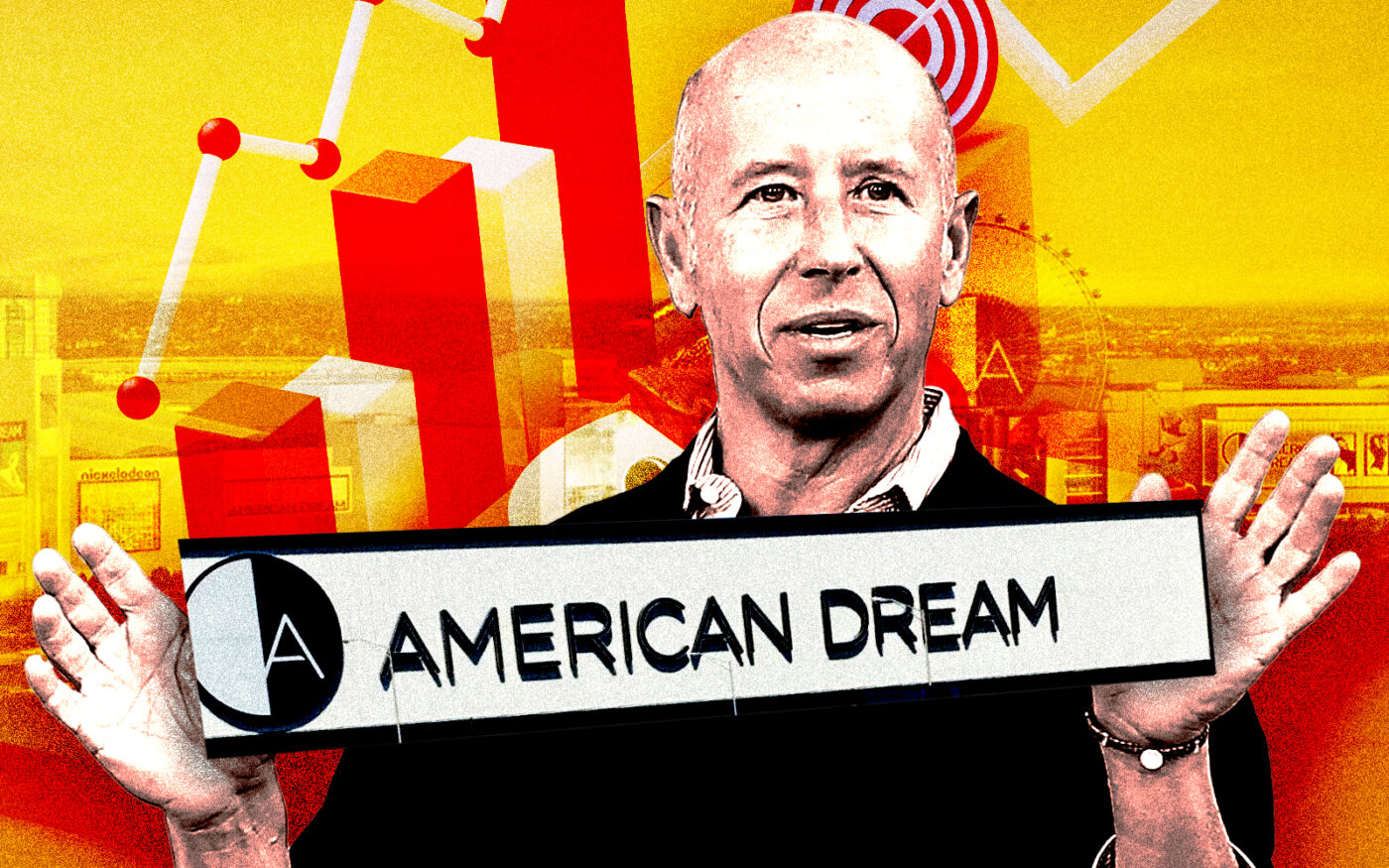

Barry Sternlicht may be ready to dump the debt his firm holds at the American Dream mall in New Jersey.

Starwood Property Trust is considering selling a $230 million loan at the East Rutherford complex at a discounted rate, Bloomberg reported. The going rate on the debt for Starwood is 70 cents on the dollar.

“I’m pretty sure we can sell it for that,” Sternlicht said during a recent investor call.

The loan was part of a $1.7 billion package provided to the Triple Five Group to finance the construction of the entertainment complex. It’s one of many financing packages the landlord has struggled to pay off since the mall’s pandemic opening, which has led to persistent struggles for the property.

Starwood hasn’t committed to marketing the debt and is still keeping all options on the table. Sternlicht may be inclined to sell, however, because the loan holds a non-accrual status, meaning the firm hasn’t recognized current income on the debt. Selling the debt would give Starwood equity to redeploy on other assets.

Starwood Property president Jeff DiModica recently disclosed that the American Dream debt reduces the firm’s distributable earnings by 11 cents per year. Starwood reported distributable earnings of 49 cents per share for the second quarter.

Read more

The mall owners have endured numerous financial struggles in recent months. In April, a judge ruled that the mall owner needed to pay a pair of lenders nearly $390 million after a default in May 2021; Triple Five didn’t contest the lawsuit.

Bondholders and surrounding towns have put pressure on the Ghermezian family, a campaign that has included lawsuits alleging owed money under development agreements. Missed payments have allegedly piled up and the complex lost $60 million in 2021.

The construction loan is the one area where Triple Five earned a reprieve, getting a four-year extension on the debt last year.

— Holden Walter-Warner