Buyers beware: The spring is shaping up to be a sellers’ market.

Pent-up demand and a likely interest rate cut appear poised to bump activity in the spring market above last year’s levels, according to UrbanDigs founder John Walkup.

“It seems to me it’s going to be busier than you would expect, given the history of the last couple years of this market,” said Walkup. “A lot of brokers, had you asked them in November or December ‘What’s the spring going to look like?’, they’d be really depressed. If you ask them now, they’ll say we’re going to be a lot busier than we anticipated.”

The question facing sellers and agents is when the seller’s market will actually arrive. After a rapid pace of sales in 2021 led to a historic sellers’ market, the balance has since shifted slightly in favor of buyers who stayed in the market.

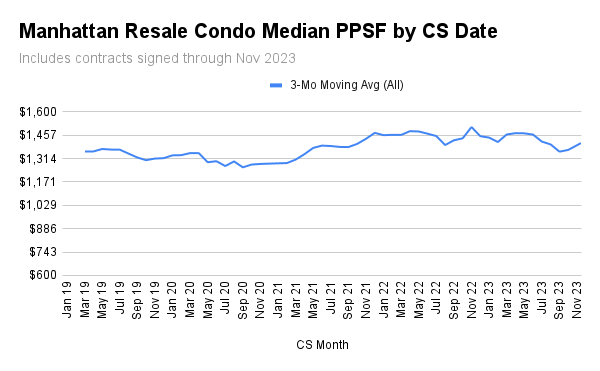

The average price per square foot for condos fell 8 percent between November 2022 and September 2023, based on an analysis of rolling three-month sale prices collected by UrbanDigs. The drop in prices suggests a lack of buyers in the market bidding up prices.

The pace at which the pendulum turns back to sellers will determine the best time to list homes. Prices have already started to tick back up, according to the most recent rolling three-month figures.

“The whole point is you want the bulk of your listing window, primarily the end bit, still in the window of when most buyers are showing up,” said Walkup. “You’re going to get the most traction and the most visibility because you have more buyers looking at listings.”

The days of falling prices could soon be over because inventory hasn’t ticked up as it usually does in a buyers’ market, according to UrbanDigs’ data.

“What’s going to happen with prices…when seasonal buyers come in and they’re hitting a pool of limited inventory?” said Walkup. “You can see some interesting movement.”

While most contracts are signed in March, the market’s peak will depend on how much of a factor interest rates have played in dissuading buyers from pulling the trigger on a new home. A rate cut in March, which Walkup said seems increasingly unlikely given the economy’s resiliency, could jumpstart activity. If rates trend sideways, activity might not spike until later in the cycle, closer to a more certain cut in June.

“We could see a really, really busy summer,” he said. “There’s only so long you can put off a move if you’ve got a new family or have a change-of-life event.”

Read more

Walkup believes there’s pent-up demand in the Manhattan market due to last year’s slow market, something agents have corroborated anecdotally.

“There will be new inventory [in the spring], but it’s not going to be this tremendous dump of inventory people are expecting,” Mike Biryla, a broker at The Agency, said.