Commercial Observer reported. In addition to replacing a $789 million senior commercial mortgage-backed securities loan at the property, the package also includes between $350 million and $360 million of fresh equity from Anthony Shaskus’ JVP Management, which is also the mezzanine lender on the property.

Rosen and Michael Fuchs’ firm was reported in February as in the market for refinancing, retaining Eastdil Secured to find a loan to retire the outstanding debt on the 38-story office property. The debt was set to mature in May, the same month RFR negotiated an extension on its $1 billion mortgage.

RFR’s billion-dollar debt was among the largest CMBS office loan set to mature this year. The Seagram Building was viewed as a litmus test for lender appetite regarding office properties in an era of raised interest rates and hybrid work, though the former could become less of an issue if the Federal Reserve cuts interest rates next year.

After facing a looming vacancy due to Wells Fargo’s departure for Hudson Yards, RFR was able to fill much of the Seagram Building and pumped $25 million into updating the 860,000-square-foot tower.

Alternative investment firm Blue Owl Capital leased 138,000 square feet a year ago, before private equity firm Clayton Dubilier & Rice decided to abandon 70,000 square feet in a more recent development.

RFR and JVP did not respond to requests for comment from the Observer. Eastdil Secured declined to comment.

— Holden Walter-Warner

Read more