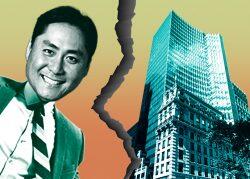

Property & Building Corporation tapped into the Tel Aviv Stock Exchange to pay off its $385 million loan from JP Morgan Chase on its Bryant Park office tower.

The raise will pay off its entire loan and will allow PBC more time to reposition the property formerly known as the HSBC tower to 10 Bryant.

The building at 452 Fifth Avenue recently secured two new leases bringing its occupancy to 99 percent, but the building’s anchor tenant, HSBC, is set to vacate next year.

PBC’s bond raise is a rarity in commercial real estate.

A decade ago U.S. developers tapped into the Israeli bond market because of cheaper rates, but those firms, like Yoel Goldman’s All Year Holdings and Starwood Capital, defaulted on their debt and the market soured on American real estate operators. PBC, with an Israeli-based parent company, is among the few that has been able to raise hundreds of millions in Israel in the past few years.

The deal also shows that financing is still available for select Class A office properties.

Despite all the negative headwinds about offices and lenders pulling out of the market, some owners are still finding financing. Blackstone recently secured a $309 million refinancing for a 36-story office building at 65 East 55th Street. Late last year, Aby Rosen’s RFR Holding scored a $1.1 billion refinancing of the Seagram’s Building.

PBC, with JLL as its leasing broker, recently inked a new lease with San Francisco-based green infrastructure investor Generate Capital to relocate from 461 Fifth Avenue to occupy 32,421 square feet across the entire 26th and 27th floors of 10 Bryant. Other tenants include Baker & McKenzie, Lombard Odier and Varadero Capital.

PBC purchased the 30-story tower for $330 million, or $381 per square foot, in 2010 from HSBC. PBC spent more than $100 million on renovations.

The glass office tower also includes a Beaux Arts 10-story building at the base.

Read more

PBC put the building up for sale in October 2021 as part of a larger portfolio sale. Some of the largest firms in New York participated in bidding, including Waterman Clark, the German fund Commerz Real, the Chera family’s Crown Acquisitions, George Comfort & Sons, Savanna and Hines. Andrew Chung’ Innovo Property Group was the winner with an offer of $855 million.

Chung’s investor deck showed that after one to three years, he planned to sell the property or recapitalize at a valuation of $1.2 billion.

But Chung failed to close. PBC instead opted to hold onto the building. The firm refinanced with JPMorgan in 2022, replacing a maturing $380 million loan. The appraised value dipped to $650 million.