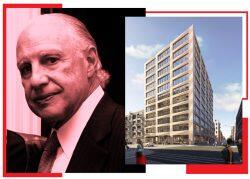

A few months ago, disaster seemed imminent for the Etsy-anchored Dumbo office portfolio jointly owned by Kushner Companies and Aby Rosen’s RFR Realty.

In September, the owners defaulted on a $180 million CMBS loan, but they were also struggling to repay a B note of $145 million, plus two mezzanine loans from Korean lenders for $80 million and $75 million. A quest for a $435 million refi reported in April 2023 had come up empty.

Headwinds seemed to come from every direction. Key tenant WeWork was in bankruptcy and breaking leases and Etsy’s lease extension through 2039 required millions of dollars in landlord-funded improvements. More broadly, interest rates remained stubbornly high and the office market’s comeback wasn’t happening.

The Dumbo portfolio’s value was reported to be $207 million, down from $640 million five years earlier, and occupancy had fallen to 73 percent from 94 percent in 2018.

Yet, somehow, Kushner and RFR got a four-year extension. They closed on the refinancing Wednesday, The Real Deal has learned. Not surprisingly, the joint venture had to put more equity in the deal, although it is not clear how much.

The $480 million package will give Kushner and RFR, who each hold a 47.5 percent stake in the joint venture, the ability to keep the portfolio and launch a new marketing effort to fill the vacant spaces. LIVWRK owns the other 5 percent.

The negotiations were complex, involving conference calls with several dozen participants. SL Green was the special servicer negotiation on behalf of CMBS investors. Workout specialist Robert Verrone of Iron Hound Management helped Kushner and RFR orchestrate the deal. Shinhan Asset Management and FTI Consulting were at the table on behalf of the mezzanine debt holders. New York investment bank Houlihan Lokey also participated.

Several factors helped the landlords. Last month WeWork decided to stay at 77 Sands Street, albeit shedding some space — something its bankruptcy filing had given it leverage to do. In addition, New York City’s economy continued to strengthen, and has regained all the jobs it lost during the pandemic.

But it is also likely that the last thing the lenders wanted was to foreclose on a Brooklyn office portfolio, especially at a time like this, when a distress sale would yield dimes on the dollar. The Koreans holding the mezzanine debt, which is junior to the CMBS notes, were particularly vulnerable.

The joint venture, which at the time included Invesco, bought the 1.2-million-square-foot portfolio in 2013 from the Jehovah’s Witnesses for $375 million and sold a majority stake in one of its five buildings, 175 Pearl Street, in 2017. The following year, Citibank originated the ill-fated five-year loan that was split into CMBS tranches.

Read more